Please use a PC Browser to access Register-Tadawul

How Investors Are Reacting To Wendy's (WEN) Strong Q2 Beat Amid Lowered 2025 Outlook

Wendy's Company WEN | 8.35 | +1.46% |

- The Wendy's Company recently reported second-quarter results, posting adjusted earnings per share of US$0.29 and revenue of US$560.93 million, both exceeding consensus analyst estimates, while also declaring a quarterly cash dividend of US$0.14 per share payable in September.

- Despite better-than-expected earnings, Wendy’s lowered its full-year 2025 guidance due to ongoing softness in U.S. sales, highlighting a contrast with continued international growth and expansion.

- We will examine how Wendy's decision to trim its earnings outlook impacts the company's investment narrative and future prospects.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Wendy's Investment Narrative Recap

For investors to remain shareholders in Wendy’s, there must be confidence in the company’s ability to reverse domestic sales weakness and leverage international growth initiatives. The recent earnings beat provides some near-term reassurance, but the lowering of 2025 guidance reflects ongoing pressure in the U.S. market, a key short-term catalyst will be signs of stabilization or recovery in same-restaurant sales. The main risk now lies in continued softness among U.S. consumers, as this could limit meaningful progress on revenue and earnings targets.

Among recent announcements, the finalized franchise agreements to open up to 190 new restaurants across Italy and Armenia stand out. This move highlights Wendy’s ongoing international expansion efforts, which align directly with the company’s focus on global growth as a potential counterbalance to domestic headwinds.

Yet, investors should also recognize that despite upbeat earnings, challenges within U.S. operations could still weigh on performance if...

Wendy's outlook anticipates $2.4 billion in revenue and $224.2 million in earnings by 2028. This is based on a 2.0% annual revenue growth rate and an increase in earnings of $32.6 million from the current $191.6 million.

Uncover how Wendy's forecasts yield a $13.38 fair value, a 33% upside to its current price.

Exploring Other Perspectives

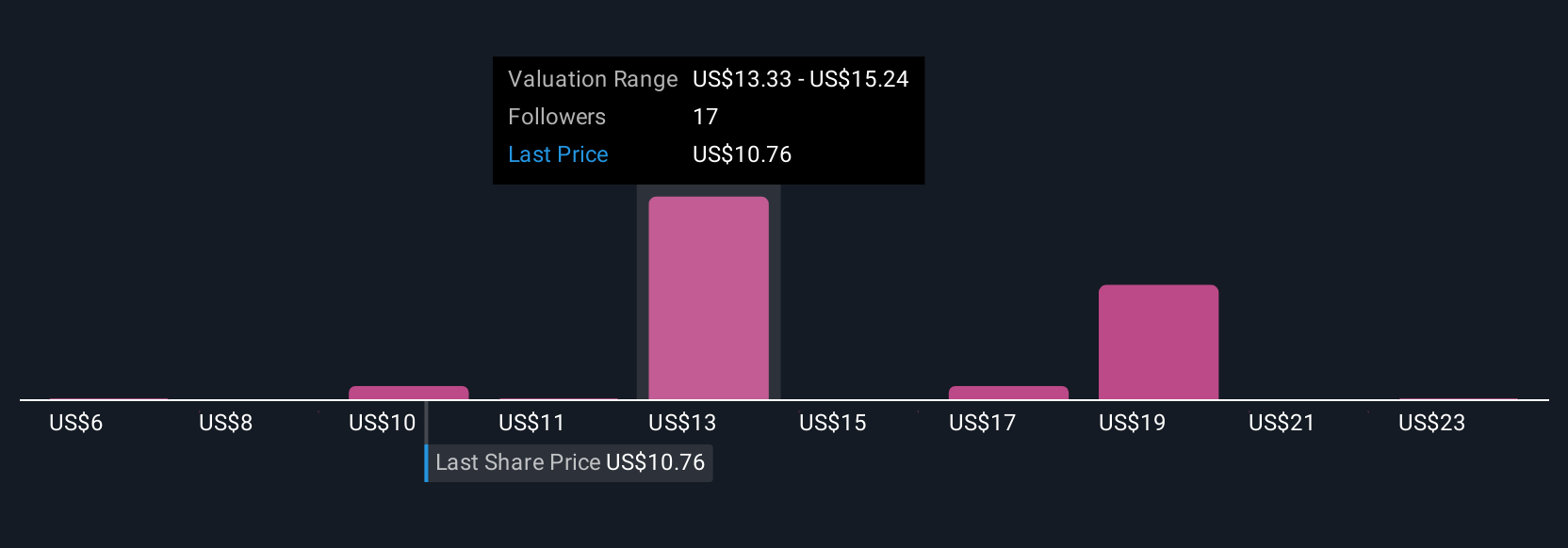

Ten fair value estimates from the Simply Wall St Community range from US$5.69 to US$24.79 per share, reflecting a wide spectrum of views. While some anticipate strong international growth, soft U.S. sales remain a cautionary factor that could shape future results, explore how these differing opinions reflect on Wendy’s outlook.

Explore 10 other fair value estimates on Wendy's - why the stock might be worth 44% less than the current price!

Build Your Own Wendy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wendy's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wendy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wendy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.