Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Victory Capital Holdings (VCTR) Surging Assets and Increased Institutional Interest

Victory Capital Holdings VCTR | 64.13 | +0.90% |

- In August 2025, Victory Capital Holdings reported total client assets of US$306.4 billion and a sequential increase in assets under management across several equity categories, alongside expanding interest from institutional investors and strong expense controls.

- This trend highlights not only ongoing momentum in asset gathering but also a growing confidence from large institutional players in the company's operational efficiency and market positioning.

- Now, we'll explore how this rise in assets under management and institutional appetite influences Victory Capital Holdings' broader investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Victory Capital Holdings Investment Narrative Recap

For Victory Capital Holdings, the key story for shareholders is ongoing growth in assets under management, expanding interest from institutional investors, and tight expense controls. The recent uptick in AUM and institutional portfolios adds support to the most important short term catalyst: sustained net inflows, which could ease concerns about organic outflows. However, these trends do not materially reduce the critical risk of negative net flows, as challenges in asset retention persist in the current quarter.

One recent development closely tied to this outlook is the reported increase in assets under management to US$306.4 billion in August 2025, driven by sequential gains in several equity categories. This strengthens the argument for Victory's market reach but does not fully address the competitive pressures and client preferences for lower-fee products, which remain pivotal for short-term results.

By contrast, investors should also be aware of continued negative organic growth in AUM…

Victory Capital Holdings' outlook anticipates $1.8 billion in revenue and $735.1 million in earnings by 2028. This is based on a projected annual revenue growth rate of 20.4% and an increase in earnings of $470.5 million from current earnings of $264.6 million.

Uncover how Victory Capital Holdings' forecasts yield a $76.43 fair value, a 11% upside to its current price.

Exploring Other Perspectives

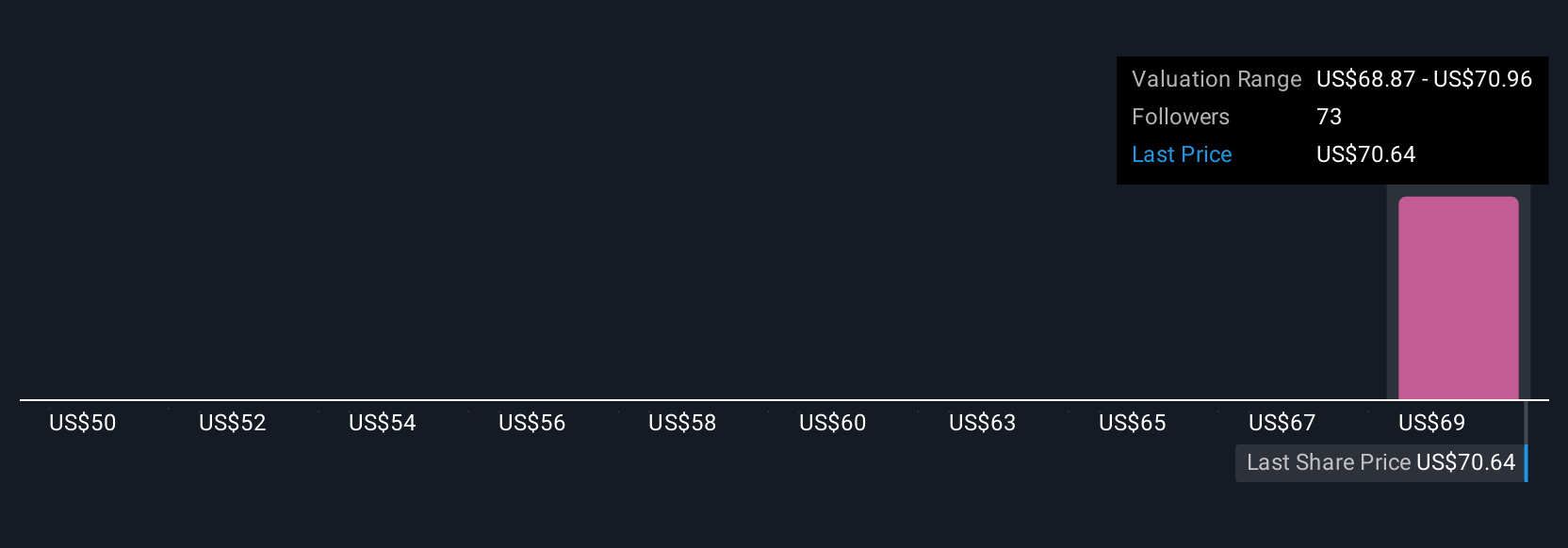

Fair value estimates from the Simply Wall St Community span US$50 to US$76.43 across four contributors. This diversity comes as the company faces ongoing pressure from negative net inflows, making it even more important to consider a range of informed perspectives.

Explore 4 other fair value estimates on Victory Capital Holdings - why the stock might be worth 27% less than the current price!

Build Your Own Victory Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Victory Capital Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Victory Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Victory Capital Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.