Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Reddit (RDDT) Analyst Upgrades Amid Strong Revenue and Monetization Prospects

RDDT | 224.78 | -3.75% |

- Reddit recently reported strong quarterly revenue growth and profitability milestones, prompting optimism among analysts about its advertising potential and future monetization opportunities.

- Analyst upgrades reflect confidence in Reddit’s resources for growth and its ability to improve monetization, despite ongoing concerns about shifts in AI data licensing and possible impacts on user engagement.

- We’ll explore how increased confidence in Reddit’s advertising and earnings growth outlook could influence the company’s long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

Reddit Investment Narrative Recap

To be a long-term Reddit shareholder, you need to believe in the platform’s ability to grow its user base and deepen engagement, converting community activity into robust advertising revenue and new monetization streams. The recent surge in revenue and profitability reported by Reddit supports this story in the short term and appears to materially strengthen the most important near-term catalyst: accelerating ad growth. However, persistently high market focus on AI data licensing and related engagement risks remains a potential source of volatility and is the main risk to watch.

Among the latest updates, Reddit’s Q2 2025 earnings release is especially relevant given the news about shifting AI data partnerships. The company delivered strong ad-driven revenue growth of 78% year over year and reported its first quarter of profitability, setting clear expectations for further gains if engagement trends hold. This progress directly responds to concerns about diversified revenue sources and can meaningfully influence market sentiment as Reddit continues to scale.

By contrast, investors should also be aware of ongoing uncertainty around data licensing’s contribution to long-term earnings...

Reddit's outlook anticipates $3.8 billion in revenue and $1.0 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 31.8% and a $783.7 million increase in earnings from the current $216.3 million.

Uncover how Reddit's forecasts yield a $222.38 fair value, a 11% upside to its current price.

Exploring Other Perspectives

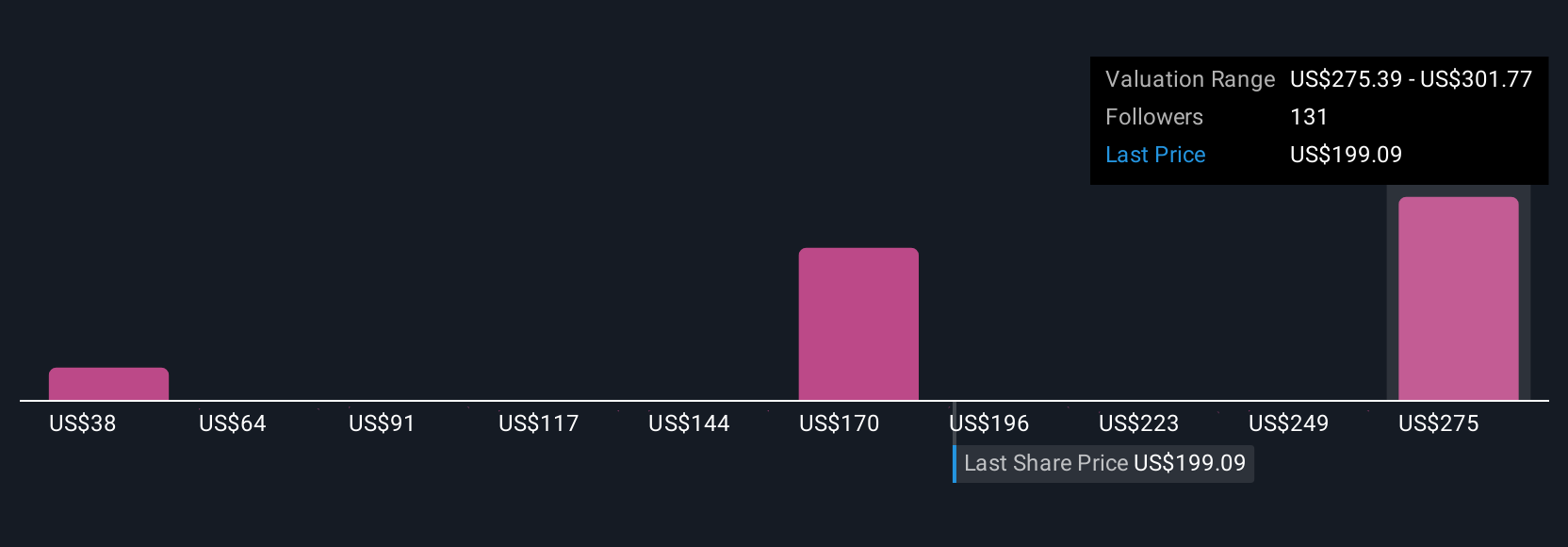

Nearly 30 Simply Wall St Community members valued Reddit between US$38 and US$295, reflecting sharply different return expectations. With competition for user attention rising, take time to compare these views and consider how engagement trends might shape Reddit’s future course.

Explore 29 other fair value estimates on Reddit - why the stock might be worth less than half the current price!

Build Your Own Reddit Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reddit research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Reddit research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reddit's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.