Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Global-E Online (GLBE) Targeting First Full-Year Profitability in 2025

Global-E Online Ltd. GLBE | 40.15 40.50 | +0.10% +0.87% Pre |

- Global-E Online reported strong 2024 results and announced it is targeting its first full-year GAAP profitability in 2025, supported by a robust partnership with Shopify and expanding operations in APAC and LATAM markets.

- An interesting angle is that Global-E's offering, which integrates localized pricing, payments, and compliance, creates high switching costs, underpinning its competitive position as cross-border commerce continues to grow.

- We'll explore how Global-E's expected transition to full-year profitability shapes its investment narrative and future expansion outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Global-E Online Investment Narrative Recap

To own Global-E Online shares, investors need confidence in sustained cross-border e-commerce growth, the company's ability to deepen merchant relationships, and success expanding in regions like APAC and LATAM. While the recent announcement of targeting full-year GAAP profitability in 2025 is an encouraging milestone and may act as a near-term catalyst for sentiment, it does not meaningfully change the core risks, especially the ongoing reliance on major partners like Shopify and the competitive pressure in its space.

Among recent company announcements, Global-E's renewed 3-year partnership with Shopify stands out. This agreement solidifies a direct-to-consumer channel, ensuring Global-E continues to power international e-commerce for some of the largest merchants, which is crucial as competition and customer concentration remain at the forefront of both opportunity and risk for the business. Yet, it also amplifies the inherent exposure to any changes in partnership terms or strategy.

But investors should not overlook the possibility that if Shopify reduces its dependency on Global-E or pursues insourcing, the resulting volatility could...

Global-E Online's outlook calls for $1.7 billion in revenue and $328.6 million in earnings by 2028. This scenario assumes 25.6% annual revenue growth and a $357 million swing in earnings from the current -$28.4 million.

Uncover how Global-E Online's forecasts yield a $47.69 fair value, a 30% upside to its current price.

Exploring Other Perspectives

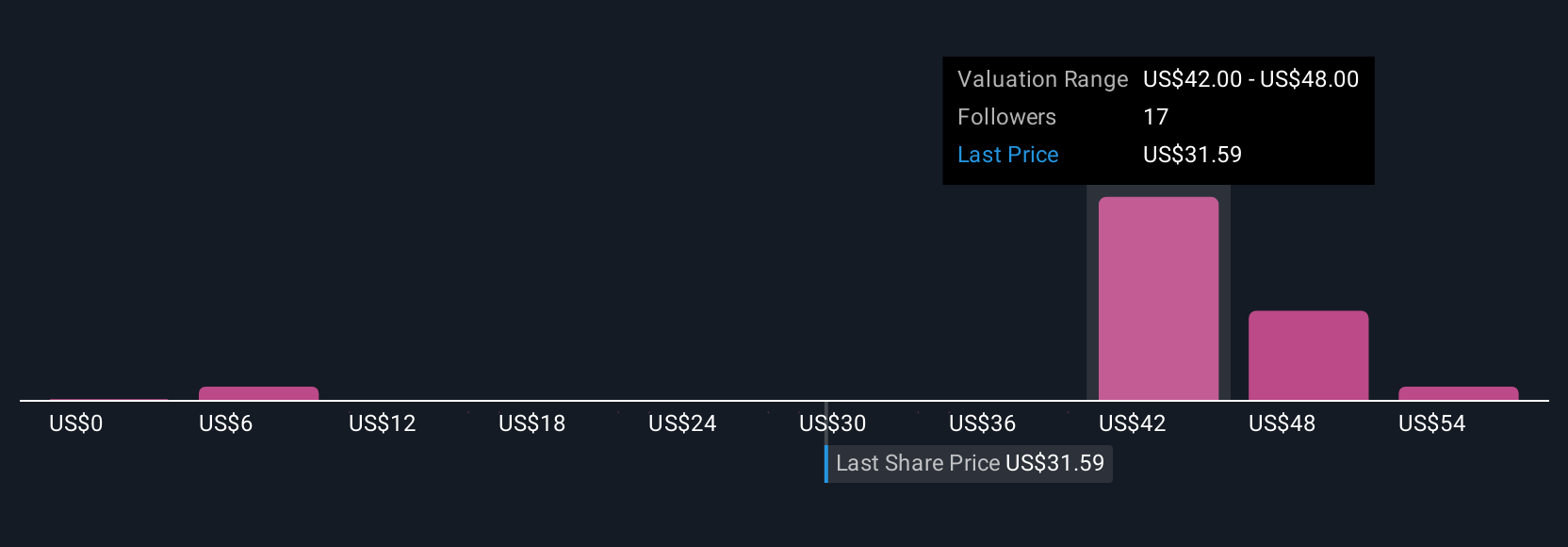

Simply Wall St Community members have submitted 11 fair value estimates on Global-E ranging from US$11.82 to US$118.19, underscoring wide-ranging outlooks. While many anticipate robust revenue gains ahead, continued dependence on partners like Shopify is a key factor influencing whether those growth targets are achieved; examine the full spectrum of peer perspectives for a well-rounded view.

Explore 11 other fair value estimates on Global-E Online - why the stock might be worth less than half the current price!

Build Your Own Global-E Online Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global-E Online research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Global-E Online research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global-E Online's overall financial health at a glance.

No Opportunity In Global-E Online?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.