Please use a PC Browser to access Register-Tadawul

How Investors May Respond To American Healthcare REIT (AHR) Launching Its First ESG and TCFD Reports

American Healthcare REIT, Inc. AHR | 47.95 | +1.49% |

- American Healthcare REIT, Inc. recently released its inaugural Corporate Responsibility Report and Task Force on Climate-related Financial Disclosures (TCFD) Report, highlighting advances in governance, climate risk management, and social responsibility.

- This marks the company's initial step toward establishing concrete environmental targets and broadening employee wellness and leadership development initiatives, signaling a deeper organizational commitment to ESG principles.

- With this move toward enhanced ESG transparency, we'll review how stronger governance and sustainability focus could influence American Healthcare REIT's investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

American Healthcare REIT Investment Narrative Recap

To be a shareholder in American Healthcare REIT right now, you need to believe in the company’s ability to capitalize on the long-term demand for senior housing and healthcare facilities, while maintaining strong operational performance despite sector headwinds. The release of the inaugural Corporate Responsibility Report adds transparency around governance and environmental strategy, but it does not materially alter the most important short-term catalyst, sustained high occupancy and rate growth in Trilogy and SHOP segments, or mitigate the most pressing near-term risk of difficult year-over-year comparisons as occupancy stabilizes and incremental growth becomes harder to achieve.

Among recent news, management's revised 2025 guidance signals greater confidence in same-store net operating income growth, now expected at 11–14 percent. This update is particularly relevant for investors focused on operational catalysts, as it reinforces the company’s narrative of robust cash flow and portfolio expansion amid an industry marked by changing demand patterns and reimbursement dynamics.

By contrast, as revenue comps toughen in the second half of 2025 and occupancy rates plateau, investors should be aware...

American Healthcare REIT's narrative projects $2.7 billion in revenue and $203.0 million in earnings by 2028. This requires 7.8% yearly revenue growth and a $235.8 million increase in earnings from the current level of -$32.8 million.

Uncover how American Healthcare REIT's forecasts yield a $46.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

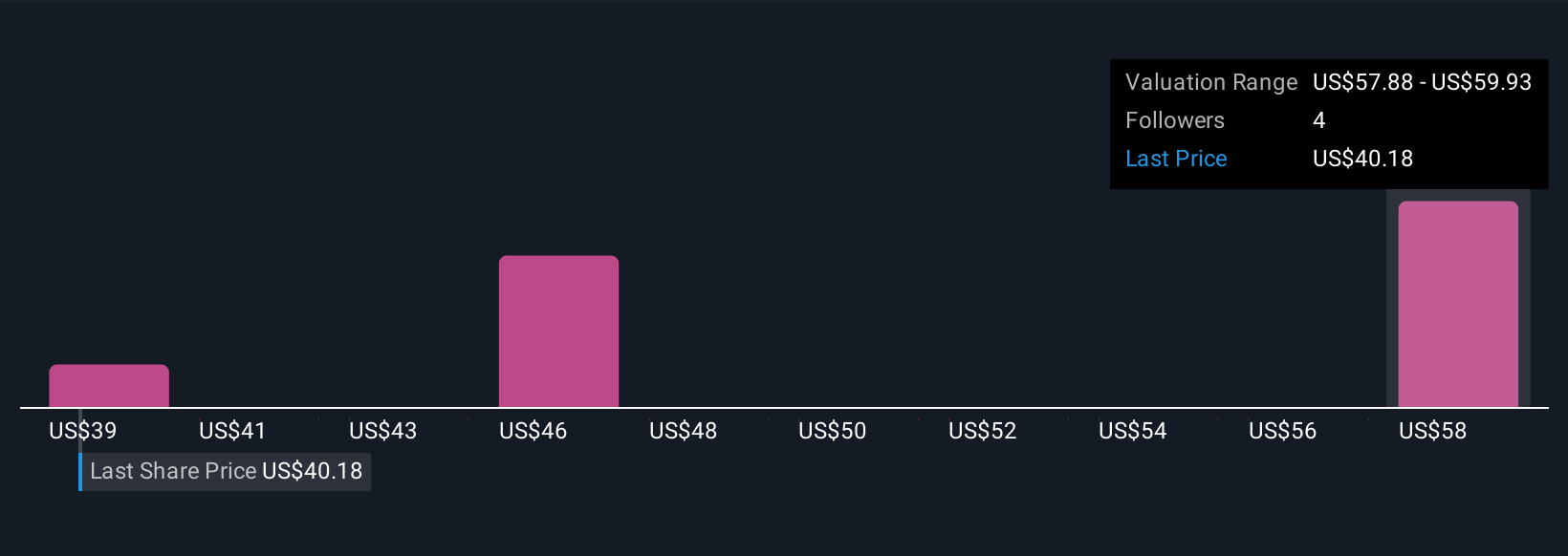

Three members of the Simply Wall St Community value American Healthcare REIT between US$39.37 and US$60.28 per share. While margin expansion and portfolio growth are current catalysts, opinions on fair value can vary widely, so consider multiple viewpoints as you assess company prospects.

Explore 3 other fair value estimates on American Healthcare REIT - why the stock might be worth as much as 41% more than the current price!

Build Your Own American Healthcare REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Healthcare REIT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Healthcare REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Healthcare REIT's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.