Please use a PC Browser to access Register-Tadawul

How Investors May Respond To DexCom (DXCM) G7 Safety Scrutiny and Expert Endorsements

DexCom, Inc. DXCM | 66.96 | -2.87% |

- In September 2025, DexCom faced scrutiny after reports alleged unauthorized design changes and safety risks linked to its G7 continuous glucose monitoring system, triggering both regulatory and legal challenges.

- Amid these developments, prominent analysts and medical experts maintained confidence in the device's reliability, with many asserting that previous technical issues have largely been resolved.

- We'll explore how renewed concerns about G7 safety and strong analyst defenses may affect DexCom's growth prospects and risk outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DexCom Investment Narrative Recap

At its core, the DexCom investment case hinges on durable adoption of CGM technology, with revenue growth fueled by expanding reimbursement and global diabetes prevalence. While recent allegations over G7 device design and safety briefly heightened business risk, analysts and medical experts continue to view the core product as reliable; thus, the most important near-term catalyst, broader insurance coverage for type 2 diabetes, remains largely intact, though regulatory and legal scrutiny could add uncertainty around execution and margins.

Amid the scrutiny, DexCom showcased new features for its glucose biosensing technology at the recent EASD Conference, emphasizing clinical trial data on glycaemic control and cost-effectiveness. These innovation efforts reinforce the drivers behind CGM adoption and help maintain trust in DexCom’s technology, which is key as the company targets coverage expansion and international growth catalysts.

But despite analyst and expert reassurance, investors should be aware that ongoing regulatory investigations into G7 safety allegations could still...

DexCom's outlook anticipates $6.5 billion in revenue and $1.4 billion in earnings by 2028. This requires 14.8% annual revenue growth and a $828.5 million increase in earnings from the current $571.5 million.

Uncover how DexCom's forecasts yield a $100.54 fair value, a 51% upside to its current price.

Exploring Other Perspectives

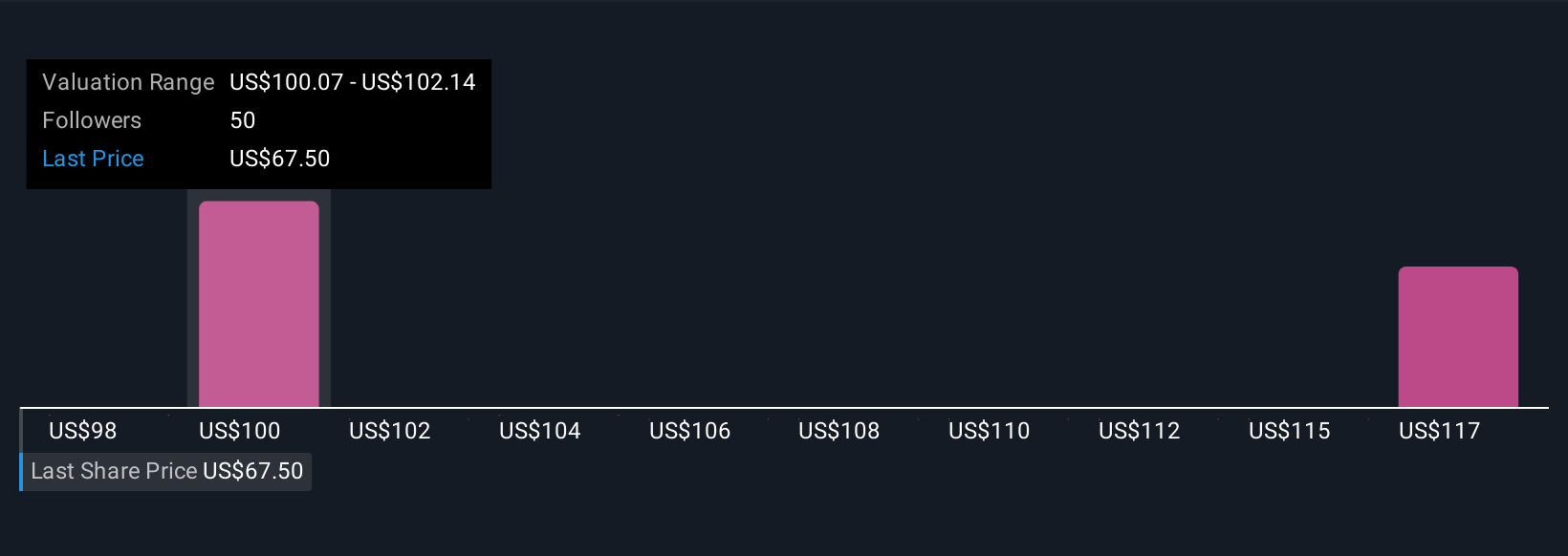

The Simply Wall St Community’s five fair value estimates for DexCom range from US$97.26 to US$117.42, revealing a US$20.16 per share spread. Some remain focused on competitive and regulatory risks that could affect future revenue, so consider how this range reflects the diversity of investor opinion.

Explore 5 other fair value estimates on DexCom - why the stock might be worth as much as 77% more than the current price!

Build Your Own DexCom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DexCom research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DexCom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DexCom's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.