Please use a PC Browser to access Register-Tadawul

How Investors May Respond To PACCAR (PCAR) Insider Selling and Anticipated Earnings Decline

PACCAR Inc PCAR | 127.07 | -0.15% |

- In recent developments, analyst commentary and insider activity have raised concerns for PACCAR ahead of its upcoming earnings release, with expectations for a significant year-over-year decline in both earnings and revenue.

- Investor caution has further intensified as PACCAR is trading at a premium to industry peers while also experiencing increased insider selling, including from executive leadership in the past quarter.

- We'll examine how concerns over earnings declines and insider selling may influence the outlook for PACCAR's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PACCAR Investment Narrative Recap

To be a shareholder in PACCAR today, you’d need to believe in the company's ability to weather near-term industry headwinds and capitalize on the expected pre-buy cycle ahead of the 2027 emissions standards. However, with the latest analyst downgrades, a negative shift in earnings expectations, and rising insider selling, including a CEO share sale, investors are watching with heightened caution as these issues weigh on short-term sentiment ahead of the next earnings report. Near-term risk is now clearly skewed toward another earnings disappointment, which could pressure both the share price and confidence in management’s strategy, but also cast uncertainty over the timeliness and strength of pre-buy demand as a near-term catalyst.

Among recent announcements, the July 2025 report showing a 38% year-over-year earnings decline and 21% revenue drop is particularly relevant, as this aligns closely with the current fears driving the analyst downgrades and negative signals from insider activity. The company’s ongoing share buyback program, with notable repurchases before this earnings miss, offers a counterpoint by signaling management's willingness to return capital to shareholders during cyclical downturns, yet this is unlikely to offset concerns about further weakness or the impact of slow truck demand if macro pressures persist.

In contrast, investors should be mindful that insider selling, especially at executive levels, often signals caution...

PACCAR's outlook anticipates $32.1 billion in revenue and $4.2 billion in earnings by 2028. This is based on a 1.1% annual revenue growth rate and an $1.1 billion increase in earnings from the current $3.1 billion.

Uncover how PACCAR's forecasts yield a $103.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

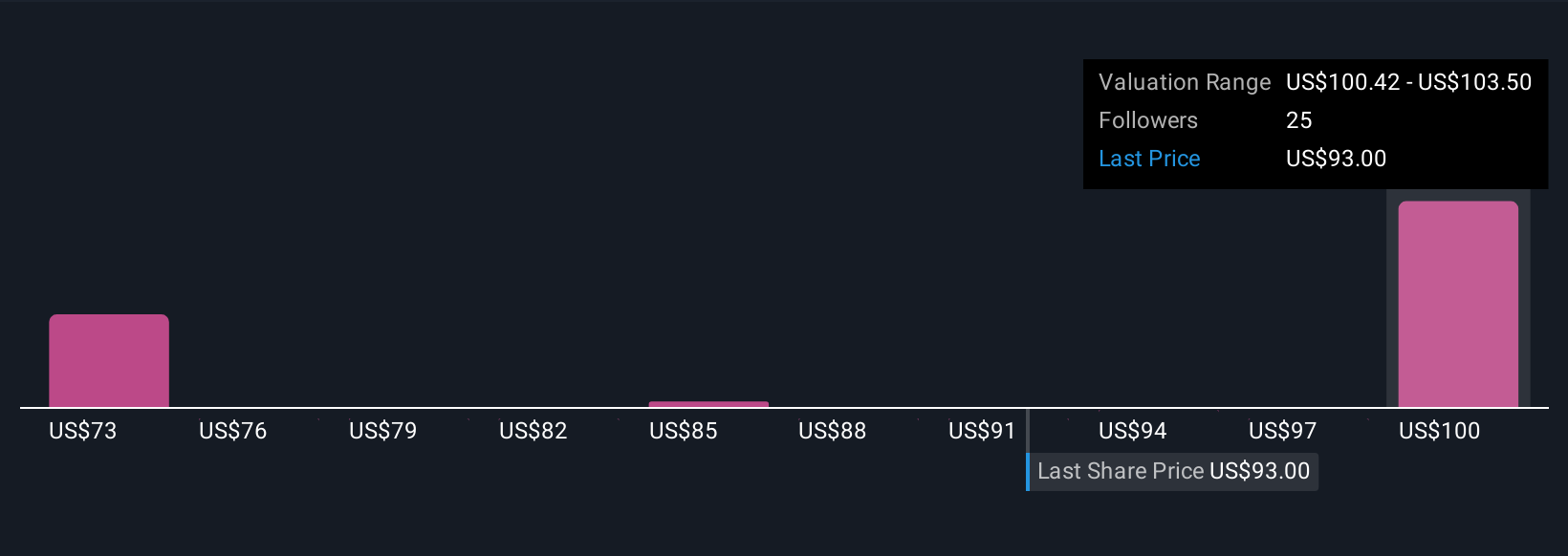

Fair value opinions from four Simply Wall St Community members span from US$73.06 to US$103.50 per share, showing wide disagreement on PACCAR’s outlook. With recent analyst downgrades tied to weak earnings, your view on future demand and margin resilience could shape your stance more than ever, see how others are approaching this puzzle.

Explore 4 other fair value estimates on PACCAR - why the stock might be worth 26% less than the current price!

Build Your Own PACCAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PACCAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PACCAR's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.