Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To PROG Holdings (PRG) Analyst Optimism on 'Four' and Cash Tax Savings

PROG Holdings Inc Ordinary Shares PRG | 30.36 30.36 | -0.91% 0.00% Pre |

- Earlier this week, KeyBanc issued a research note following meetings with PROG Holdings, expressing heightened confidence in the company's Buy Now, Pay Later offering, Four, and highlighting expectations for substantial cash tax savings from the OBBBA initiative.

- This analyst commentary is unique for emphasizing the future value potential of Four, suggesting it could be worth hundreds of millions of dollars and spotlighting improved free cash flow yield, despite ongoing industry headwinds.

- We'll now explore how KeyBanc's increased optimism about Four may influence expectations for PROG Holdings' long-term earnings and growth story.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PROG Holdings Investment Narrative Recap

If you own PROG Holdings for the long run, the big idea you’re backing is that their Buy Now, Pay Later (BNPL) unit, Four, will continue to drive growth and profitability, helping offset slower demand in legacy leasing. The recent KeyBanc update adds credibility to this thesis by calling out Four’s value potential and highlighting expected cash tax savings, but it doesn’t fundamentally shift the biggest near-term catalyst, the path to sustained BNPL growth, or change the key risk of competitive pressure in that segment.

Of recently announced activities, the sharp uptick in Q2 net income and raised FY 2025 earnings guidance stands out as most relevant, especially when considered alongside the optimism tied to the Four platform. These factors collectively strengthen the near-term narrative around PROG Holdings’ ability to deliver higher free cash flow and potentially increase returns, but investors should keep an eye on whether BNPL competition will weigh on margin expansion.

By contrast, investors should also be mindful of rising competition in the BNPL market and how it could force pricing changes or margin compression...

PROG Holdings' outlook anticipates $2.7 billion in revenue and $141.4 million in earnings by 2028. This is based on 2.5% annual revenue growth but a decrease in earnings of $73.3 million from the current $214.7 million.

Uncover how PROG Holdings' forecasts yield a $38.57 fair value, a 8% upside to its current price.

Exploring Other Perspectives

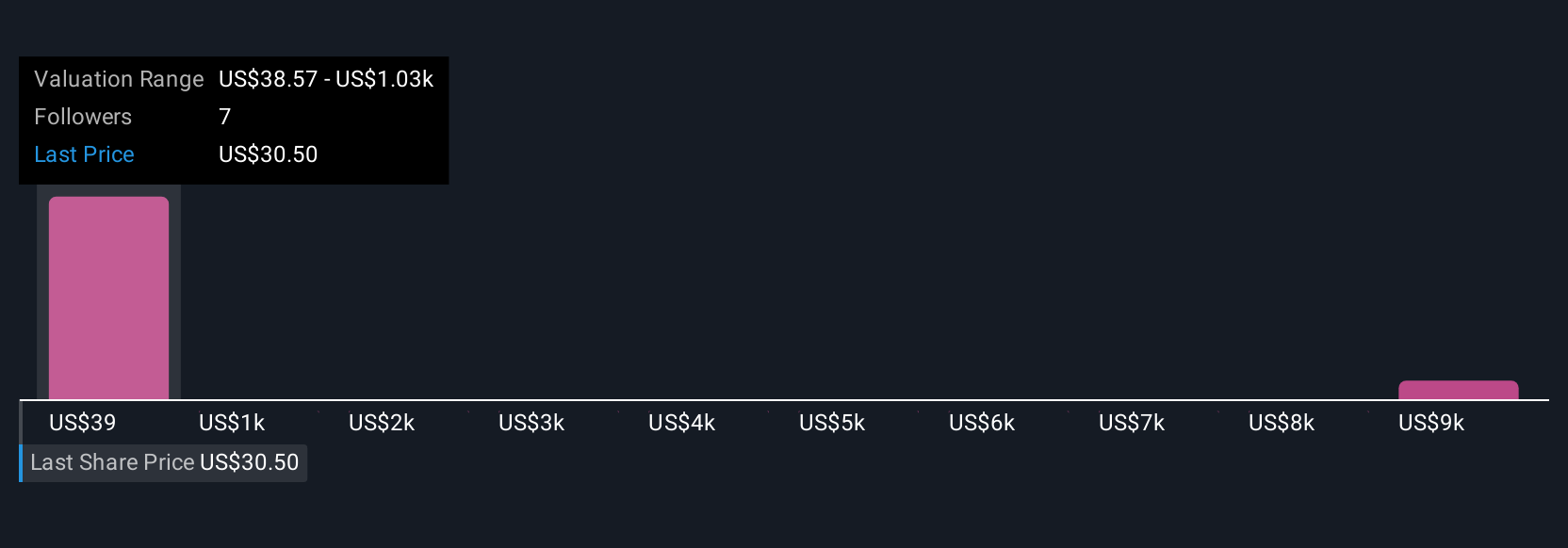

Three individual fair value estimates from the Simply Wall St Community place PROG Holdings' fair value anywhere between US$38 and US$9,999. This wide range of views arrives as accelerating BNPL momentum faces intense competition, prompting you to consider several viewpoints on the company’s future.

Explore 3 other fair value estimates on PROG Holdings - why the stock might be a potential multi-bagger!

Build Your Own PROG Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PROG Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PROG Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PROG Holdings' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.