Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Ultragenyx Pharmaceutical (RARE) Legal Probe and Uncertainty in Phase 3 Study

Ultragenyx Pharmaceutical, Inc. RARE | 33.21 | -3.29% |

- Earlier this month, Ultragenyx Pharmaceutical filed a shelf registration for up to US$95.94 million in common stock as part of an ESOP-related offering, while Pomerantz LLP began investigating potential securities fraud or unlawful practices related to the company's recent clinical updates.

- The launch of a legal investigation following updates on the Phase 3 UX143 study highlights heightened investor sensitivity to clinical trial communications and corporate governance at Ultragenyx.

- We'll now examine how this new legal scrutiny and clinical milestone uncertainty may affect Ultragenyx's growth outlook and analyst expectations.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ultragenyx Pharmaceutical Investment Narrative Recap

To be an Ultragenyx shareholder, you need conviction in the company's rare disease pipeline and its ability to deliver on key late-stage clinical trials, especially UX143 for osteogenesis imperfecta. Recent legal scrutiny and the ESOP-related share registration do not materially change the single most important short-term catalyst: clear, positive clinical results from the ongoing Phase 3 UX143 study, but they do increase near-term risk around investor sentiment and corporate communications.

The announcement most relevant here is the July 9 update stating that the Phase 3 Orbit study for UX143 is moving toward a year-end final analysis and that safety results remain acceptable. This progress preserves the main near-term catalyst and underpins Ultragenyx’s growth narrative, though any additional volatility tied to legal or regulatory developments could affect how investors react to future trial results.

By contrast, investors should watch for unexpected developments in clinical trial disclosures and how these might...

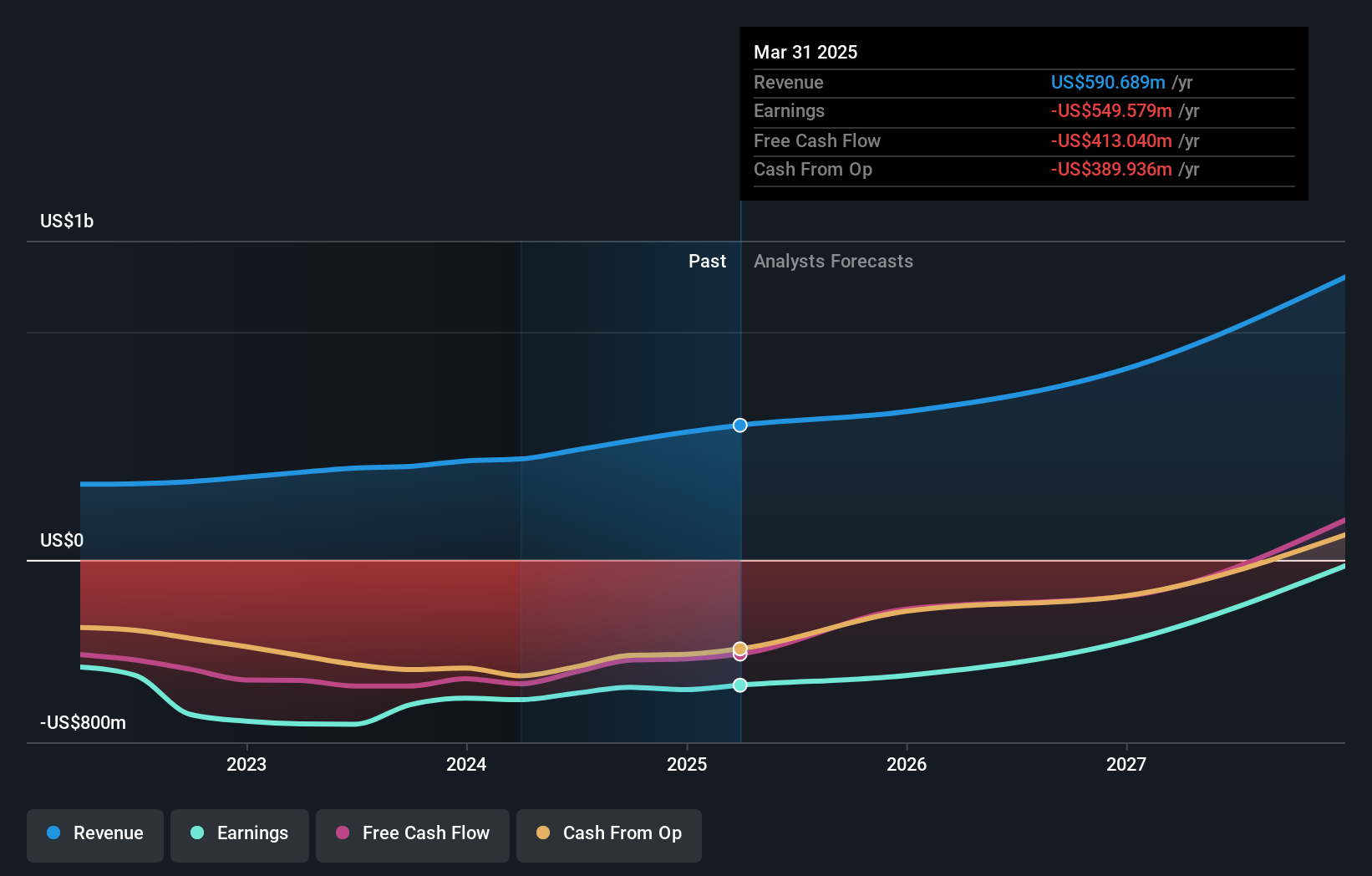

Ultragenyx Pharmaceutical's narrative projects $1.3 billion in revenue and $140.6 million in earnings by 2028. This requires 31.2% yearly revenue growth and a $690 million increase in earnings from the current -$549.6 million.

Uncover how Ultragenyx Pharmaceutical's forecasts yield a $87.21 fair value, a 216% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members posted two separate fair value targets for Ultragenyx ranging from US$87 to US$451 per share. Yet with the company’s prospects hinging on Phase 3 UX143 outcomes, opinions about its future performance can vary widely, review all perspectives before deciding.

Explore 2 other fair value estimates on Ultragenyx Pharmaceutical - why the stock might be a potential multi-bagger!

Build Your Own Ultragenyx Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ultragenyx Pharmaceutical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ultragenyx Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ultragenyx Pharmaceutical's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.