Please use a PC Browser to access Register-Tadawul

How Investors May Respond To AllianceBernstein (AB) Reaching Record Assets and Strong Private Wealth Growth

AllianceBernstein Holding L.P. AB | 39.96 39.96 | -1.72% 0.00% Pre |

- AllianceBernstein Holding L.P. reported third-quarter 2025 earnings with net income of US$73.75 million and basic earnings per share from continuing operations of US$0.79, alongside an increased cash distribution per unit payable in November.

- The firm also announced new partnerships and reached a record US$860 billion in assets under management, with rapid growth in its Bernstein Private Wealth division fueled by ultra-high-net-worth client acquisitions.

- We’ll consider how AllianceBernstein’s record private wealth asset growth may impact its long-term investment thesis in light of recent results.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

AllianceBernstein Holding Investment Narrative Recap

To be a shareholder in AllianceBernstein, investors need confidence in its expansion across high-growth asset management markets and the company’s ability to offset industry challenges through product and distribution innovation. The recent earnings report, while showing record private wealth and AUM growth, did not meaningfully alter the main short-term catalyst of private markets expansion or the prevailing risk of persistent fee and margin pressures, these remain central to understanding the near-term outlook.

The company’s announcement of an increased cash distribution per unit to US$0.86 is particularly relevant, reflecting management’s ongoing commitment to returning cash to unitholders even as net income trends lower versus the previous year. This move is consistent with past practice and aligns with one of the key attractions for income-focused investors, but it will be important to assess whether this rate of distribution is sustainable if earnings pressure continues.

Yet, while private wealth inflows build momentum, it is the risk of prolonged competitive fee compression that investors should watch most closely...

AllianceBernstein Holding's projections indicate revenues reaching $5.5 billion and earnings of $431.8 million by 2028. This outlook implies a 245.2% annual revenue growth rate and a $34.7 million increase in earnings from the current $397.1 million.

Uncover how AllianceBernstein Holding's forecasts yield a $40.43 fair value, in line with its current price.

Exploring Other Perspectives

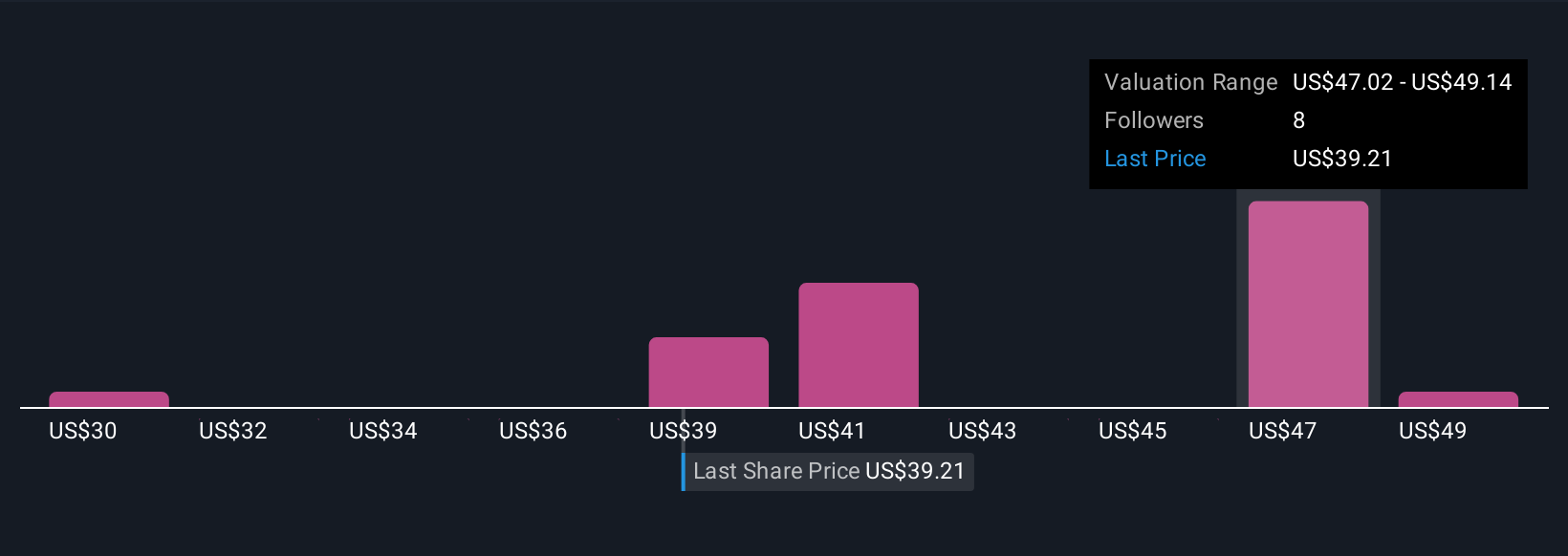

Fair value estimates from the Simply Wall St Community span US$30 to US$51.27, based on five diverse forecasts. Divergent views highlight how margin pressure and competitive threats remain central themes in shaping company performance, so consider different perspectives before making your next move.

Explore 5 other fair value estimates on AllianceBernstein Holding - why the stock might be worth as much as 29% more than the current price!

Build Your Own AllianceBernstein Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AllianceBernstein Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free AllianceBernstein Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AllianceBernstein Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.