Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Baidu (BIDU) Uber Partnership For Global Apollo Go Expansion

Baidu, Inc. Sponsored ADR Class A BIDU | 119.31 | +0.40% |

- Baidu and Uber recently announced a multi-year partnership to deploy thousands of Apollo Go autonomous vehicles for ridesharing on Uber's platform in markets outside the U.S. and mainland China, with initial launches expected in Asia and the Middle East.

- This move marks Baidu’s largest push yet into international mobility, highlighting Apollo Go's expanding global reach and the company’s ambitions in the autonomous vehicle sector.

- We'll now explore how the Uber partnership could accelerate Apollo Go's global expansion and influence Baidu’s long-term investment case.

Baidu Investment Narrative Recap

To be a Baidu shareholder today, you need to be convinced of the company's ability to monetize its AI and autonomous vehicle technologies internationally while managing the persistent weakness in its core online marketing segment. The Uber partnership could become a timely catalyst for Apollo Go's expansion, but near-term investor focus may remain on Baidu's ability to reverse online marketing declines; at present, this announcement doesn’t directly address the biggest risk of revenue erosion from its primary business.

One recently relevant announcement is Baidu’s March 2025 agreement with Dubai’s Roads and Transport Authority to launch Apollo Go in the city, which helped establish a global foundation ahead of the Uber partnership. Both deals can be seen as steps towards validating the international scalability of Baidu's autonomous ride-hailing business, linking directly to the company’s growth catalyst in mobility.

However, even with global partnerships, investors should be aware that Baidu’s heavy reliance on online marketing exposes it to sustained revenue declines if that segment continues to shrink...

Baidu's outlook anticipates CN¥153.1 billion in revenue and CN¥25.6 billion in earnings by 2028. This implies 4.8% annual revenue growth and a CN¥2.4 billion increase in earnings from current earnings of CN¥23.2 billion.

Exploring Other Perspectives

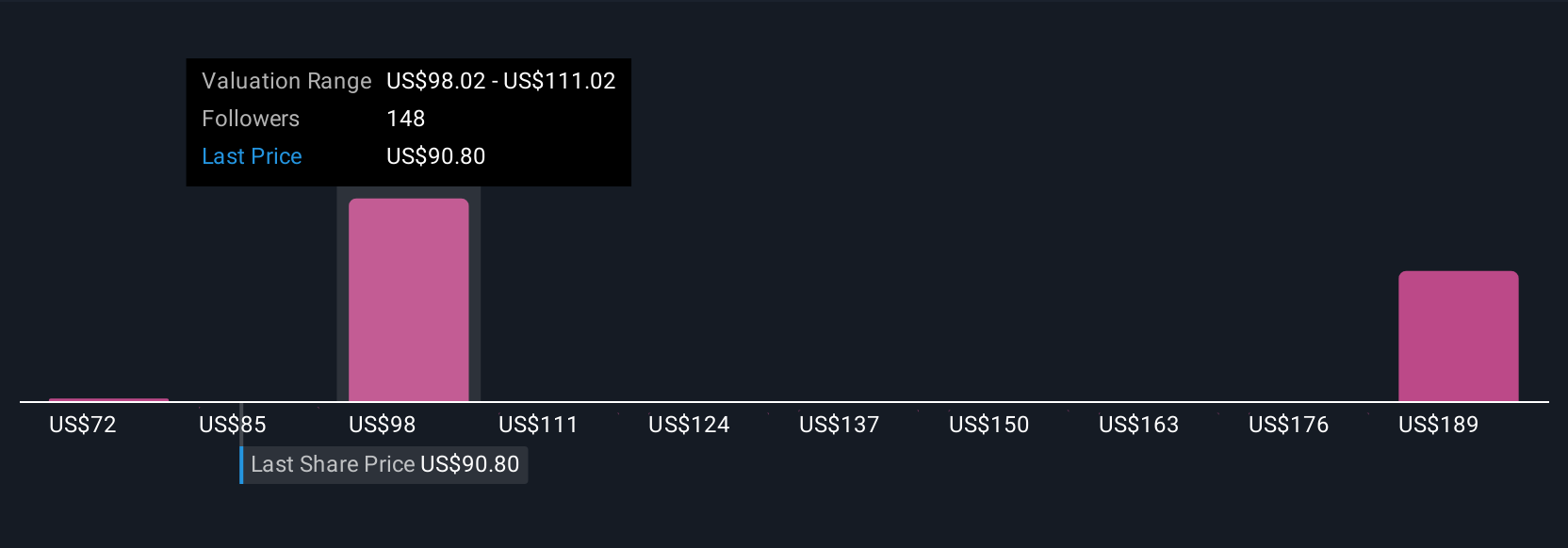

With 15 community fair value estimates for Baidu ranging from CN¥74.22 to CN¥197.02, opinions in the Simply Wall St Community span more than doubling or halving the current share price. As you compare these viewpoints, remember that Baidu’s catalyst for future growth hinges on international adoption of its autonomous vehicle technology.

Build Your Own Baidu Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baidu research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Baidu research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baidu's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.