Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Mohawk Industries (MHK) Earnings Decline and Completed Buyback Program

Mohawk Industries, Inc. MHK | 109.20 109.20 | -1.00% 0.00% Pre |

- Earlier this month, Mohawk Industries reported its second-quarter and six-month financial results, revealing flat sales year-over-year but a decline in net income and earnings per share, alongside the completion of a large share repurchase program totaling 3,760,007 shares for US$491.13 million since February 2022.

- An independent news summary has recently highlighted lingering operational challenges at Mohawk, citing shrinking returns on capital and slowing growth as possible concerns for investors.

- We'll explore how the recent earnings decline and operational headwinds could influence Mohawk's previously optimistic investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mohawk Industries Investment Narrative Recap

Owning shares in Mohawk Industries means believing in a recovery in global housing demand and flooring, along with the company’s ability to drive efficiency and innovation in a challenging market. The latest earnings report showed softer income and flat sales; these mixed results may limit optimism in the short term, though the most pressing risk remains sustained weak residential remodeling and new construction rather than last quarter’s figures, so the near-term outlook is largely unchanged.

The completion of Mohawk’s significant share repurchase program, totaling 3,760,007 shares for US$491.13 million since early 2022, stands out. This action brings attention to how the company is deploying capital in light of recent profit pressures, but the buyback itself does not materially change the company’s central catalysts around demand recovery or margin improvement.

Yet against these signs of resilience, investors should be aware of persistent pricing pressure in key markets and…

Mohawk Industries is projected to achieve $11.5 billion in revenue and $830.0 million in earnings by 2028. This is based on an assumed annual revenue growth rate of 2.5% and represents an increase in earnings of $355.7 million from the current earnings of $474.3 million.

Uncover how Mohawk Industries' forecasts yield a $134.88 fair value, a 11% upside to its current price.

Exploring Other Perspectives

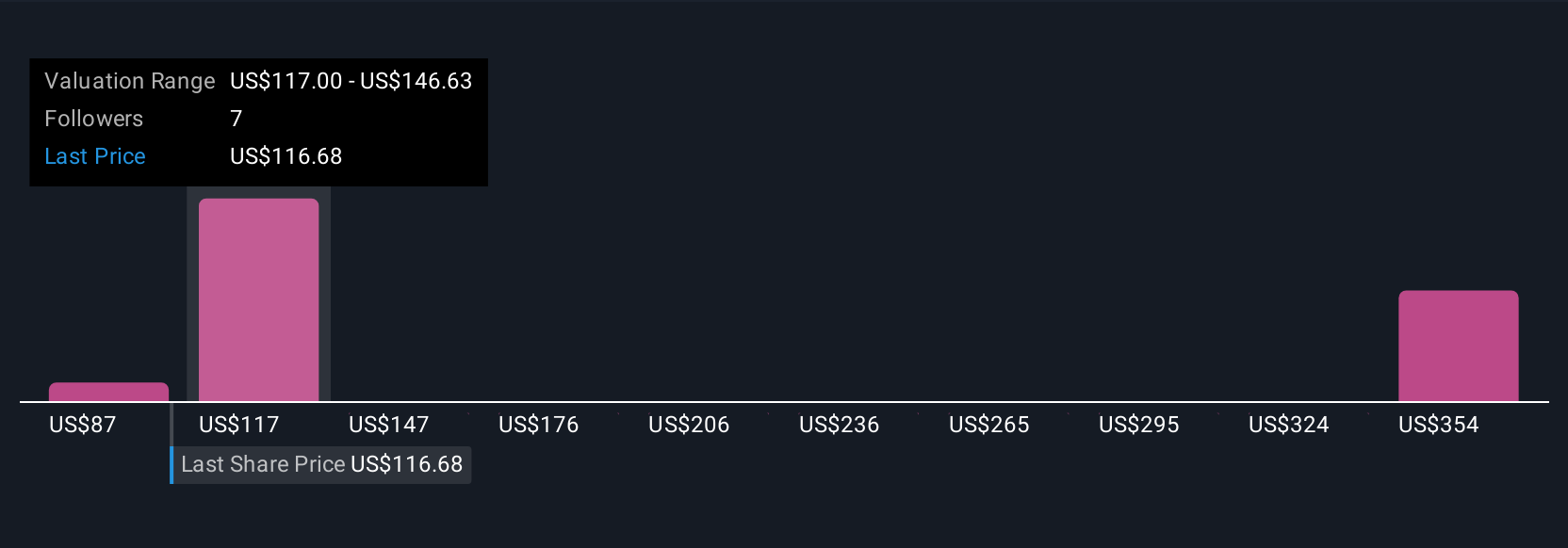

Three fair value estimates from the Simply Wall St Community range from US$87.37 to US$355.11 per share. With industry pricing pressure emerging as a central risk, you can see how opinions on Mohawk’s future performance can vary substantially.

Explore 3 other fair value estimates on Mohawk Industries - why the stock might be worth over 2x more than the current price!

Build Your Own Mohawk Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mohawk Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mohawk Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mohawk Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.