Please use a PC Browser to access Register-Tadawul

How Investors May Respond To LiveRamp (RAMP) Launching Agentic AI Tools and Publicis Partnership

LiveRamp Holdings, Inc. Common Stock RAMP | 30.21 30.21 | -0.30% 0.00% Pre |

- Earlier this month, LiveRamp Holdings introduced a suite of advanced AI tools, including agentic AI solutions and AI-powered segmentation and search, to its data collaboration platform, and announced a partnership with Publicis Groupe Middle East to expand commerce media capabilities.

- This move marks LiveRamp as the first platform enabling autonomous AI agents to collaborate with governed access to identity, segmentation, activation, and measurement solutions, reshaping how marketers leverage connected data for campaign optimization.

- We'll examine how LiveRamp's agentic AI rollout could impact its position as a neutral enabler for AI-driven marketing and data collaboration.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

LiveRamp Holdings Investment Narrative Recap

To be a LiveRamp shareholder today is to believe in the value of secure, AI-driven data connectivity as marketers look for better ways to personalize campaigns and manage identity in an increasingly fragmented digital world. The recent rollout of advanced agentic AI tools enhances LiveRamp’s position as a neutral data enabler, a key short-term catalyst, but does not immediately reduce the company’s ongoing revenue concentration risk, which remains the biggest threat if major enterprise clients are lost.

Among recent announcements, LiveRamp’s introduction of AI-powered segmentation stands out for its alignment with the growing demand for smarter, faster audience creation using a company’s own data. This feature, driven by natural language prompts and interoperable with major data partners, supports the wider adoption of LiveRamp’s platform and directly ties into the core business catalyst of facilitating privacy-compliant, AI-powered marketing automation.

Yet investors should also be aware that, despite innovative product releases, LiveRamp’s results are still exposed to customer churn and...

LiveRamp Holdings is projected to reach $969.7 million in revenue and $154.0 million in earnings by 2028. This outlook assumes an 8.3% annual revenue growth rate and an increase in earnings of $141.3 million from the current level of $12.7 million.

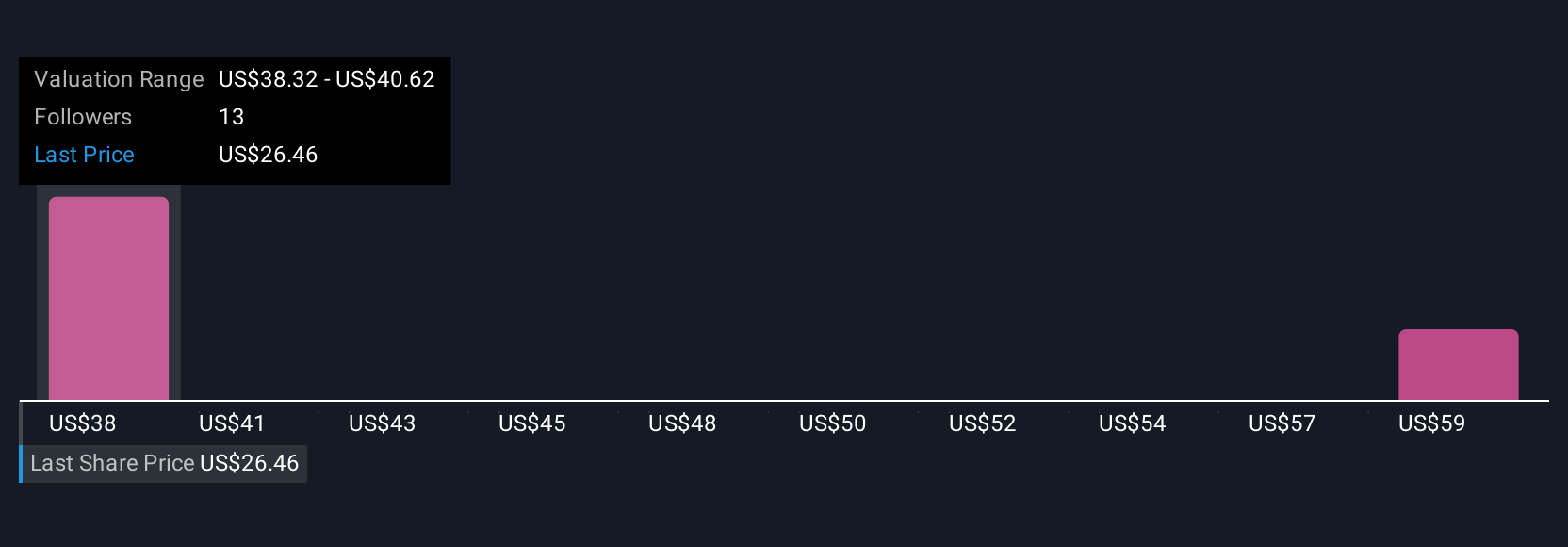

Uncover how LiveRamp Holdings' forecasts yield a $39.62 fair value, a 47% upside to its current price.

Exploring Other Perspectives

LiveRamp fair value estimates from the Simply Wall St Community range from US$28 to US$52.57 across four user-generated analyses. While many see catalyst potential in AI-powered marketing, some community members remain concerned about ongoing concentration risk and its effect on long-term business stability.

Explore 4 other fair value estimates on LiveRamp Holdings - why the stock might be worth just $28.00!

Build Your Own LiveRamp Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LiveRamp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LiveRamp Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LiveRamp Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.