Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To V2X (VVX) Expanding Secure AI Partnerships And Reviving A US$4.30 Billion Contract

V2X Inc VVX | 68.59 | -3.22% |

- In recent weeks, V2X, Inc. has unveiled partnerships with Google Public Sector and Amazon to deploy secure AI, cloud, and smart warehousing technologies for U.S. defense, intelligence, and government logistics programs, alongside resuming work on its US$4.30 billions T-6 COMBS aircraft supply contract after a protest was denied.

- Together, these moves deepen V2X’s role at the intersection of advanced AI and long-duration government support contracts, expanding its reach across both mission-critical operations and next-generation digital infrastructure.

- Next, we’ll examine how V2X’s push into secure, government-focused AI through Google Public Sector could reshape its broader investment narrative.

The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

What Is V2X's Investment Narrative?

For V2X, the big picture an investor needs to buy into is a company that pairs long-duration, contracted defense support work with a growing layer of secure, AI-enabled services. The resumption of the US$4.30 billions T-6 COMBS contract shores up one of the most visible near-term catalysts, adding clarity to revenue visibility through 2034 and easing some uncertainty around contract risk. The new partnerships with Google Public Sector and Amazon look more like medium-term story builders than immediate financial game changers, but they do sharpen V2X’s positioning around government-grade AI, data and logistics, which could influence how the market thinks about its margin and growth profile ahead of the upcoming Q4 2025 result. The flip side is execution risk on complex tech deployments, alongside a balance sheet where interest coverage already merits close attention.

Yet one issue in particular could matter more than many shareholders expect.

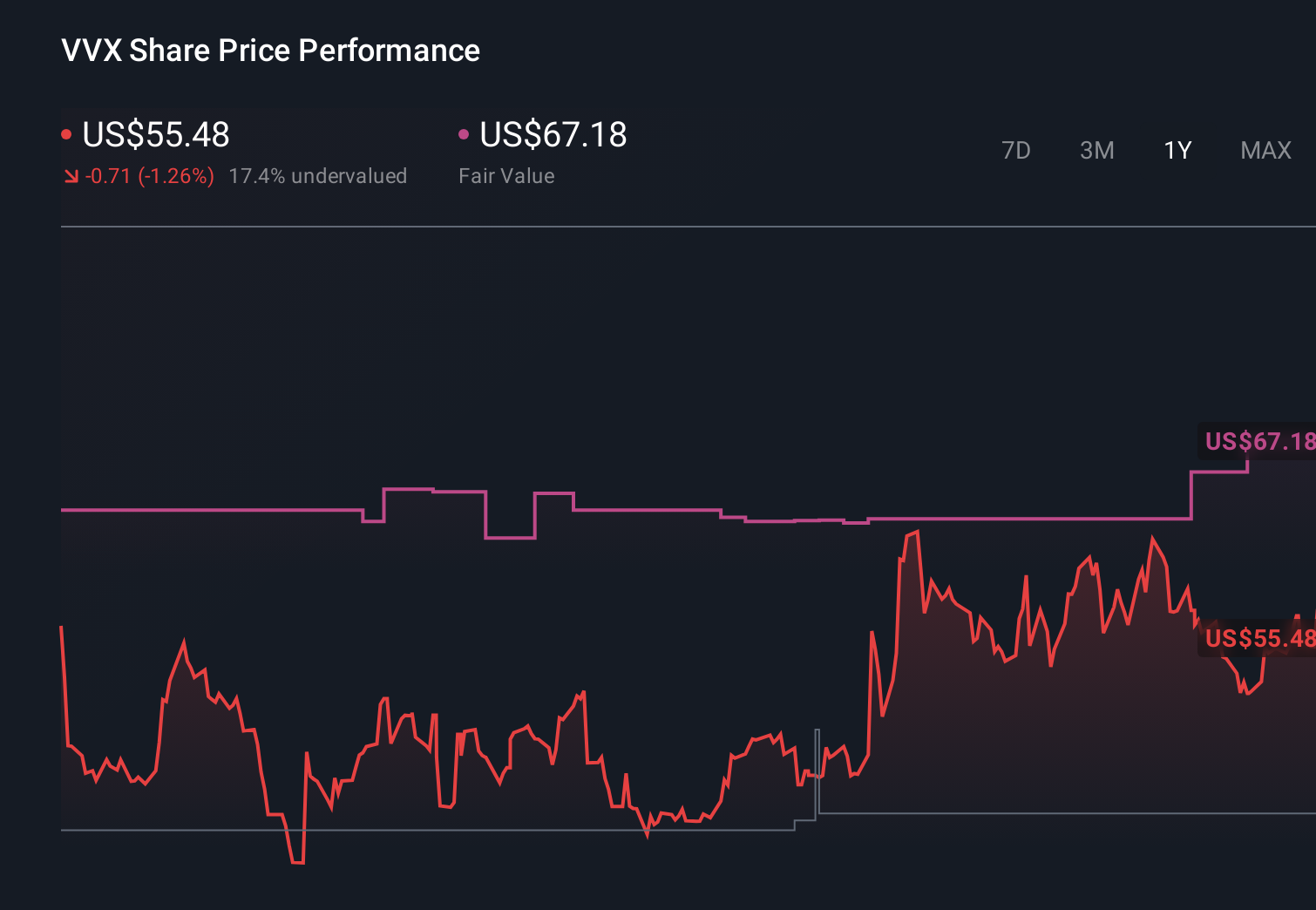

V2X's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$37 to US$155, reflecting very different views on V2X’s long-term potential. Set against that breadth of opinion, the recent AI partnerships and the renewed US$4.30 billions T-6 COMBS contract raise important questions about how reliably V2X can convert its contract backlog and technology ambitions into stronger profitability over time. Investors can benefit from weighing these contrasting community views alongside the evolving contract and balance sheet risks.

Explore 4 other fair value estimates on V2X - why the stock might be worth 45% less than the current price!

Build Your Own V2X Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V2X research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free V2X research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V2X's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- This technology could replace computers: discover 22 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.