Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Coterra Energy (CTRA) Earnings Growth and Management’s Outlook

Coterra Energy CTRA | 25.30 | -3.69% |

- Coterra Energy is expected to report a year-over-year increase in quarterly earnings for the period ended June 2025, with results anticipated on August 4.

- Investor attention has focused on management's upcoming commentary, as it may provide insight into the sustainability of recent earnings momentum and the company’s future outlook.

- We’ll explore how earnings anticipation and management guidance could influence Coterra Energy’s investment narrative moving forward.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Coterra Energy Investment Narrative Recap

To be a shareholder in Coterra Energy, you need to believe in the company's ability to balance oil and gas production amid shifting commodity prices, alongside consistent capital efficiency. The anticipated Q2 2025 earnings release remains the primary near-term catalyst, but management's guidance will be scrutinized for signals on production growth and cost control; while current earnings optimism is positive, it does not remove the short-term risk posed by potential decreases in oil activity due to price pressures. Coterra's most relevant recent announcement was the May 2025 update on share repurchases, with 883,000 shares bought back in Q1 for US$24.31 million. This shareholder-focused move aligns with efforts to enhance value, yet it sits alongside operational risks like activity reductions in the Permian that could affect future cash flow and growth plans. By contrast, investors should also keep in mind the uncertain outlook around planned oil volume growth if price trends continue to prompt further cutbacks...

Coterra Energy's outlook anticipates $9.5 billion in revenue and $2.2 billion in earnings by 2028. This scenario relies on an 18.0% annual revenue growth rate and an increase in earnings of $0.9 billion from the current $1.3 billion.

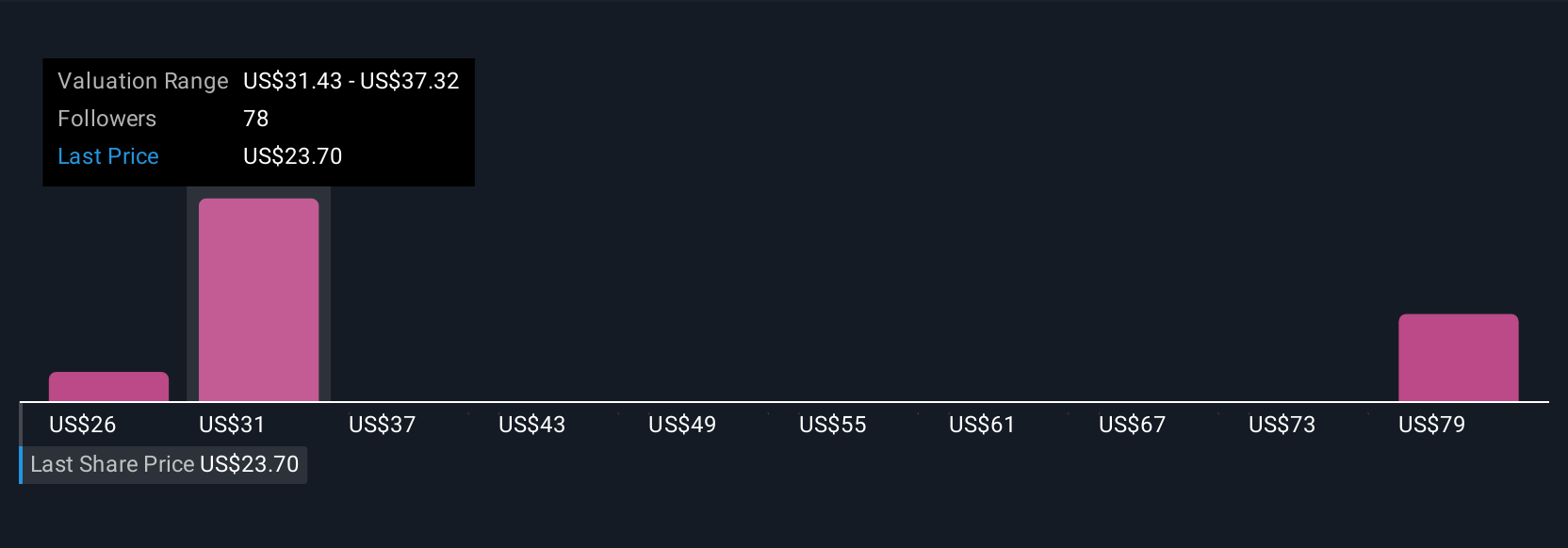

Uncover how Coterra Energy's forecasts yield a $33.27 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community valuations range widely from US$25.55 to US$68.08 per share. As capital spending shifts in response to commodity price changes, your outlook on revenue growth and operational flexibility could matter more than ever.

Explore 4 other fair value estimates on Coterra Energy - why the stock might be worth over 2x more than the current price!

Build Your Own Coterra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coterra Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coterra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coterra Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.