Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To SL Green (SLG) After Major Lease and Dividend Amid Net Loss

SL Green Realty Corp. SLG | 44.64 44.64 | -0.25% 0.00% Pre |

- SL Green Realty recently declared a monthly cash dividend of US$0.2575 per share, confirmed its annual earnings guidance, reported higher year-over-year revenue for both the second quarter and first half of 2025, and signed a major lease at One Madison Avenue, raising occupancy at the property to 78.1%.

- Despite these positive developments, the company posted a net loss for both the quarter and year-to-date, signaling that operating challenges persist even as leasing momentum and shareholder returns continue.

- We’ll consider how the new lease at One Madison Avenue may influence the company’s investment narrative and future performance outlook.

SL Green Realty Investment Narrative Recap

To be a shareholder of SL Green Realty, you need to believe that premier, amenity-rich Manhattan office properties can continue attracting top-tier tenants even as the sector faces headwinds. The recent One Madison Avenue lease, which raises occupancy to 78.1%, highlights leasing progress that could support the company’s most crucial short-term catalyst: driving strong occupancy and reducing revenue volatility. However, persistent net losses and ongoing operating challenges mean the impact on near-term profitability remains limited, and the larger risk of prolonged high interest costs still looms.

Among the latest announcements, the reaffirmation of SL Green’s 2025 earnings guidance stands out. Maintaining a net income range of US$1.27 to US$1.57 per share, even after another net loss, signals consistency in management’s expectations despite ongoing leasing wins and continued cost pressures. This helps frame the catalysts and risks discussed, with occupancy gains and rising interest expenses shaping both the outlook and investor sentiment.

Yet, even with leasing success, investors should not overlook the possibility that higher interest expenses could...

SL Green Realty is forecast to reach $657.1 million in revenue and $39.4 million in earnings by 2028. This projection assumes a revenue decline of 0.9% per year and an earnings increase of $77.4 million from the current earnings of -$38.0 million.

Exploring Other Perspectives

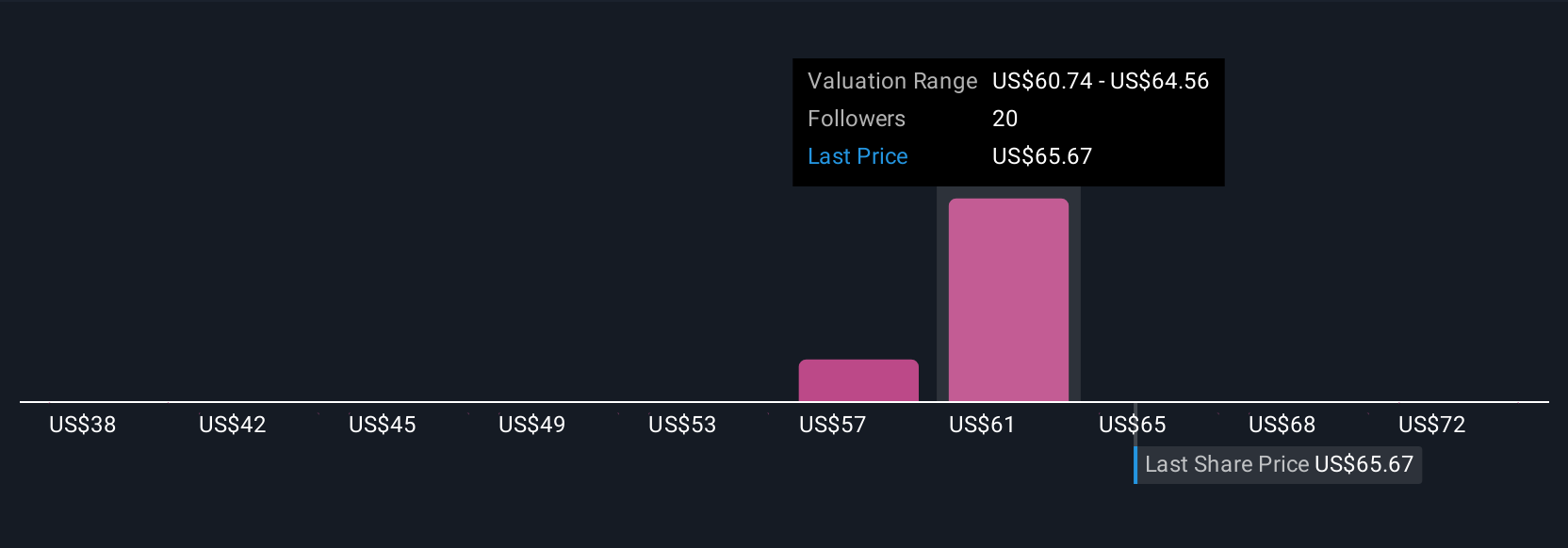

Three Simply Wall St Community members offered fair value estimates for SL Green ranging from US$37.86 to US$70.60. While some see upside, the risk from sustained high interest expenses could have broader repercussions for profitability and capital returns.

Build Your Own SL Green Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SL Green Realty research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free SL Green Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SL Green Realty's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.