Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Southern Copper (SCCO) Record Profits Amid Lower Output And Market Deficit

Southern Copper Corporation SCCO | 201.01 | +3.58% |

- Southern Copper Corporation recently reported fourth-quarter 2025 sales of US$3,869.8 million and net income of US$1,307.9 million, capping a year in which full-year sales reached US$13.42 billion and net income climbed to US$4.33 billion.

- Alongside these record results, management flagged a copper market deficit and lower near-term production due to declining ore grades in Peru, while still committing to substantial growth projects like the Tía María development.

- Next, we’ll examine how record earnings combined with expected lower copper output shape Southern Copper’s investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Southern Copper's Investment Narrative?

To own Southern Copper today, you have to believe in the long-term demand story for copper while accepting that the next couple of years may be choppy. The company just posted record 2025 earnings of US$4.33 billion, yet management is guiding to a 4.7% drop in 2026 copper output as Peruvian ore grades decline and is flagging a market deficit of 320,000 tonnes. That combination, plus copper prices at all-time highs and a share price trading above both analyst targets and estimated cash flow value, makes near term expectations a key catalyst and a key vulnerability. The big swing factors now are how copper prices react if supply tightness eases and whether large growth projects like Tía María stay on track without cost or permitting surprises. Recent price gains of over 30% in a month suggest any disappointment could quickly reprice the stock.

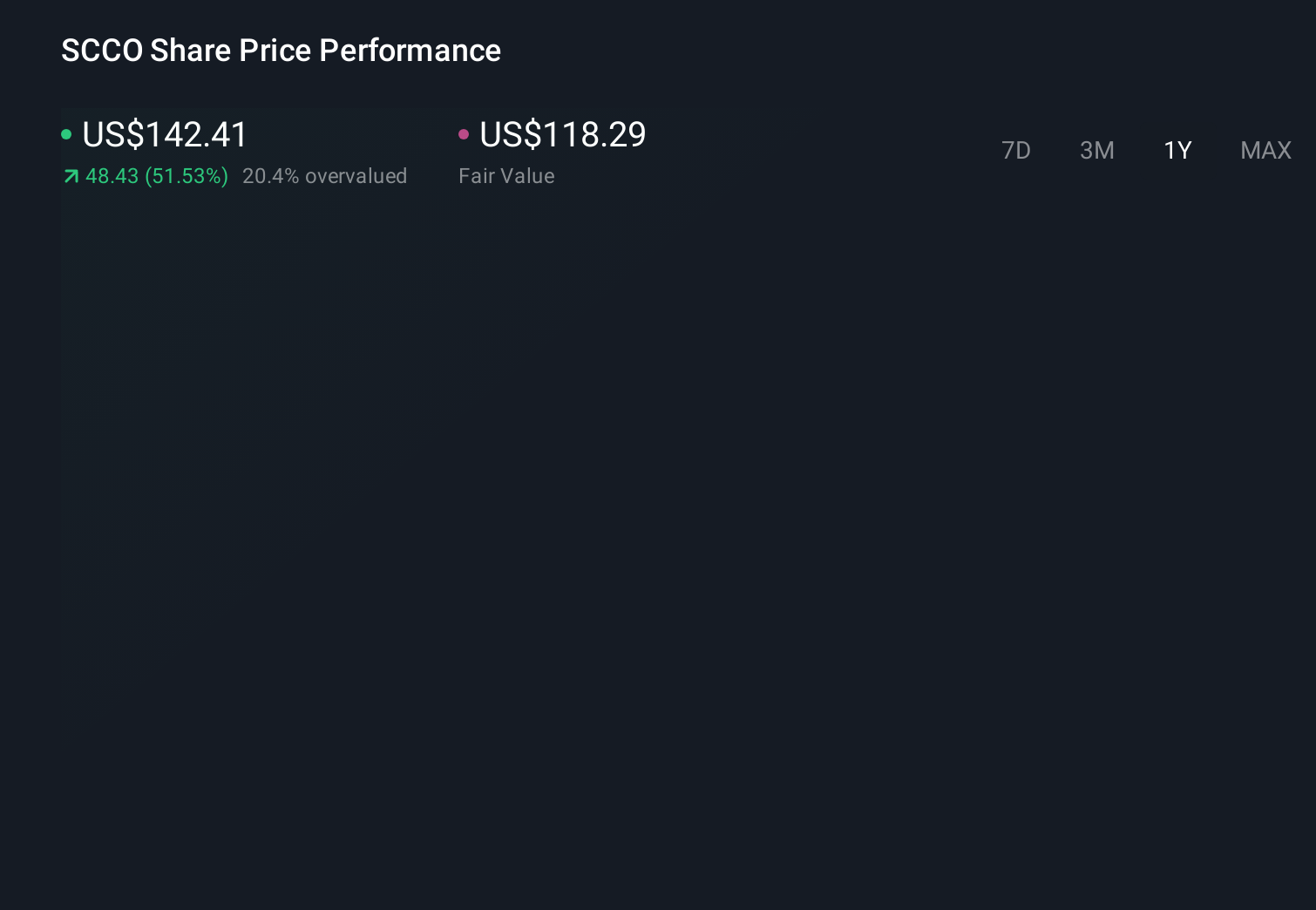

However, one risk around future copper volumes is becoming more important for shareholders to watch. Southern Copper's shares are on the way up, but they could be overextended by 26%. Uncover the fair value now.Exploring Other Perspectives

Four Simply Wall St Community fair values, ranging from US$100 to about US$172, show how differently people see Southern Copper’s upside, especially with ore grade pressures and ambitious expansion plans now reshaping expectations.

Explore 4 other fair value estimates on Southern Copper - why the stock might be worth 47% less than the current price!

Build Your Own Southern Copper Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Copper's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 110 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.