Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Macy's (M) Upbeat Outlook After Outperforming Revised Expectations

Macy's Inc M | 24.15 24.00 | +0.63% +0.14% Pre |

- Macy’s, Inc. recently increased its full-year 2025 revenue guidance after reporting second quarter net income of US$87 million, with sales and earnings lower than the previous year but exceeding revised expectations.

- Management credited gains from store optimization, improved luxury and digital performance, and enhancements to the omnichannel experience for strengthening operating results despite ongoing economic uncertainty.

- With the company raising its revenue outlook following operational improvements, we’ll now examine how this update shapes Macy’s investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Macy's Investment Narrative Recap

To own Macy’s, investors typically need to believe in the company’s transformation, balancing brick-and-mortar strengths with digital growth while stabilizing revenue despite secular headwinds. The recent guidance increase provides some reassurance that operational improvements are helping offset softness in physical store traffic for now, but it doesn’t materially change the fact that persistent shifts to online shopping remain the most important challenge, while macroeconomic sensitivity still poses the biggest near-term risk to results.

Of the recent announcements, the ongoing share buyback program stands out in this context. With Macy’s repurchasing 4,000,000 shares in the last quarter alone, it has now bought back over 13% of outstanding shares under its existing mandate, reflecting management’s focus on returning value as top-line growth remains subdued and store productivity initiatives unfold.

However, before banking on recovery, it’s worth remembering that consumer migration to e-commerce and lingering weaknesses in unit demand could...

Macy's narrative projects $18.5 billion in revenue and $663.0 million in earnings by 2028. This requires a 6.5% annual revenue decline and a $169.0 million earnings increase from the current earnings of $494.0 million.

Uncover how Macy's forecasts yield a $14.77 fair value, a 13% downside to its current price.

Exploring Other Perspectives

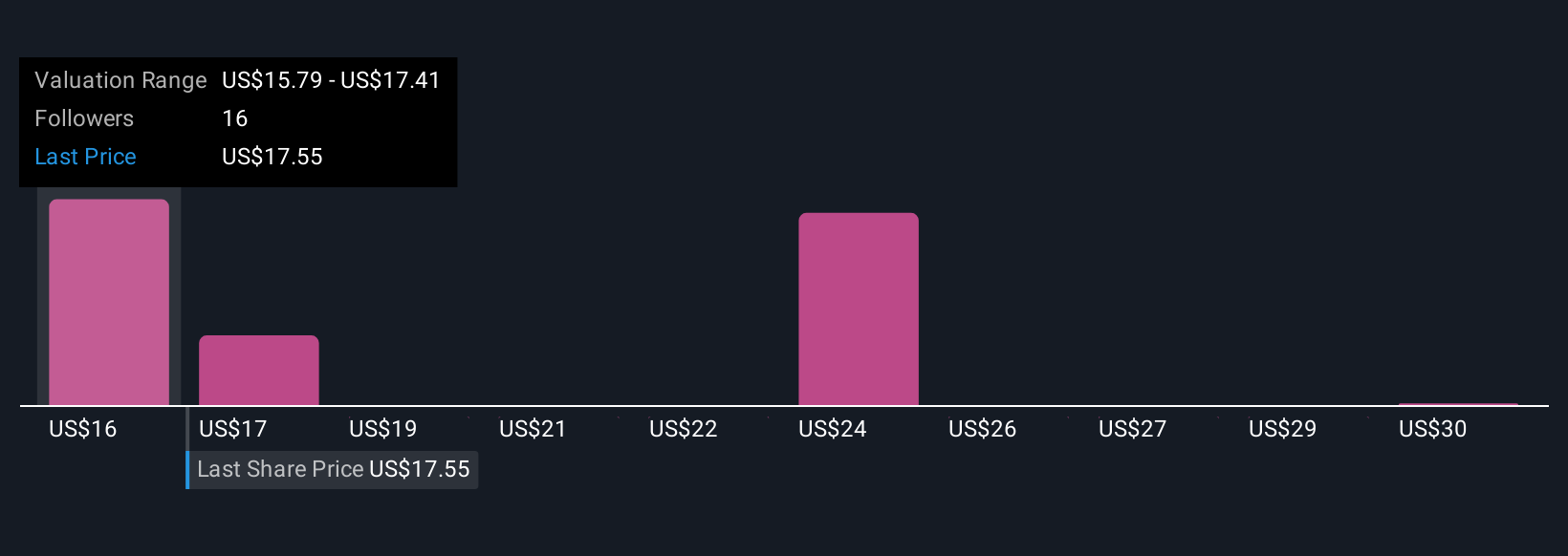

Four members of the Simply Wall St Community have valued Macy’s between US$14.77 and US$32 per share. While opinions differ widely, uncertainty around the pace of digital adoption and store productivity gains continues to shape how the company’s future performance is viewed.

Explore 4 other fair value estimates on Macy's - why the stock might be worth 13% less than the current price!

Build Your Own Macy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Macy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macy's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.