Please use a PC Browser to access Register-Tadawul

How Investors May Respond To KBR (KBR) Winning LNG FEED, Defense and Earth Observation Contracts

KBR, Inc. KBR | 44.68 | -0.67% |

- In recent days, Coastal Bend LNG announced it has selected KBR and Técnicas Reunidas for front-end engineering and design of a planned LNG export facility on the Texas Gulf Coast, alongside KBR’s new U.S. defense and Earth observation contracts that together span missile defense and advanced geospatial technology support.

- These awards highlight how KBR’s engineering, digital, and mission-critical capabilities are being applied across energy, defense, and Earth observation, potentially reinforcing its position in complex, technology-intensive projects.

- Now we’ll explore how KBR’s role in the Coastal Bend LNG FEED and related contract wins may influence its existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

KBR Investment Narrative Recap

To own KBR, you need to believe in its ability to turn a large, mixed government and energy project pipeline into profitable, higher margin work despite contract and funding uncertainty. The Coastal Bend LNG FEED, along with the recent U.S. defense and Earth observation awards, appears supportive of this thesis but does not, on its own, remove near term risks around government award timing or exposure to large, complex contracts.

Among the latest wins, KBR’s seat on the MDA SHIELD IDIQ contract with a US$151 billion ceiling is most relevant, because it sits squarely in the core defense and mission tech catalyst that underpins many growth expectations. While individual task orders are not guaranteed, SHIELD aligns closely with the idea that a deep, long duration defense framework could partially offset volatility from delayed or lost programs elsewhere.

Yet even with these contracts, investors should be aware that KBR’s reliance on large, complex government programs could still...

KBR's narrative projects $9.4 billion revenue and $664.3 million earnings by 2028. This requires 5.4% yearly revenue growth and a $264.3 million earnings increase from $400.0 million today.

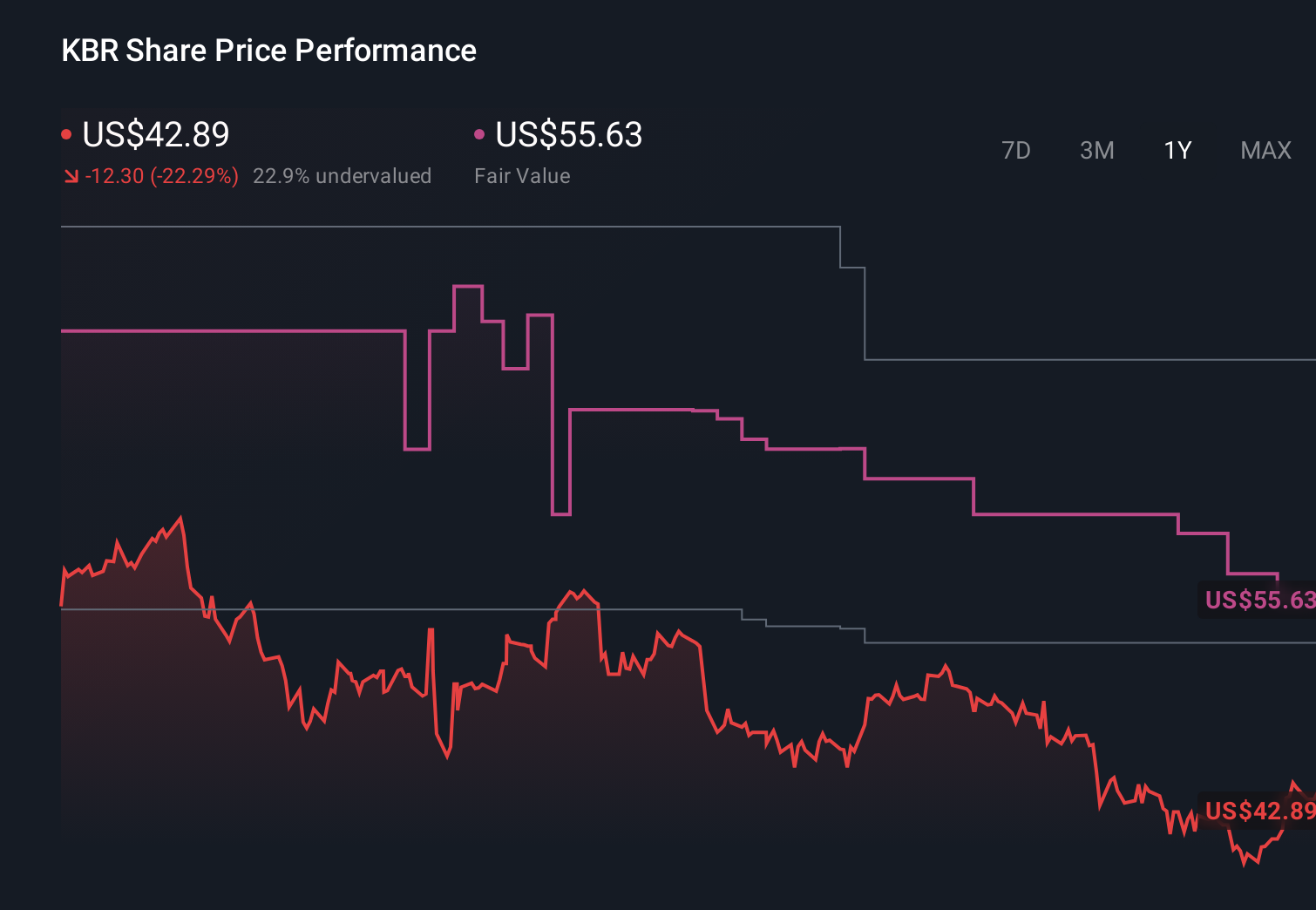

Uncover how KBR's forecasts yield a $54.78 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$40 to over US$5,400 per share, showing how far apart individual views can be. Set against this, the current dependence on timely government contract awards and funding decisions may influence how you weigh those valuations against KBR’s ability to convert its record pipeline into steadier earnings over time.

Explore 8 other fair value estimates on KBR - why the stock might be a potential multi-bagger!

Build Your Own KBR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KBR research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KBR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KBR's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.