Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To National HealthCare (NHC) Surging Revenue and Strong Cash Flow

National HealthCare Corporation NHC | 138.57 138.57 | +0.60% 0.00% Pre |

- Earlier this week, National HealthCare Corporation reported a 28.7% increase in revenue, highlighting strong growth across its Inpatient and Homecare and Hospice Services segments.

- The company's healthy free cash flow and prudent dividend policy underscore its ability to adapt and thrive within the evolving healthcare sector.

- We’ll explore how strong financial health and market diversification drive National HealthCare’s overall investment narrative following this earnings report.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is National HealthCare's Investment Narrative?

For anyone considering National HealthCare, the “big picture” is anchored by steady financial management and clear resilience in a challenging healthcare setting. This week’s revenue jump affirms market reach and ongoing demand for its inpatient and homecare services, adding positive momentum and slightly softening concerns about short-term stagnation. If the latest numbers sustain, they could act as a near-term catalyst and lend more support to recent dividend hikes and robust free cash flow. However, sharpening profitability remains crucial; past quarters have seen margins and net income fluctuate, even as revenue grew. Leadership changes, especially the coming COO retirement, introduce a new layer of risk and uncertainty over continuity in strategy and execution. While the recent results are material in their optimism, their long-term impact will depend on management’s ability to build on this momentum and maintain cost controls.

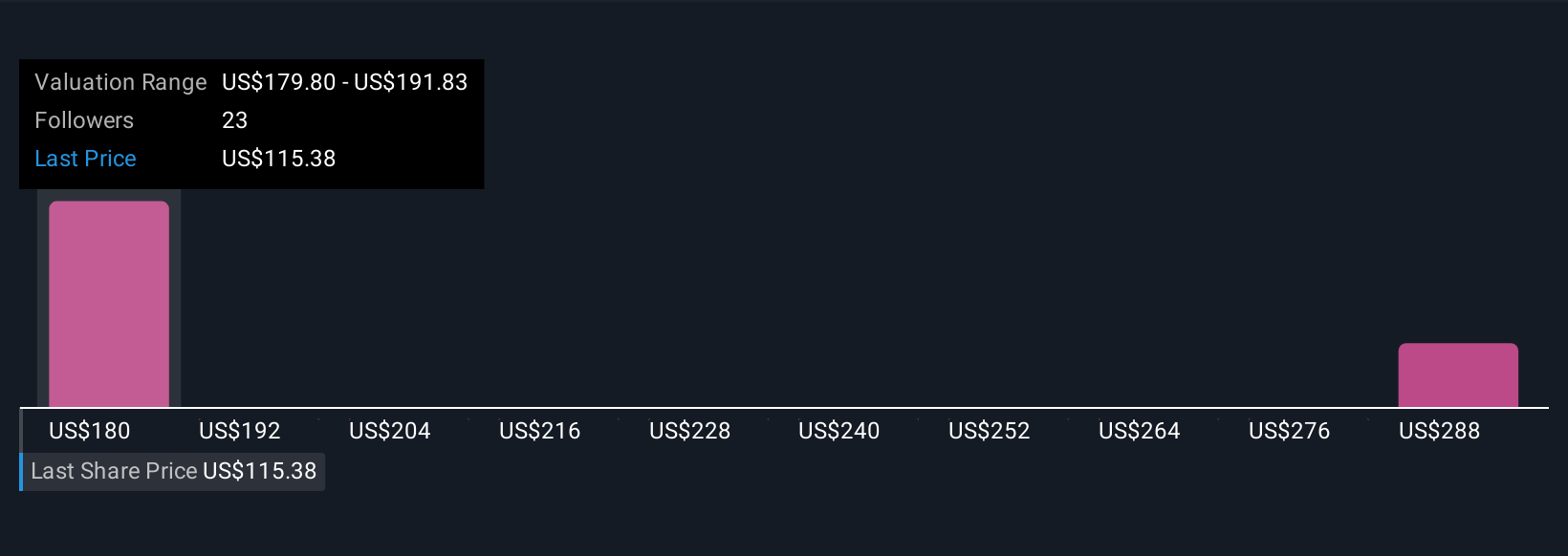

On the other hand, shifts within senior management could affect performance in ways investors should watch closely. National HealthCare's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on National HealthCare - why the stock might be worth over 2x more than the current price!

Build Your Own National HealthCare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National HealthCare research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free National HealthCare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National HealthCare's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.