Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Tenet Healthcare (THC) Amid Renewed Analyst Optimism and Stable Earnings Forecasts

Tenet Healthcare Corporation THC | 195.51 | -0.92% |

- In the past week, analysts reaffirmed their optimistic outlook on Tenet Healthcare, with heightened earnings projections and strong consensus support highlighting current investor confidence in the company.

- This analyst momentum coincides with a period of stable earnings estimate revisions and an appraisal of Tenet Healthcare as an attractive value option among its industry peers.

- We'll explore how this renewed analyst optimism and stable earnings outlook could influence Tenet Healthcare's broader investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Tenet Healthcare Investment Narrative Recap

Owning Tenet Healthcare stock means believing in the long-term power of demographic trends and outpatient expansion to drive higher-acuity hospital admissions and sustained revenue growth, even as volume headwinds and policy risks persist. The recent uptick in analyst optimism, reflected in higher price targets and stable earnings estimates, may provide short-term momentum, but does not significantly change the central catalyst of demand growth or the ongoing risk of healthcare reimbursement and payer pushback, which remain crucial for investors to watch.

Of the company's recent updates, the July 2025 guidance revision stands out as most relevant. The company now projects 2025 net income between US$1.279 billion and US$1.379 billion, with EPS guidance raised since earlier in the year, signaling management’s confidence in operational trends despite admitted pressures on margins and patient volumes. Yet, while these upward revisions may align with positive analyst sentiment, they do not eliminate the risk that reimbursement challenges and payer disputes could compress margins moving forward.

On the other hand, investors should be aware that rising reimbursement pressure and shifting payer behavior can...

Tenet Healthcare is projected to deliver $23.3 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.0% and a decrease of $0.1 billion in earnings from the current $1.5 billion.

Uncover how Tenet Healthcare's forecasts yield a $199.48 fair value, a 3% upside to its current price.

Exploring Other Perspectives

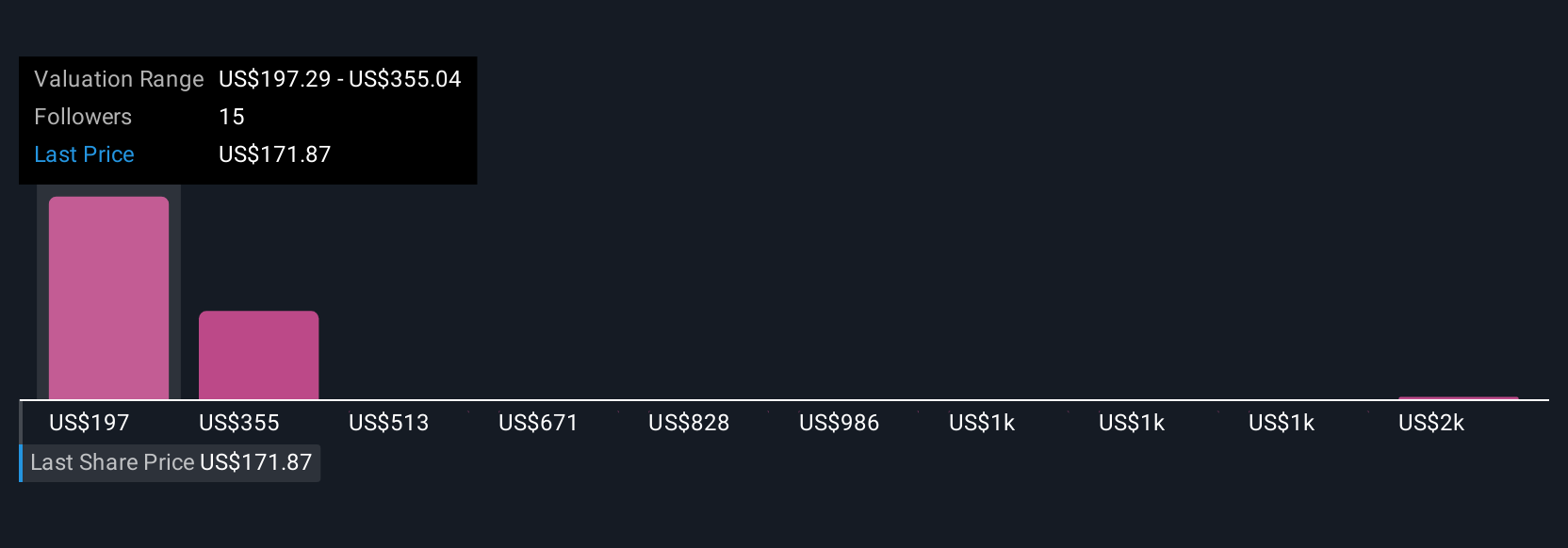

Fair value estimates from the Simply Wall St Community span US$199 to an exceptional US$1,775, based on three user forecasts. With such a wide range of opinions, paired with ongoing healthcare policy risks, consider how diverging assumptions could influence your outlook on Tenet Healthcare’s future performance.

Explore 3 other fair value estimates on Tenet Healthcare - why the stock might be worth over 9x more than the current price!

Build Your Own Tenet Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tenet Healthcare research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Tenet Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tenet Healthcare's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.