Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Fiserv (FI) Facing Legal Uncertainty Amid New SMB Cybersecurity Push

Fiserv FI | 63.80 | 0.00% |

- In September 2025, VikingCloud announced it is enhancing cybersecurity support for small and medium-sized businesses in partnership with Fiserv by enabling the new Mastercard-designed Compliance and Validation Exemption Program (C-VEP) during the third quarter of the year.

- This development underscores the urgent need for improved cyber defenses among SMBs, as recent Mastercard research showed that business-crippling attacks are a significant risk for unprepared firms.

- Given the recent securities fraud allegations tied to Fiserv’s platform migration disclosures, we’ll examine how this legal uncertainty may impact its investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fiserv Investment Narrative Recap

To be a shareholder in Fiserv, you have to believe in the company’s long-term ability to capitalize on the shift toward digital payments and financial automation, while maintaining execution discipline across its platforms. The recent VikingCloud partnership supports the view that solving emerging cybersecurity concerns can add value for its SMB customers, but the growing legal uncertainty around securities fraud allegations tied to platform migrations remains the most important short-term risk, and this ongoing situation could influence broader sentiment and near-term performance.

The recent announcement of Fiserv’s collaboration with VikingCloud to enable the Mastercard C-VEP program is especially relevant given cybersecurity’s rising importance for small and medium-sized clients, a core part of Fiserv’s addressable market. While boosting value-added services may support long-term catalysts, questions remain about Fiserv’s ability to deliver reliable execution on new initiatives while simultaneously managing the fallout from legal challenges and competitive pressure.

However, investors should be aware that beyond product innovation, the unresolved legal matters tied to Payeezy-Clover migration could lead to...

Fiserv's outlook forecasts $24.7 billion in revenue and $5.9 billion in earnings by 2028. This requires a 5.4% annual revenue growth rate and a $2.5 billion earnings increase from the current $3.4 billion.

Uncover how Fiserv's forecasts yield a $184.16 fair value, a 37% upside to its current price.

Exploring Other Perspectives

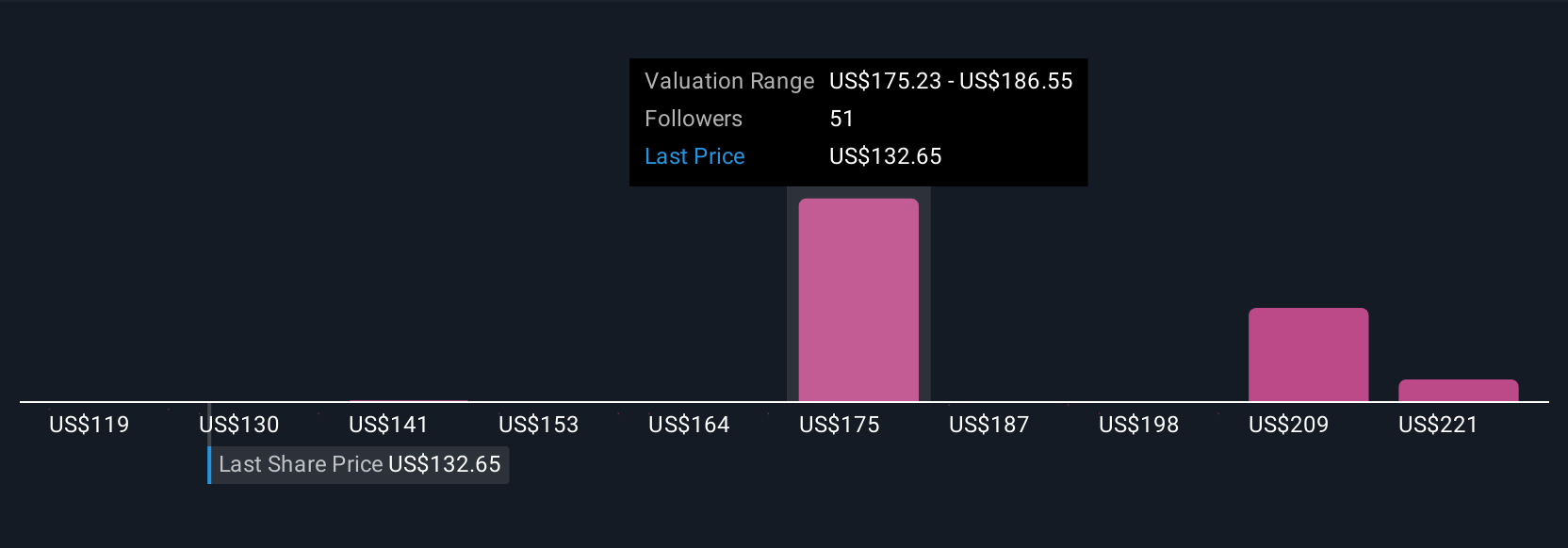

Fair value estimates from 9 Simply Wall St Community members for Fiserv range from US$118.62 to US$231.84 per share. Revenue growth from international expansion is attracting attention, though recent lawsuits may shape future expectations in ways analysts have not yet considered.

Explore 9 other fair value estimates on Fiserv - why the stock might be worth 12% less than the current price!

Build Your Own Fiserv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiserv research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fiserv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiserv's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.