Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To TFS Financial (TFSL) Amid Rising Loan Quality Concerns in Regional Banks

TFS Financial Corporation TFSL | 13.74 13.74 | -0.07% 0.00% Pre |

- Earlier this week, concerns about loan quality spread across the regional banking sector as multiple banks, including Zions Bancorp and Western Alliance Bancorp, reported significant loan charge-offs and collateral issues.

- This surge in credit risk anxiety is amplified by ongoing pressures from high interest rates and declining commercial real estate values, drawing investor attention to the sector's overall stability.

- We'll explore how heightened focus on loan quality could reshape TFS Financial's investment narrative going forward.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is TFS Financial's Investment Narrative?

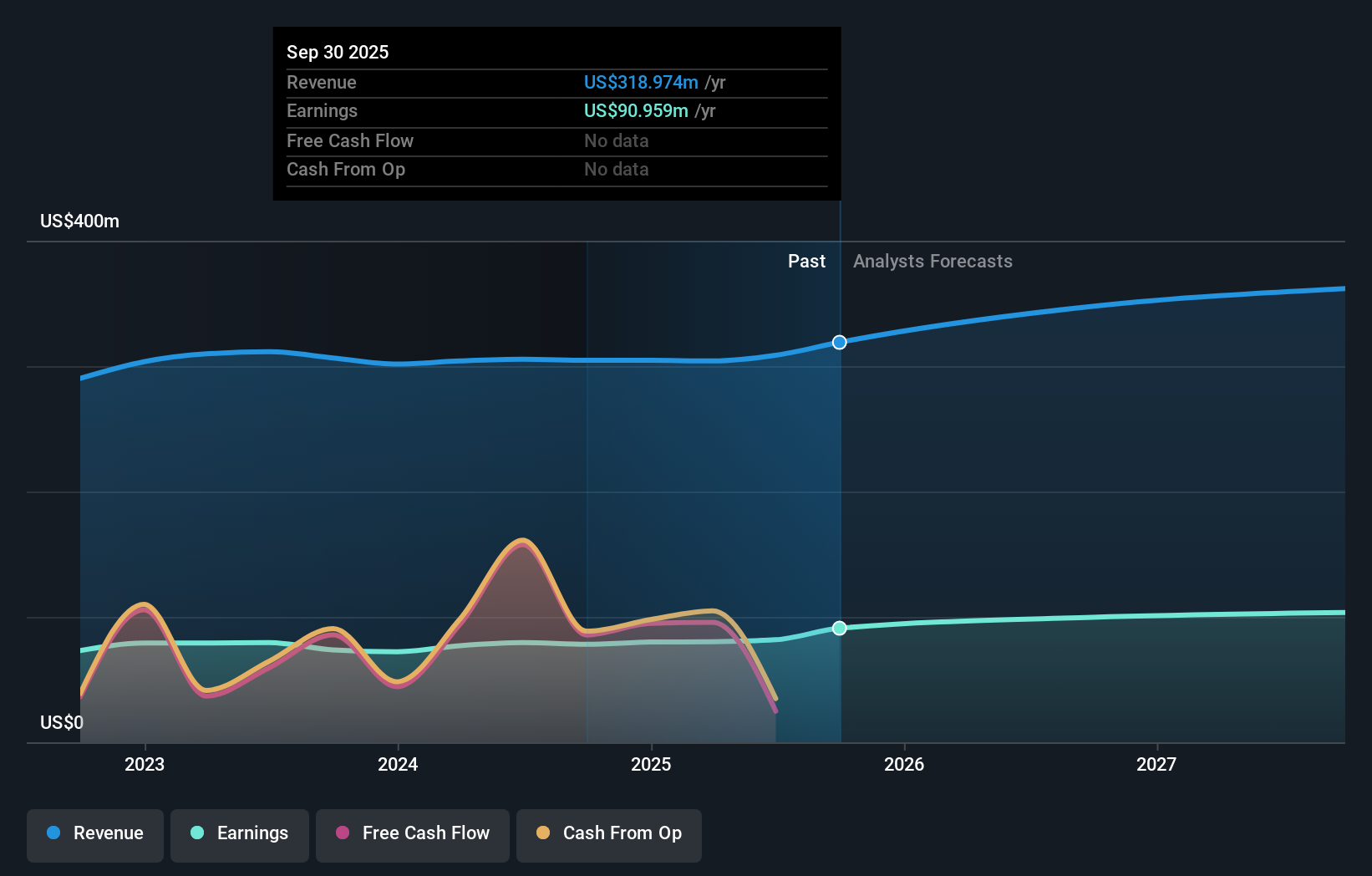

To be a shareholder in TFS Financial, you need to trust in its steady, income-focused model and the appeal of consistent dividends, rather than expecting breakneck growth. Until now, much of the short-term investment story hinged on the sustainability of the bank’s attractive payout, management’s share buybacks, and incremental earnings improvements. However, the wave of concern rippling through the regional banking sector after Zions and Western Alliance’s loan issues could shift that narrative. For TFS, the biggest risk on the horizon now appears to be related to asset quality and credit risk, as market anxiety about potential losses overshadows previous debates about valuation or slower-than-market growth. The recent share price wobble suggests the news is being taken seriously, but unless TFS reveals similar loan-loss troubles, the direct impact on forthcoming catalysts might be limited. Yet some are asking whether rising credit costs could pressure future dividends and profits.

TFS Financial's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on TFS Financial - why the stock might be worth less than half the current price!

Build Your Own TFS Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TFS Financial research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free TFS Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TFS Financial's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.