Please use a PC Browser to access Register-Tadawul

How Investors May Respond To FIS Launching Cloud-Native Private Capital Suite Integration

Fidelity National Information Services, Inc. FIS | 67.11 67.11 | -0.19% 0.00% Pre |

- In September 2025, Fidelity National Information Services announced it reengineered its Private Capital Suite into a cloud-native SaaS platform, integrating its new Investor Services Suite to create a comprehensive front-to-back private equity solution.

- This upgrade aims to streamline operations and compliance for private equity managers by automating complex fund processes and enhancing global, multijurisdictional capabilities.

- We'll examine how FIS's focus on end-to-end digital solutions for private capital could influence the company’s long-term investment prospects.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Fidelity National Information Services Investment Narrative Recap

To own shares in Fidelity National Information Services, you have to believe that its digital transformation and next-generation cloud platforms can offset competitive and margin pressures, allowing it to expand recurring revenue and operate at scale as a partner for global financial institutions. The launch of its reengineered Private Capital Suite is a positive step for product innovation in private markets, yet the most important near-term catalyst remains integration and margin execution, while the risk of ongoing operating complexity and earnings volatility from past acquisitions is still present. No immediate, material change to that risk emerges from this product news, but it does support the company’s efforts to upsell cloud and AI-powered services to new and existing private equity clients.

Among recent announcements, September’s launch of the FIS Neural Treasury solution stands out for its relevance to this digital push. This AI-powered treasury suite not only aligns with the company’s strategic move to deepen high-value SaaS offerings, but also directly feeds into the catalyst of increasing client demand for cloud-based and AI-powered fintech solutions that could drive long-term revenue expansion and margin improvement.

However, if operational integration issues persist, results could disappoint investors who are watching for ...

Fidelity National Information Services' outlook anticipates $11.7 billion in revenue and $2.4 billion in earnings by 2028. This scenario requires 4.3% annual revenue growth and a $2.24 billion increase in earnings from the current $158.0 million.

Uncover how Fidelity National Information Services' forecasts yield a $85.61 fair value, a 29% upside to its current price.

Exploring Other Perspectives

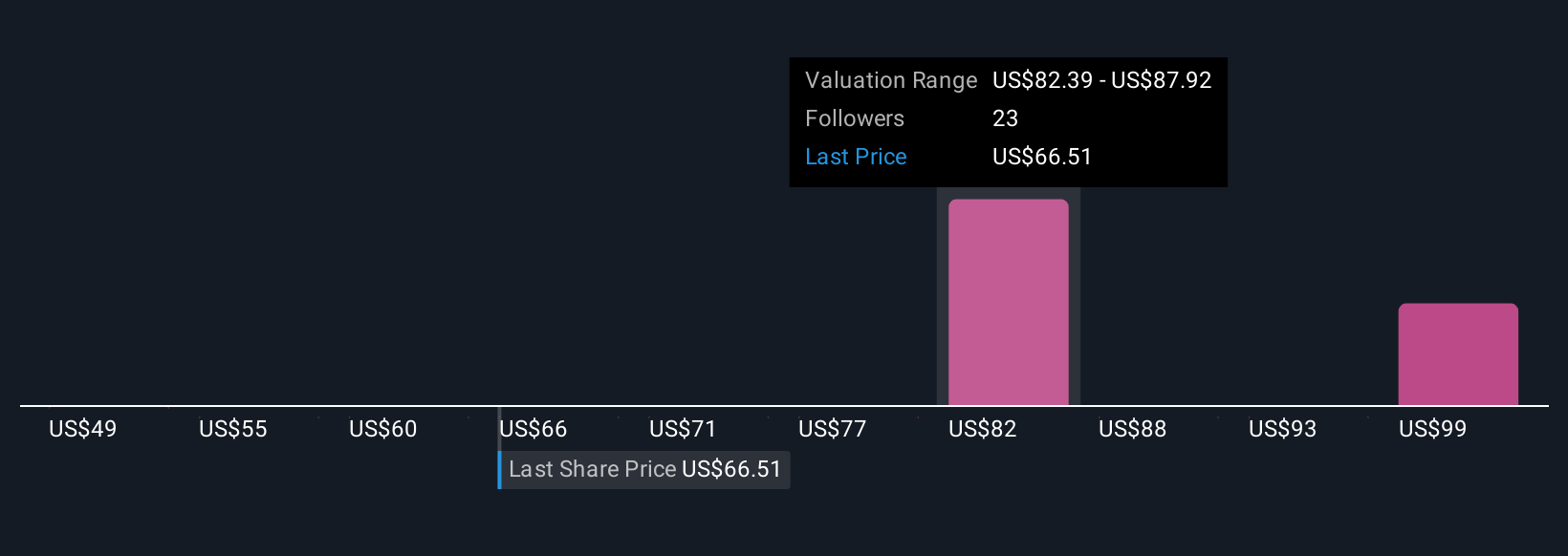

The Simply Wall St Community’s fair value estimates for FIS range from US$49.20 to US$105.48 based on three analyses. While these community viewpoints vary, analysts remain focused on whether FIS can translate its cloud and AI initiatives into sustainable margin growth and improved earnings.

Explore 3 other fair value estimates on Fidelity National Information Services - why the stock might be worth 26% less than the current price!

Build Your Own Fidelity National Information Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Fidelity National Information Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelity National Information Services' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.