Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Uber Technologies (UBER) Expanding Autonomous Delivery Through Serve Robotics Partnership

Uber Technologies,Inc. UBER | 85.11 | -0.39% |

- Serve Robotics recently announced the expansion of its autonomous delivery robot fleet in partnership with Uber Eats, aiming to deploy 2,000 robots across five U.S. cities before the end of 2025 and unveiling a new multiyear collaboration with DoorDash to broaden its reach.

- This move highlights Uber's ability to leverage technology partnerships to accelerate its presence in the competitive last-mile logistics and autonomous delivery market.

- We'll explore how Uber's rapid scale-up in autonomous delivery technology, particularly through its collaboration with Serve Robotics, could influence the company’s investment outlook.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Uber Technologies Investment Narrative Recap

To be a shareholder in Uber Technologies today, you have to believe in the company's ability to scale mobility and delivery services profitably, while leveraging technology partnerships like its recent expansion with Serve Robotics. The partnership may help Uber keep pace in last-mile automation, but it doesn't materially impact Uber's biggest near-term catalyst, growth in cross-platform user engagement, or the largest risk: the financial commitment to autonomous technology, given ongoing losses in AV operations.

One recent announcement that stands out is Uber Eats’ nationwide partnership with ALDI, including SNAP-EBT payments. This move directly supports user base expansion and increased gross bookings, both crucial to offset mounting costs and competition as Uber ramps up delivery automation.

On the other hand, investors should be aware that rising spending on autonomous delivery could increase capital pressures if...

Uber Technologies is projected to generate $71.2 billion in revenue and $9.7 billion in earnings by 2028. This outlook assumes a 14.6% annual revenue growth rate, but a decrease in earnings of $2.9 billion from the current $12.6 billion.

Uncover how Uber Technologies' forecasts yield a $107.62 fair value, a 14% upside to its current price.

Exploring Other Perspectives

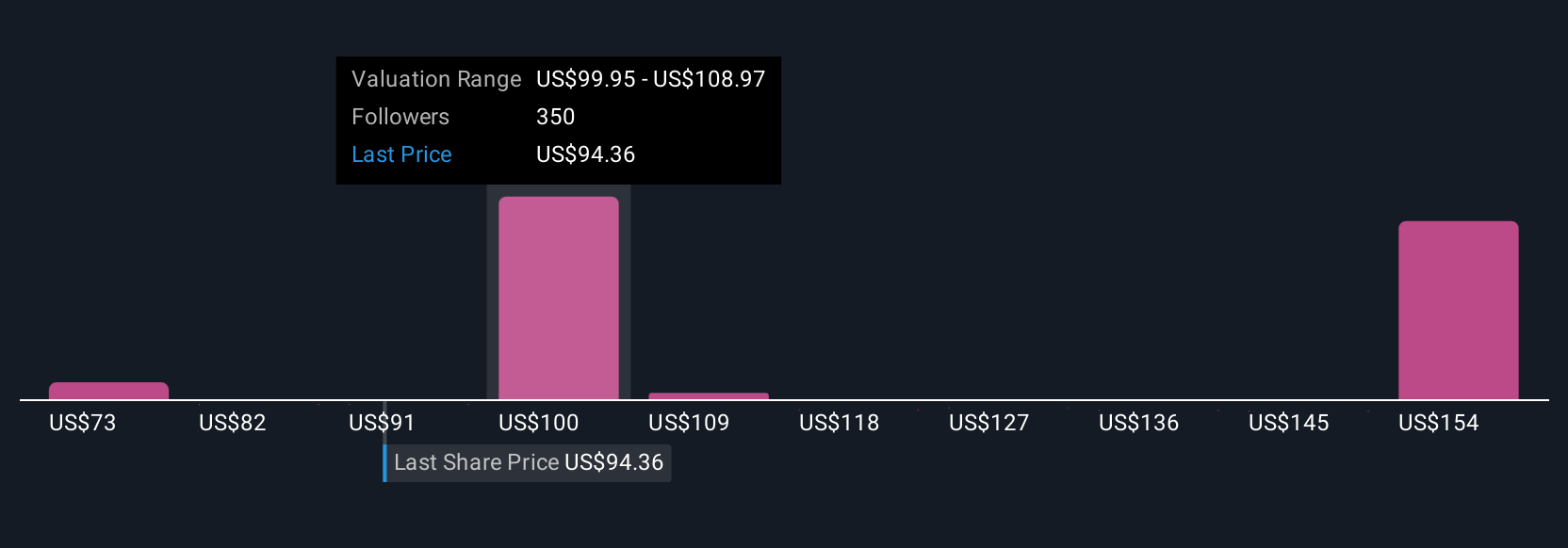

58 members of the Simply Wall St Community estimated Uber’s fair value from US$72.92 to US$159.84. With substantial uncertainty around the profitability of autonomous delivery, your own assumptions about future cash flows could significantly shift your view.

Explore 58 other fair value estimates on Uber Technologies - why the stock might be worth as much as 69% more than the current price!

Build Your Own Uber Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Uber Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uber Technologies' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.