Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Akamai Technologies (AKAM) Launching Joint Bot Mitigation Solution for Online Sales

Akamai AKAM | 85.88 | +0.50% |

- Queue-it and Akamai Technologies recently announced the launch of Hype Event Protection, a joint solution designed to combat automated bot attacks during high-demand online sales, such as product drops and ticket releases, by combining advanced bot detection with virtual queuing capabilities.

- This partnership targets a critical challenge for industries frequently impacted by bot-driven inventory shortages, aiming to deliver a fairer experience for real customers and reduce operational disruptions during major online events.

- We’ll explore how this advanced bot mitigation solution strengthens Akamai’s positioning within security and high-demand event services.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Akamai Technologies Investment Narrative Recap

To be a shareholder in Akamai Technologies, you'd need conviction in its transition from a maturing CDN business into higher-growth areas like security, cloud infrastructure, and edge computing. The Hype Event Protection launch with Queue-it targets a fast-evolving security market, reinforcing a key growth catalyst around cybersecurity, yet it does not materially shift the near-term risk: the reliance on large contracts for cloud and compute revenue, which can create volatility in earnings.

Against this, Akamai’s recent expansion with Apiiro, integrating advanced API security, further supports its growing focus on security-driven offerings. Such moves contribute to its momentum in capturing enterprise spend on cybersecurity solutions and fortify its relevance among top catalysts.

Yet, despite security innovation, ongoing margin pressures, especially as partner-sourced solutions drag on profitability, remain a point investors should not ignore...

Akamai Technologies' outlook estimates $4.9 billion in revenue and $765.1 million in earnings by 2028. This is based on a forecast annual revenue growth rate of 6.1% and an earnings increase of $340.5 million from the current $424.6 million.

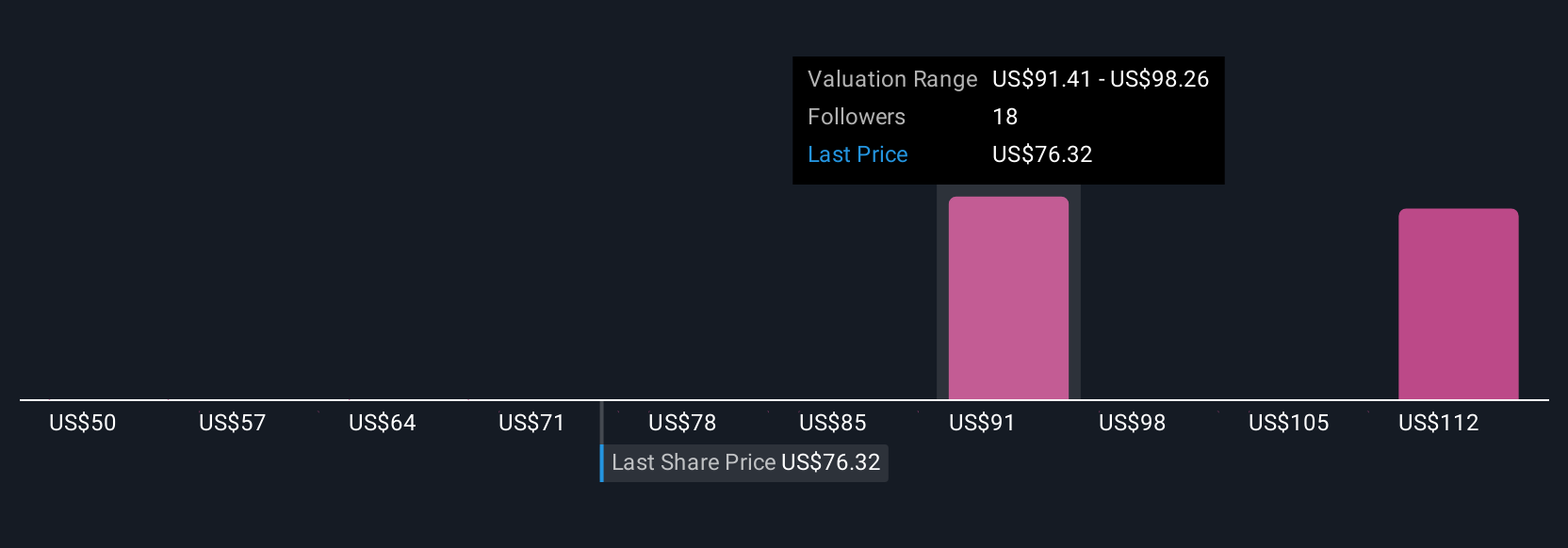

Uncover how Akamai Technologies' forecasts yield a $95.20 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Five independent fair value estimates from the Simply Wall St Community land between US$66 and US$131.64 per share. While some community members see considerable upside, keep in mind that continued customer concentration in cloud and compute contracts could add earnings unpredictability for Akamai, shaping different expectations for the company’s future.

Explore 5 other fair value estimates on Akamai Technologies - why the stock might be worth 9% less than the current price!

Build Your Own Akamai Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Akamai Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Akamai Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Akamai Technologies' overall financial health at a glance.

No Opportunity In Akamai Technologies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.