Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Equifax (EFX) Facing Regulator Scrutiny Over Credit-Report Pricing Practices

Equifax Inc. EFX | 219.57 | +0.16% |

- In early January 2026, Federal Housing Finance Agency Director Bill Pulte publicly questioned the pricing practices of major credit bureaus, including Equifax, after mortgage lenders raised concerns about rising credit-reporting costs.

- This criticism brings regulatory attention squarely onto Equifax’s core business model, raising questions about how pricing oversight could influence its profitability and competitive position.

- Next, we’ll examine how this heightened regulatory scrutiny of Equifax’s pricing model could influence the company’s previously outlined investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Equifax Investment Narrative Recap

To own Equifax, you need to believe its data, analytics and verification platforms can keep attracting lenders, employers and governments despite competition, litigation and regulatory pressure. The FHFA’s criticism directly targets pricing power in mortgage credit reporting, which is a key short term catalyst for margins and also sharpens the biggest near term risk that tighter oversight, higher compliance costs or pricing changes could weigh on profitability.

Against this backdrop, Equifax’s late 2025 results and raised full year revenue guidance highlight how management has been framing its earnings outlook before this new scrutiny emerged. That guidance, together with ongoing investment in cloud and new product platforms, sits at the core of the existing growth catalyst around expanding multi data solutions and efficiency gains, and now needs to be weighed against the possibility of more constrained pricing in core reporting services.

Yet behind Equifax’s technology story, rising regulatory and legal attention on how it prices and uses consumer data is something investors should be aware of...

Equifax's narrative projects $7.8 billion revenue and $1.3 billion earnings by 2028.

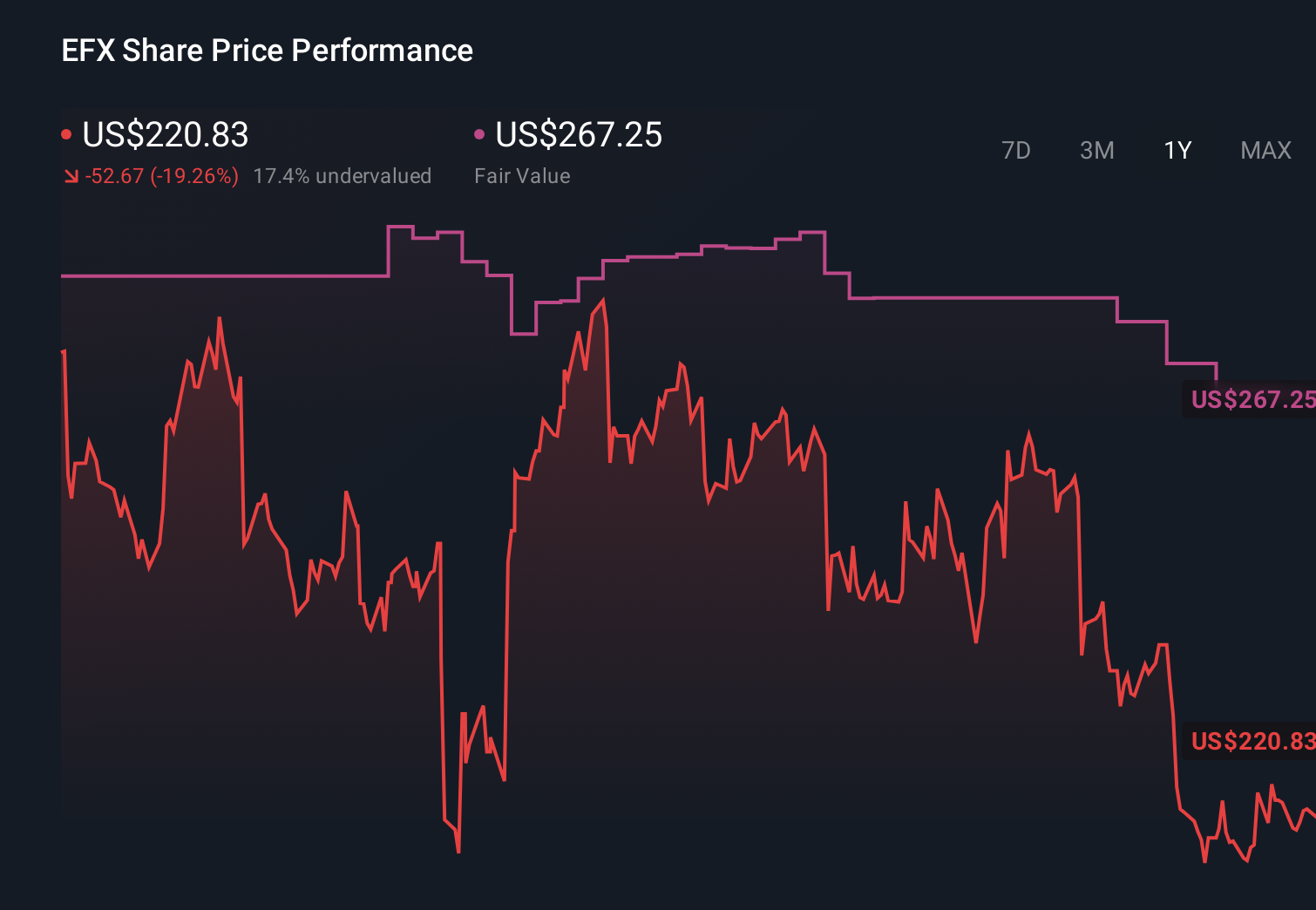

Uncover how Equifax's forecasts yield a $266.75 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from US$256.57 to US$536.18, reflecting very different views of Equifax’s upside. You should weigh those opinions against the growing regulatory focus on its pricing model, which could influence both margins and how durable the current business momentum really is.

Explore 5 other fair value estimates on Equifax - why the stock might be worth over 2x more than the current price!

Build Your Own Equifax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Equifax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equifax's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.