Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Shoals Technologies Group (SHLS) Expanding Patent Protections in Solar Wiring Litigation

Shoals Technologies Group, Inc. Class A SHLS | 9.21 | +0.22% |

- Shoals Technologies Group recently announced the issuance of a new U.S. patent expanding its Big Lead Assembly intellectual property portfolio and initiated legal action to defend this asset in its ongoing litigation against Voltage, LLC.

- This development highlights Shoals' commitment to safeguarding innovation in plug-and-play wiring solutions, which play a pivotal role in driving efficiency and reliability in U.S. solar project deployment.

- We'll examine how Shoals’ move to defend its solar wiring innovation may influence its future growth prospects within renewable infrastructure.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

Shoals Technologies Group Investment Narrative Recap

Investors in Shoals Technologies Group are typically aligned with the long-term renewable energy buildout and the need for dependable, innovative infrastructure like the company’s plug-and-play wiring solutions. The latest patent expansion strengthens Shoals’ intellectual property and legal footing, but this news is unlikely to materially offset the most immediate challenge: persistent margin pressure and high legal and warranty costs, which continue to weigh on earnings and free cash flow in the near term.

Among recent announcements, Shoals’ new U.S. patent reinforcing the Big Lead Assembly portfolio stands out for its direct relevance to ongoing litigation with Voltage, LLC. Protecting this technology is crucial as the company works to convert its robust backlog in utility-scale solar into higher-margin, recurring revenue streams, a key catalyst for any potential improvement in future profitability.

Yet, despite these advances, investors should be aware that elevated legal expenses and negative free cash flow remain a core risk if cash outflows do not moderate...

Shoals Technologies Group's outlook anticipates $589.7 million in revenue and $80.2 million in earnings by 2028. This scenario is based on a 13.8% annual revenue growth rate and a $59.1 million increase in earnings from the current $21.1 million.

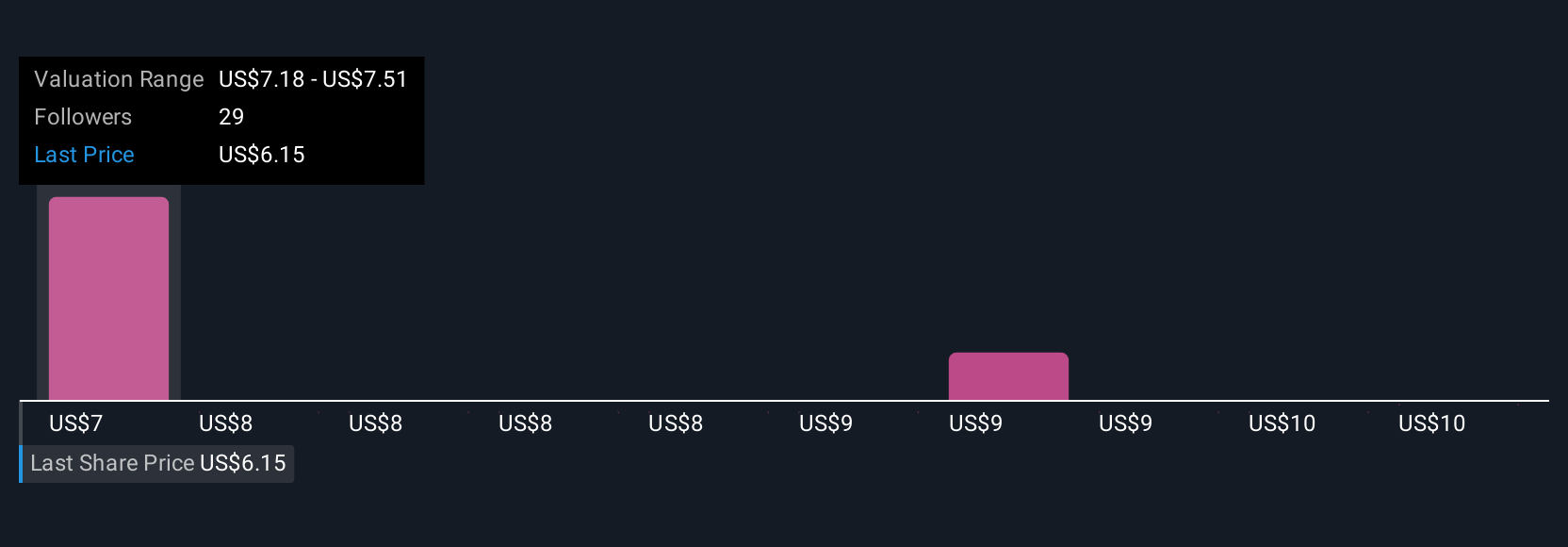

Uncover how Shoals Technologies Group's forecasts yield a $7.34 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for Shoals Technologies Group, ranging from US$7.34 to US$9.77 per share. While a diverse set of opinions exists, ongoing margin compression continues to be a critical factor shaping future earnings potential and may influence how different investors view long-term value.

Explore 2 other fair value estimates on Shoals Technologies Group - why the stock might be worth just $7.34!

Build Your Own Shoals Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shoals Technologies Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shoals Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shoals Technologies Group's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.