Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Recursion Pharmaceuticals (RXRX) AI Platform Spotlight Ahead of CEO's Dubai Talk

Recursion Pharmaceuticals, Inc. Class A RXRX | 4.19 | -3.01% |

- Recursion Pharmaceuticals recently drew increased investor attention ahead of CEO Chris Gibson's presentation at a Dubai AI conference, where the company highlighted advances in AI-driven drug discovery and automation.

- An interesting insight is the company's sharpened focus on its proprietary AI platform and key partnerships, reinforcing its push to industrialize drug discovery and streamline its pipeline following acquisitions and program prioritization.

- We'll examine how anticipation for Recursion's CEO presentation on AI-driven data generation and experiment automation may influence its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Recursion Pharmaceuticals Investment Narrative Recap

At its core, the investment case for Recursion Pharmaceuticals hinges on belief in the company's ability to industrialize drug discovery through AI and automation, building a scalable pipeline with big pharma partnerships. While CEO Chris Gibson's upcoming AI conference presentation could energize sentiment and reinforce Recursion's innovation narrative, the event is unlikely to significantly change the biggest short-term catalyst: advancing key internal drug programs amid high cash burn, with the main risk remaining around funding needs and potential dilution.

Among recent company developments, the launch of Boltz-2, the open-source biomolecular foundation model powered by Recursion's supercomputer and NVIDIA collaboration, stands out. This announcement is directly relevant to the company's pipeline acceleration ambitions and demonstrates the practical impact of its AI investments, tying into both anticipated collaboration revenue and pipeline progress that investors follow as near-term drivers.

In contrast, investors should be aware that despite technology advances, Recursion’s unprofitable profile and substantial quarterly losses mean...

Recursion Pharmaceuticals' outlook anticipates $220.9 million in revenue and $35.5 million in earnings by 2028. This scenario relies on a 50.7% annual revenue growth rate and a $684.6 million increase in earnings from the current loss of $-649.1 million.

Uncover how Recursion Pharmaceuticals' forecasts yield a $6.47 fair value, a 22% upside to its current price.

Exploring Other Perspectives

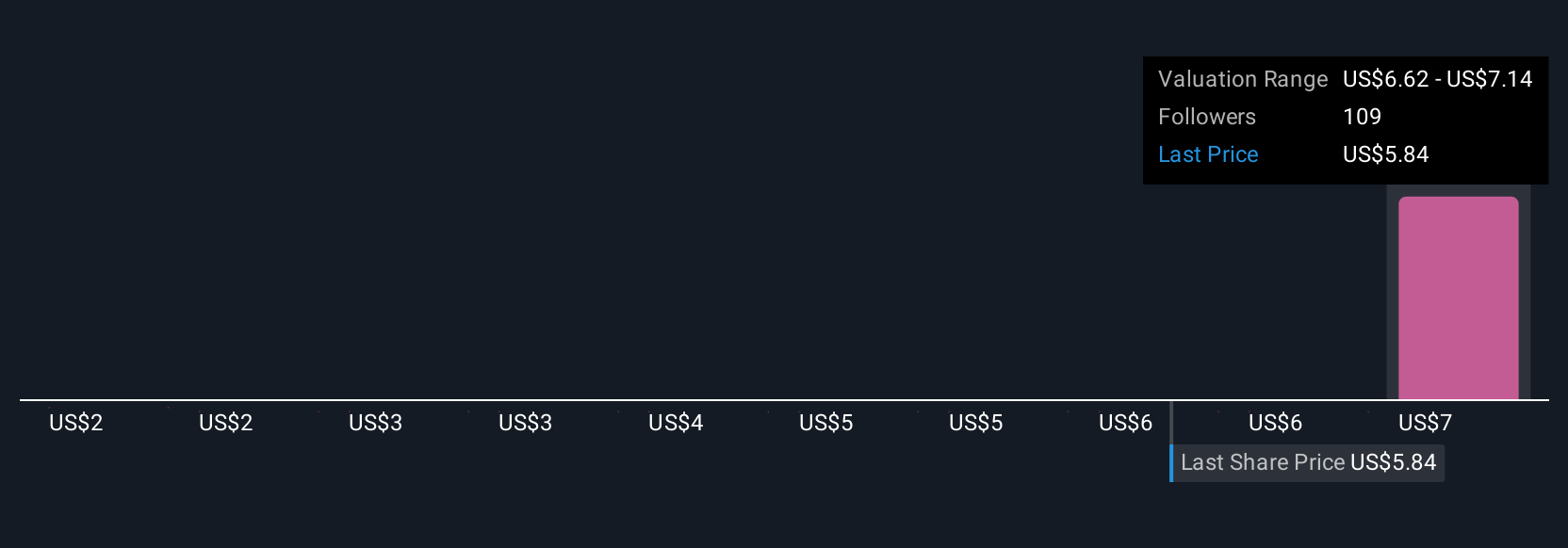

Four fair value estimates from the Simply Wall St Community range from US$1.92 to US$10, reflecting considerable difference in outlook. Persistent cash burn and dependence on future pipeline or partner milestones add further complexity to the company’s performance, see how fellow investors approach these questions.

Explore 4 other fair value estimates on Recursion Pharmaceuticals - why the stock might be worth as much as 88% more than the current price!

Build Your Own Recursion Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Recursion Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Recursion Pharmaceuticals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.