Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To N-able (NABL) Launching Always-On AI-Powered Cybersecurity and Automation Enhancements

N-able Inc Ordinary Shares NABL | 7.62 | +0.79% |

- Earlier this month, N-able, Inc. announced significant enhancements to its Cove Data Protection platform, launching Anomaly Detection as a Service (ADaaS) with built-in honeypot technology to proactively identify and thwart cyber threats, alongside the introduction of Cat-MIP, a new AI standardization initiative for IT automation.

- By combining proactive anomaly detection with industry-wide AI language standardization, N-able is addressing increasingly complex cybersecurity risks and streamlining automation for managed service providers and their clients.

- To assess the impact of these security upgrades, we will explore how N-able's new always-on anomaly detection capabilities shape its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

N-able Investment Narrative Recap

For those interested in N-able, the key belief is that growing cyber threats and the rapid shift toward integrated IT management will continue increasing demand for end-to-end cyber resilience platforms. The launch of Anomaly Detection as a Service (ADaaS) boosts N-able’s security offering for managed service providers and could reinforce confidence around customer retention, a critical short-term catalyst, though rising competitive pressures from vertical integration and commoditization remain a significant risk. At this stage, the direct impact on these drivers appears incremental, not transformational.

The introduction of Cat-MIP, standardizing AI language across platforms, is the most relevant recent announcement in context. By streamlining automation and reducing ambiguities for MSPs, Cat-MIP may help address industry-wide demands for reliability and interoperability. This supports N-able’s bid to remain essential to partners even as competition heats up among consolidated service providers.

In contrast, investors should be aware that even as security upgrades improve defenses, the trend toward consolidation among MSPs could...

N-able's narrative projects $620.4 million revenue and $15.9 million earnings by 2028. This requires 8.7% yearly revenue growth and a $13 million earnings increase from $2.9 million today.

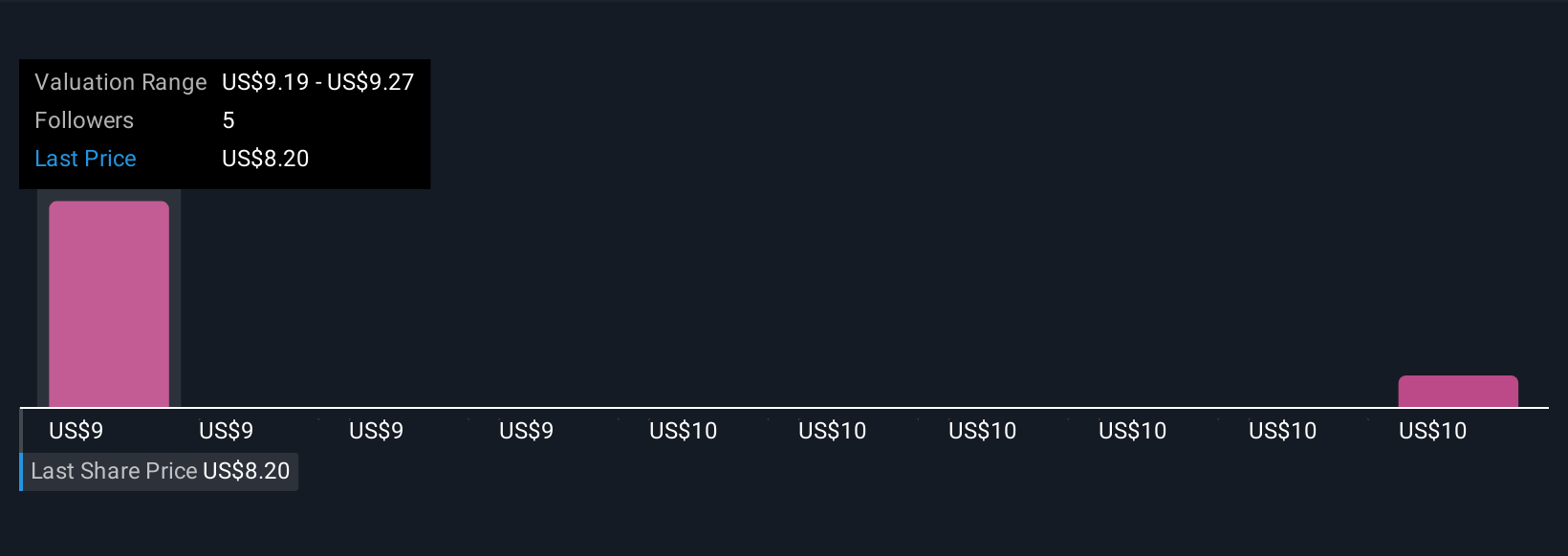

Uncover how N-able's forecasts yield a $9.19 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for N-able range from US$9.19 to US$9.97 across 2 distinct analyses on Simply Wall St, with views sometimes diverging sharply. These varied outlooks echo how consolidation and greater bargaining power among MSPs could affect N-able’s revenue and margins, so be sure to consider several viewpoints when weighing the company’s prospects.

Explore 2 other fair value estimates on N-able - why the stock might be worth just $9.19!

Build Your Own N-able Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your N-able research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free N-able research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate N-able's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.