Please use a PC Browser to access Register-Tadawul

How Investors May Respond To EMCOR Group (EME) Upgraded 2025 Outlook And Acquisition-Fueled Expansion

EMCOR Group, Inc. EME | 812.79 | +1.15% |

- EMCOR Group has recently attracted positive attention after highlighting strong financial strength, profitability, and growth metrics, supported by rising demand across key electrical and mechanical construction end markets and several 2025 acquisitions, including Miller Electric.

- The company’s raised 2025 revenue, operating margin, and EPS outlook, alongside high-quality analyst endorsement, underscores management’s confidence and its perceived competitive position within facilities services.

- We’ll now explore how this improved outlook and acquisition-driven expansion shapes EMCOR Group’s investment narrative for investors.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

What Is EMCOR Group's Investment Narrative?

For EMCOR Group to make sense in a portfolio, you need to be comfortable with a construction and facilities services business that is executing well, deploying capital into bolt-on deals, and backing that up with rising dividends. The recent highlight of EMCOR’s strong balance sheet, profitability and high GF Score, along with six acquisitions in 2025 and raised 2025 guidance, reinforces revenue and margin growth as the key short term catalysts. Stifel’s higher price target and positive sector view add to that momentum, but do not fundamentally change the story so much as validate it. At the same time, the bigger risk skew is shifting toward integration and execution on those new acquisitions, alongside existing macro and supply chain uncertainties, rather than purely demand risk.

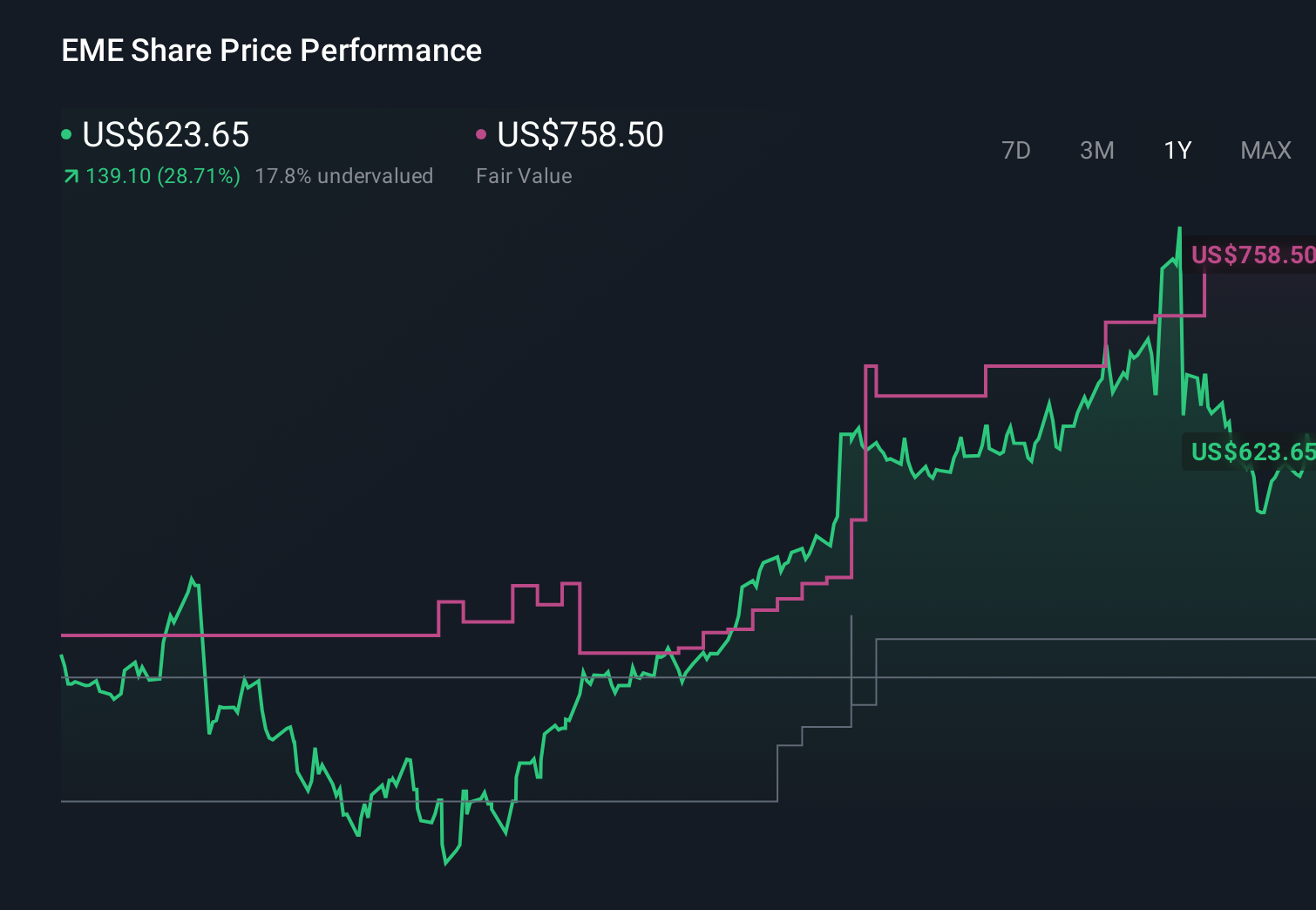

EMCOR Group's shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Nine Simply Wall St Community fair value views span roughly US$470 to US$905, highlighting wide disagreement on EMCOR’s upside. Set that against the raised 2025 outlook and acquisition integration risk, and you can see why different investors may weigh the same facts very differently.

Explore 9 other fair value estimates on EMCOR Group - why the stock might be worth 35% less than the current price!

Build Your Own EMCOR Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EMCOR Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free EMCOR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EMCOR Group's overall financial health at a glance.

No Opportunity In EMCOR Group?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.