Please use a PC Browser to access Register-Tadawul

How Investors May Respond To GoDaddy (GDDY) Analyst Upgrades After Oversold Share Slide

GoDaddy, Inc. Class A GDDY | 100.67 | +0.15% |

- In recent weeks, GoDaddy has come under heavy selling pressure, with its shares moving into oversold territory even as the company heads toward upcoming earnings.

- At the same time, Wall Street analysts have raised their earnings estimates and upgraded GoDaddy’s rating, signaling increasing confidence in its profit outlook despite the prior downturn in sentiment.

- With improved earnings estimates now supporting the story, we’ll examine how this analyst optimism influences GoDaddy’s broader investment narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

What Is GoDaddy's Investment Narrative?

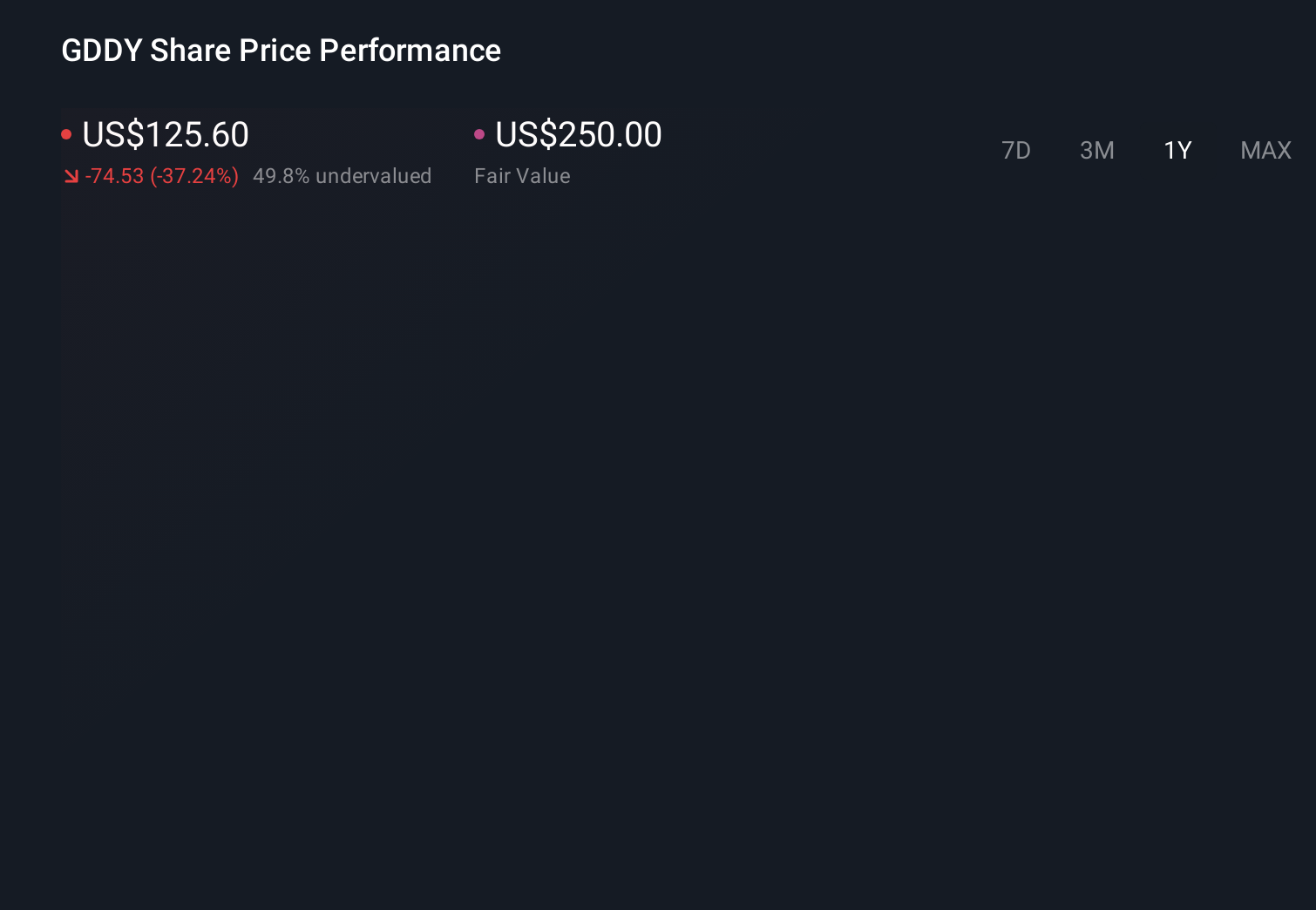

For someone considering GoDaddy, the big picture is really about believing in its ability to keep monetizing its domain, hosting and small business tools while layering on new AI services like Airo and the Agent Name Service. The recent selloff has pushed the stock into oversold territory just as analysts have lifted earnings estimates, which potentially strengthens near term catalysts around the upcoming results and ongoing buybacks under the multi billion dollar program. At the same time, the stock’s strong discount to both analyst and modelled fair values was already part of the thesis, so the latest price drop mainly amplifies that valuation angle rather than changing it. Where the recent news matters more is in sentiment: if the higher EPS expectations are not met, concerns around high debt, compressed margins and insider selling could quickly move back to the foreground.

However, one key issue around GoDaddy’s balance sheet is easy to overlook. Despite retreating, GoDaddy's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on GoDaddy - why the stock might be worth just $175.06!

Build Your Own GoDaddy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoDaddy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free GoDaddy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoDaddy's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 110 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.