Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Crescent Energy (CRGY) BMO’s ‘Transition Year’ Framing And 2026 Outlook

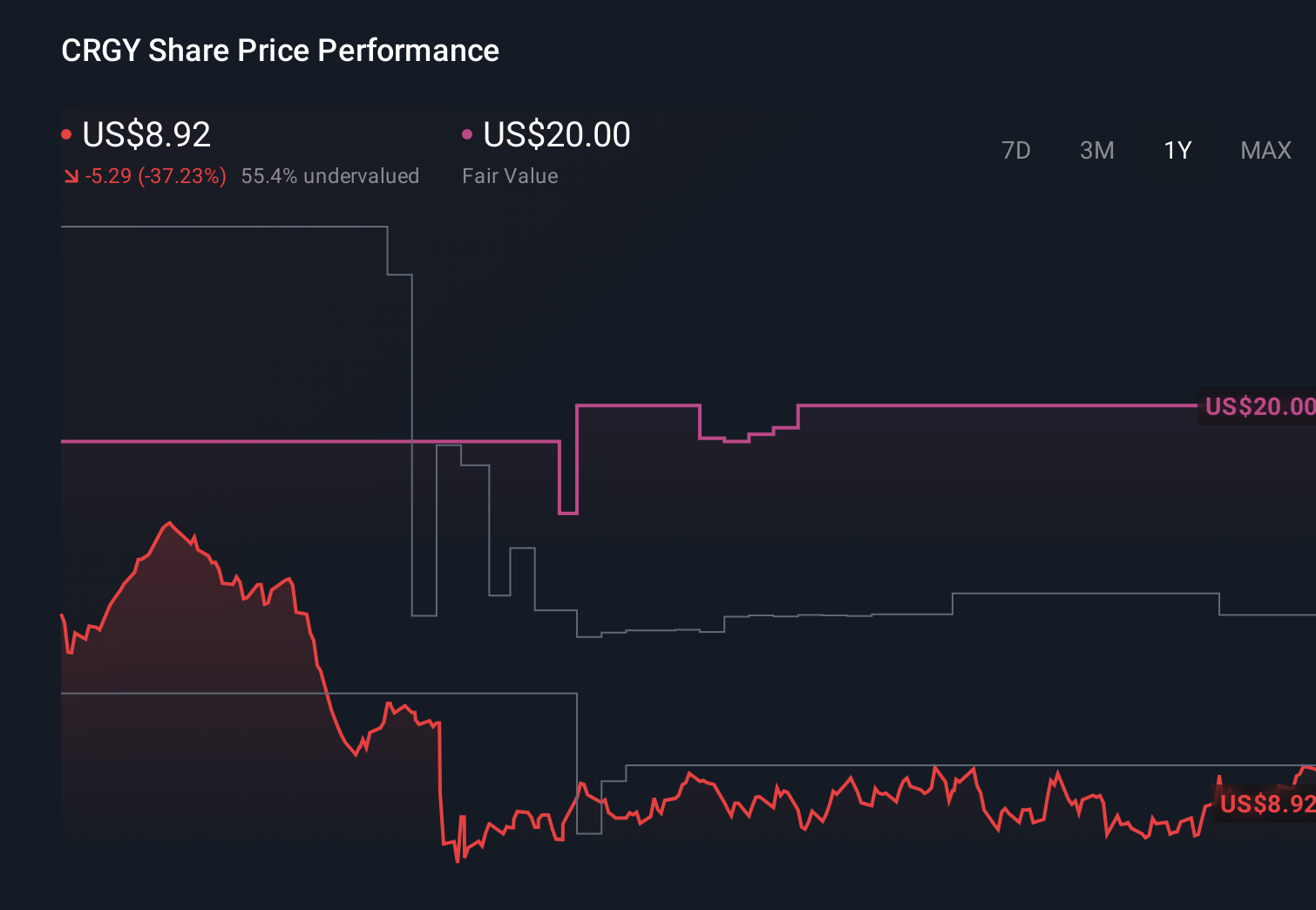

Crescent Energy Company Class A CRGY | 10.71 | +0.56% |

- BMO Capital recently initiated coverage on Crescent Energy with a Market Perform rating, highlighting improved margins and a leaner asset base but also describing 2026 as a transition year marked by declining legacy Vital production and slower balance sheet de-leveraging amid softer oil prices.

- Crescent Energy also previously announced it will discuss its fourth-quarter 2025 and full-year results, along with its 2026 outlook, on a February 2026 call, which may clarify how management plans to handle this transition phase and evolving cost structure.

- Next, we'll examine how BMO's characterization of 2026 as a transition year may influence Crescent Energy's existing investment narrative.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Crescent Energy Investment Narrative Recap

To own Crescent Energy today, you need to be comfortable with a company that is reshaping its portfolio, managing leverage and living with commodity-driven swings in profitability. BMO’s “transition year” framing for 2026 reinforces that the key near term catalyst remains execution on its streamlined asset base, while the biggest risk is slower de-leveraging in a weaker oil price backdrop, which could further strain already thin margins and interest coverage.

The upcoming February 26, 2026 call on Crescent’s Q4 2025 and full year results, along with its 2026 outlook, looks particularly important against this backdrop. It should give investors clearer visibility into how management sees production normalizing from legacy Vital assets, how the cost structure is evolving and whether current dividend levels still fit alongside the company’s leverage, margin profile and acquisition driven history.

Yet behind Crescent’s apparent progress on costs and portfolio simplification, investors should be aware of the ongoing reliance on acquisitions and asset divestitures for growth, which...

Crescent Energy's narrative projects $5.2 billion revenue and $672.6 million earnings by 2028.

Uncover how Crescent Energy's forecasts yield a $14.08 fair value, a 73% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently estimate Crescent Energy’s fair value between US$12 and about US$44.97, underscoring how far opinions can diverge. Set that wide range against BMO’s view of 2026 as a transition year with slower balance sheet de-leveraging, and you can see why it may pay to compare multiple theses before deciding how Crescent fits into your portfolio.

Explore 5 other fair value estimates on Crescent Energy - why the stock might be worth just $12.00!

Build Your Own Crescent Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crescent Energy research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Crescent Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crescent Energy's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.