Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To MINISO (MNSO) Pivoting Toward Global IP Platform And Immersive Stores

MINISO Group Holding Ltd. Sponsored ADR MNSO | 19.64 19.64 | +0.15% 0.00% Pre |

- In late January 2026, MINISO Group Holding outlined an accelerated global growth roadmap at its Global Partner Conference in Guangzhou, focusing on immersive store upgrades, proprietary IP development, and expanded international reach, while also reporting a strong fiscal third quarter 2025 that exceeded its own revenue guidance and marked a milestone of more than 8,000 stores worldwide.

- An interesting development is the launch of the MINISO IP Genius Program, which aims to build proprietary IP by funding global creative talent and speeding up commercialization of new concepts across international markets, signaling a deeper shift toward becoming a global IP operation platform rather than just a value-focused retailer.

- We’ll now examine how MINISO’s push into proprietary IP and upgraded store formats could influence its broader investment narrative for investors.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is MINISO Group Holding's Investment Narrative?

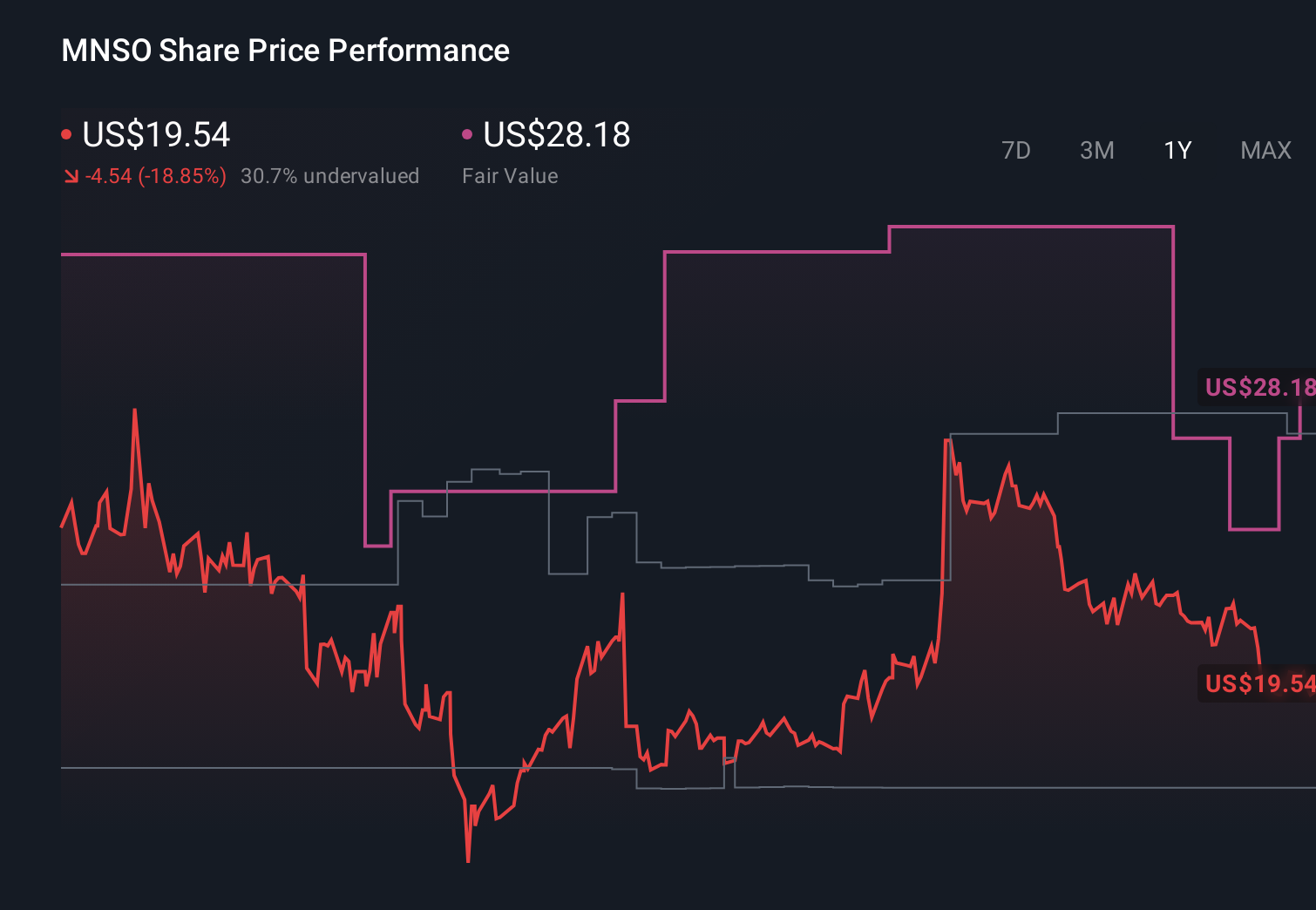

To own MINISO today, you have to buy into a story of disciplined global rollout, improving store economics and an expanding IP engine that can keep customers coming back, not just trading up on price. The latest Global Partner Conference and IP Genius Program reinforce that shift toward higher-margin proprietary IP and more immersive stores, which could become key short term catalysts if they translate into better sales mix and stronger brand power across its 8,000-plus locations. At the same time, recent earnings show pressure on margins and a share price that has lagged both the market and its own consensus fair value, so execution risk around heavier IP and overseas investment is front and center. In that context, the new roadmap looks material rather than cosmetic.

However, one emerging risk in this pivot is easy to miss at first glance. Despite retreating, MINISO Group Holding's shares might still be trading 44% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Eight members of the Simply Wall St Community currently see MINISO’s fair value between US$23 and about US$33.38, a wide span that reflects very different expectations for its IP push and global expansion. As you weigh those viewpoints, it is worth keeping in mind how much of the company’s story now hinges on successfully monetising proprietary IP without eroding its low-cost appeal.

Explore 8 other fair value estimates on MINISO Group Holding - why the stock might be worth just $23.00!

Build Your Own MINISO Group Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MINISO Group Holding research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MINISO Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MINISO Group Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.