Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Sweetgreen (SG) 2025 Growth Plans and Lower Same-Store Sales Outlook

Sweetgreen, Inc. Class A SG | 5.79 | -4.14% |

- Earlier this week, Sweetgreen announced its 2025 business outlook, planning at least 40 net new restaurant openings, 20 featuring its Infinite Kitchen technology, and updated guidance with expected annual revenue in the range of US$700 million to US$715 million and a same-store sales change of 4% to 6% decline.

- This combination of significant restaurant growth, technology rollouts, and revised sales guidance indicates a pivotal year for Sweetgreen as it balances expansion with evolving operational performance.

- Let's look at how the 2025 Infinite Kitchen rollout and updated revenue outlook may reshape Sweetgreen's investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sweetgreen Investment Narrative Recap

For investors interested in Sweetgreen, belief in the company’s scalable growth model and technology-driven efficiency remains central. The recent 2025 guidance, outlining 40 new restaurants, half equipped with the Infinite Kitchen, and a revised revenue outlook with negative same-store sales, brings both opportunity and renewed attention to operational execution. At this stage, while these initiatives remain key catalysts, near-term risks around same-store sales volatility appear especially acute and the update makes this risk more visible in the short term.

Among recent announcements, the unveiling of Sweetgreen’s Infinite Kitchen expansion is particularly relevant. The planned rollout to 20 new locations aligns directly with the main short-term catalyst of margin improvement, positioning technology as an important part of Sweetgreen’s bid to offset labor and operational headwinds as the company works to stabilize underlying sales trends.

However, it’s important investors remain aware that, while potential efficiencies are clear, sudden swings in same-store sales, particularly if driven by unpredictable factors such as market-level disruptions or changing customer habits, could...

Sweetgreen's narrative projects $1.1 billion revenue and $89.1 million earnings by 2028. This requires 17.1% yearly revenue growth and a $178.4 million earnings increase from -$89.3 million.

Uncover how Sweetgreen's forecasts yield a $20.08 fair value, a 59% upside to its current price.

Exploring Other Perspectives

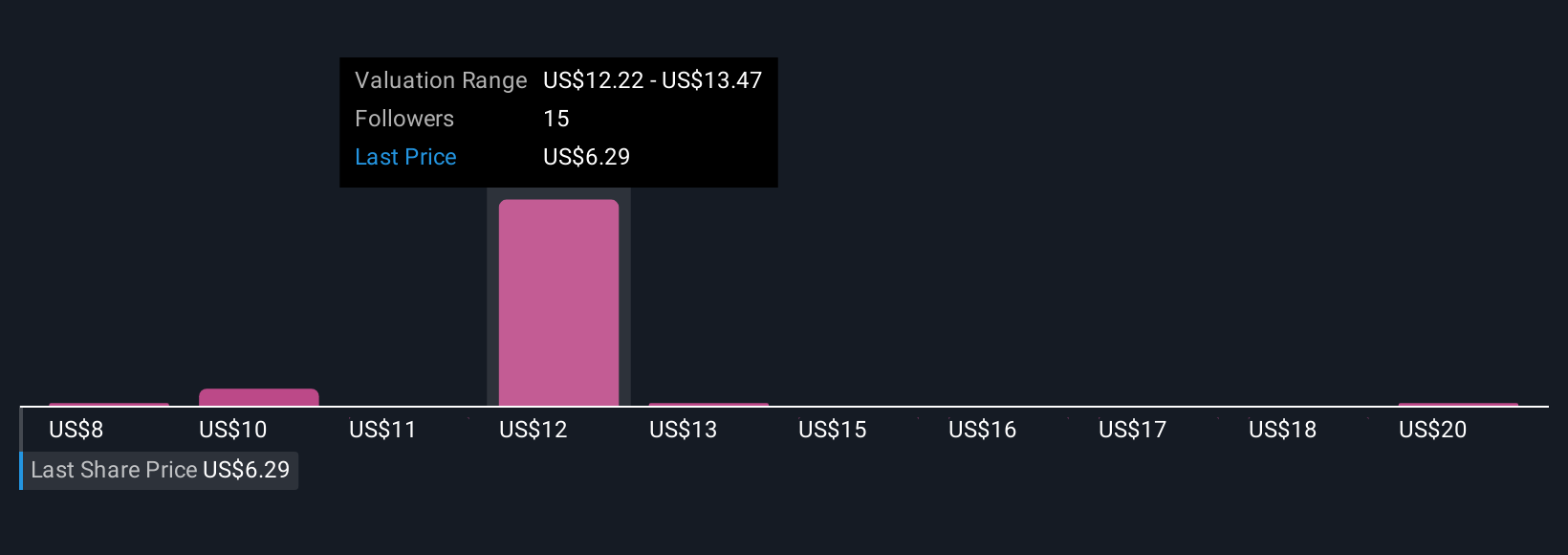

Simply Wall St Community members’ fair value estimates for Sweetgreen range widely, from US$10.24 to US$42.58, across four viewpoints. Ongoing concerns around same-store sales declines suggest it’s worth comparing these contrasting valuations and perspectives before making any decisions.

Explore 4 other fair value estimates on Sweetgreen - why the stock might be worth over 3x more than the current price!

Build Your Own Sweetgreen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sweetgreen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sweetgreen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sweetgreen's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.