Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Life Time Group Holdings (LTH) Guiding Higher 2026 Sales But Lower Profit

Life Time Group Holdings, Inc. LTH | 28.95 | +0.35% |

- In January 2026, Life Time Group Holdings issued earnings guidance, projecting fourth-quarter 2025 revenue of US$743 million–US$745 million and net income of US$120 million–US$123 million, alongside full-year 2025 and 2026 outlooks.

- An interesting aspect of the update is that while 2026 revenue is guided higher at about US$3.30 billion–US$3.33 billion, the company anticipates lower net income of US$330 million–US$336 million compared with its 2025 forecast.

- Next, we will examine how Life Time’s projected 2026 revenue and profit profile shapes its investment narrative for shareholders and prospective investors.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Life Time Group Holdings' Investment Narrative?

To own Life Time Group Holdings, you need to believe in a durable demand for premium, club-based fitness and lifestyle experiences that can support steady expansion while keeping a tight rein on debt. The latest guidance update fits into this story in a nuanced way. Management is pointing to higher 2026 revenue of about US$3.30 billion–US$3.33 billion but a step down in net income versus 2025, which puts margins and cost control back under the spotlight as near term catalysts. That shift could temper enthusiasm around the previous run of upgraded 2025 guidance and the stock’s strong three month move, even if the long term club rollout and brand partnerships remain intact. The biggest risk now is that higher operating or financing costs eat into earnings just as growth investments continue.

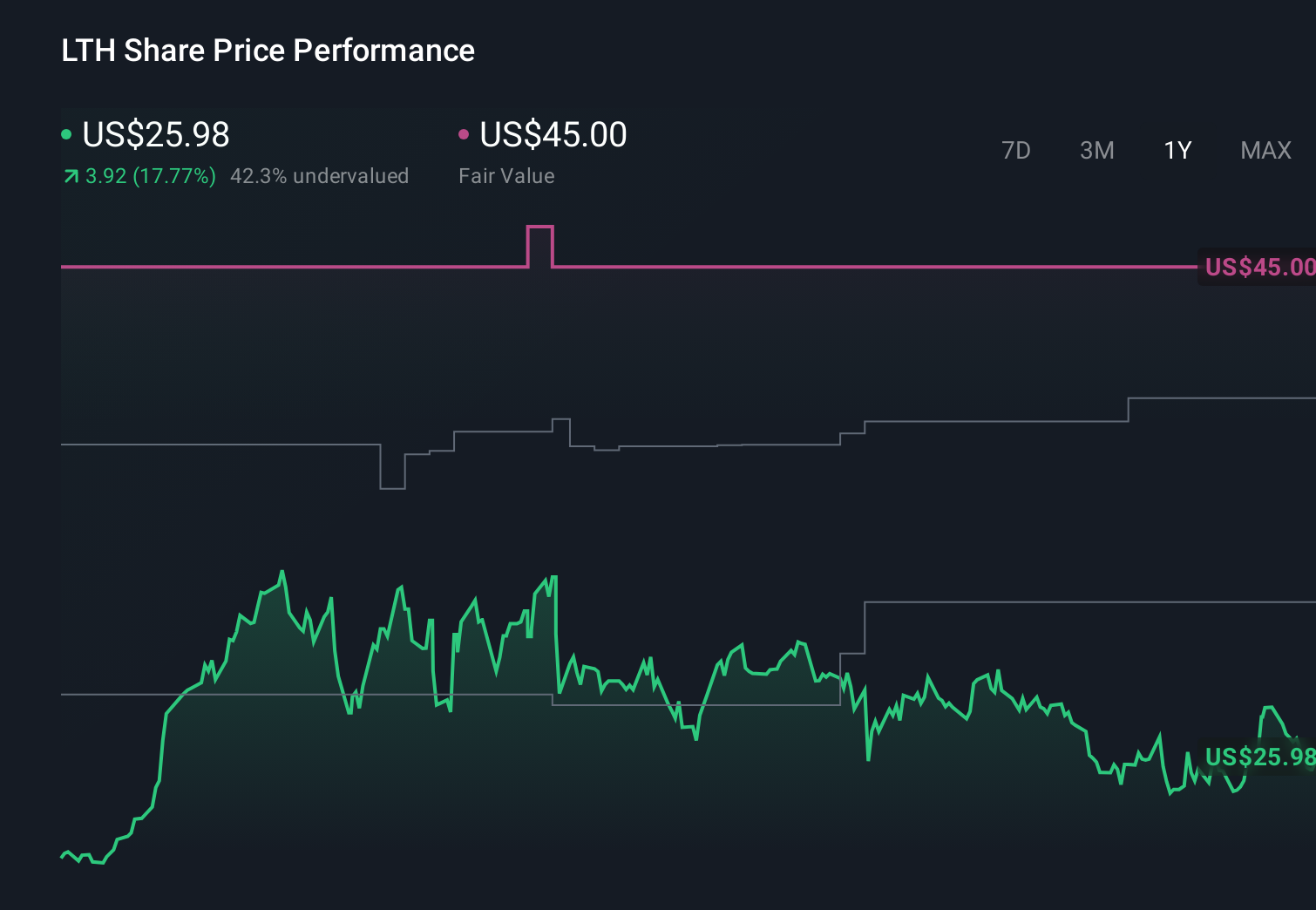

However, investors should understand why Life Time expects higher sales but lower profit in 2026. Life Time Group Holdings' share price has been on the slide but might be up to 15% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 3 other fair value estimates on Life Time Group Holdings - why the stock might be worth as much as 54% more than the current price!

Build Your Own Life Time Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Life Time Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Life Time Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Life Time Group Holdings' overall financial health at a glance.

No Opportunity In Life Time Group Holdings?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.