Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To VICI (VICI) Surpassing Q2 Earnings and Revenue Expectations

VICI Properties VICI | 28.31 | -1.01% |

- VICI Properties Inc. reported its second-quarter 2025 earnings with revenue of US$1.00 billion and net income of US$865.08 million, both higher than the prior year.

- These results highlight consistent growth in core operations, driven by steady performance from its hospitality and gaming-focused real estate portfolio.

- We'll examine how stronger revenue and earnings growth influence VICI Properties' investment narrative and outlook for expanding cash flows.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

VICI Properties Investment Narrative Recap

To be a shareholder in VICI Properties, an investor needs to believe in the resilience of long-term, triple-net leased real estate focused on hospitality and gaming, with exposure to regional and Las Vegas markets. The Q2 2025 earnings beat highlights steady operational growth and strong cash flow trends, yet does not materially change near-term catalysts such as new property openings or the primary risk tied to tribal gaming development execution, which remains a watch point after recent results.

Of the company's recent announcements, the April 2025 debt offering stands out as most relevant to these results; raising US$400 million in senior notes and enhancing liquidity provide VICI with financial flexibility to support both expansion efforts and ongoing dividend commitments, underpinning the cash flow story that Q2 results help reinforce. For shareholders watching the evolving partnership with Red Rock Resorts, these capital moves are closely tied to the funding and risk management around new casino developments.

However, against this backdrop of robust earnings, investors should be aware that the unique risks of tribal gaming expansion could still...

VICI Properties' narrative projects $4.3 billion in revenue and $2.9 billion in earnings by 2028. This requires 3.1% yearly revenue growth and a $0.3 billion earnings increase from current earnings of $2.6 billion.

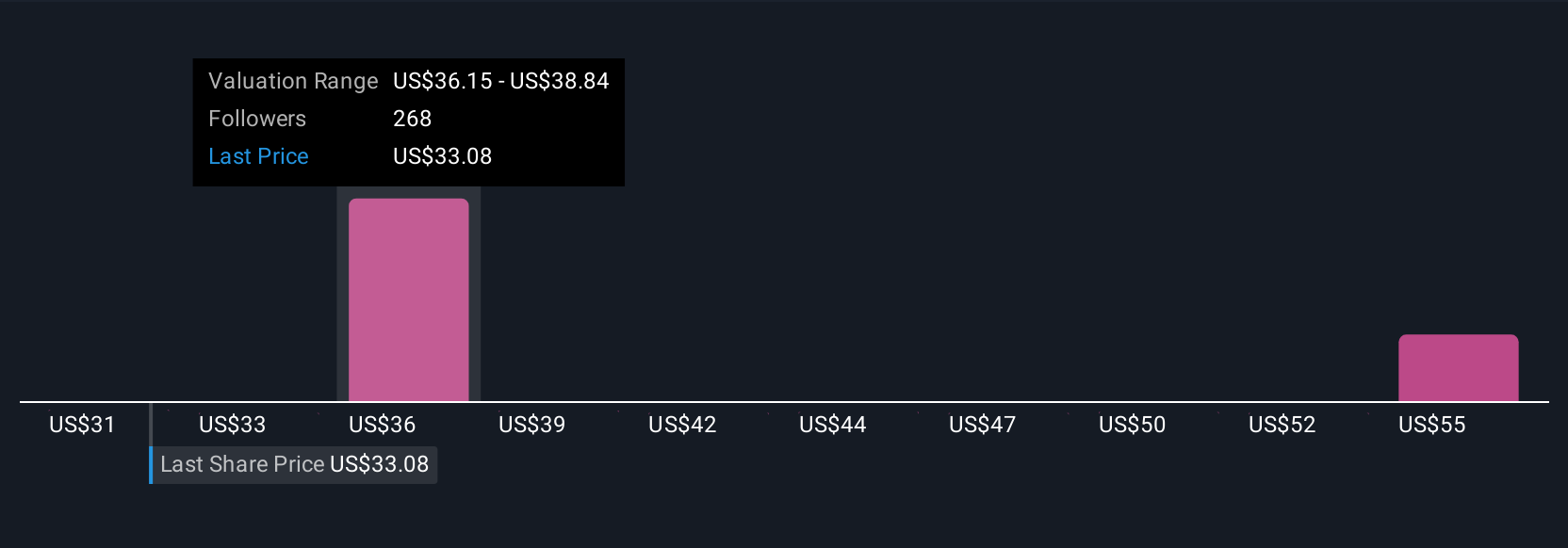

Uncover how VICI Properties' forecasts yield a $36.31 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 12 separate fair value estimates for VICI Properties, ranging from US$30.78 to US$62.26 per share. While the Q2 earnings highlight new strength, execution risks related to large expansion projects remain top of mind and make it important to consider several viewpoints.

Explore 12 other fair value estimates on VICI Properties - why the stock might be worth as much as 88% more than the current price!

Build Your Own VICI Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VICI Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free VICI Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VICI Properties' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.