Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Popular (BPOP) Margin Gains Amid Slower Net Interest Income Growth

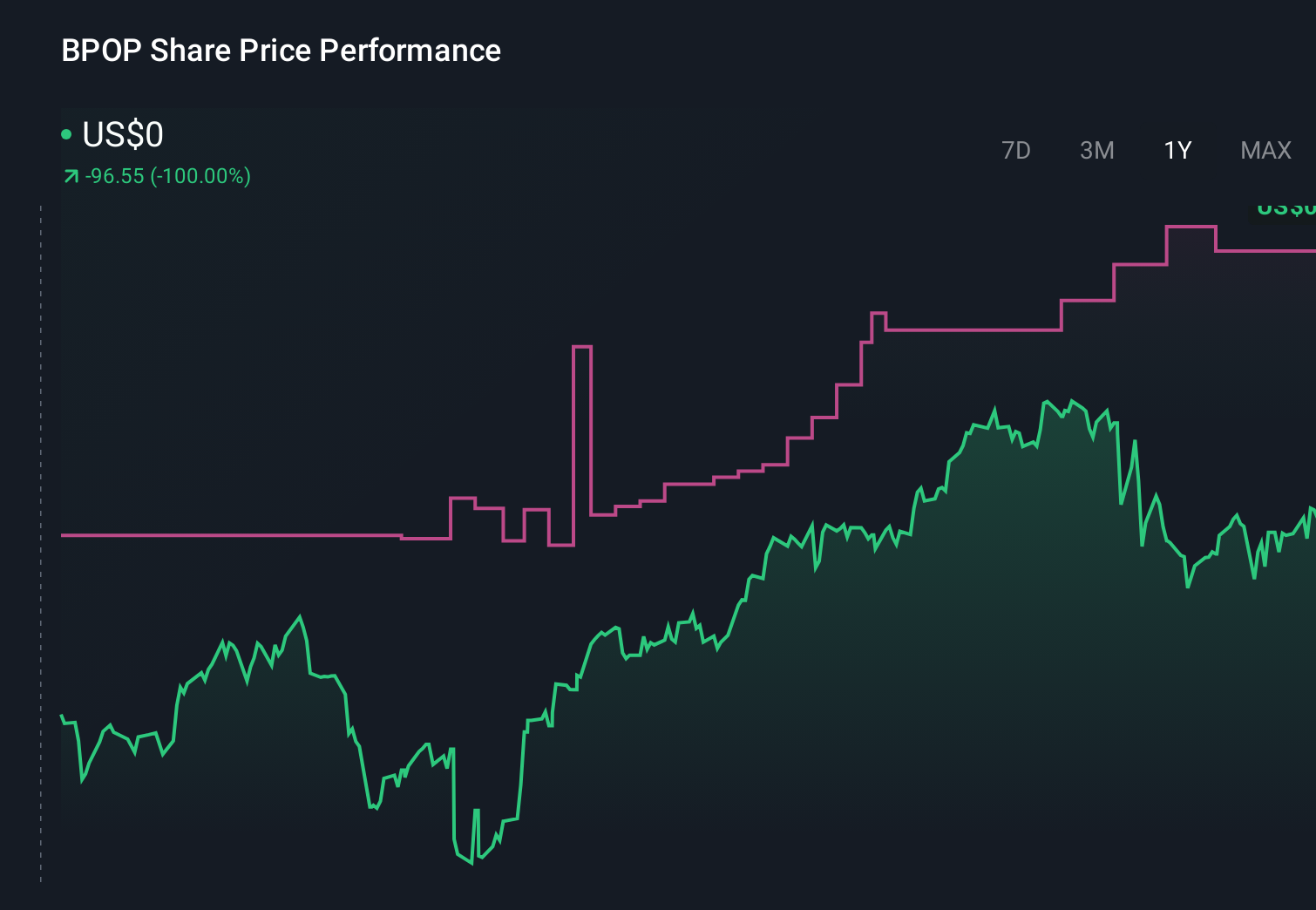

Popular, Inc. BPOP | 126.60 | -1.55% |

- In recent months, Popular Inc. has reported a higher net interest margin and strong growth in tangible book value per share, signalling a more resilient balance sheet and improved profitability drivers compared with two years ago.

- At the same time, analysts are reassessing Popular’s position as its revenue growth and asset base strengthen, even though its net interest income expansion trails the wider banking industry and leaves questions about underlying loan demand.

- With Popular’s expanding net interest margin now in focus, we’ll examine what this means for the bank’s existing investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Popular Investment Narrative Recap

To own Popular today, you need to be comfortable with a bank that is improving its core profitability while still facing some structural questions. The recent uplift in net interest margin and tangible book value per share supports the near term catalyst of earnings resilience, but slower net interest income growth versus peers keeps loan demand and funding pressure as key risks that this news does not fully resolve.

Among the latest announcements, the board’s decision on 14 November 2025 to affirm a US$0.75 quarterly common dividend stands out, because it sits alongside stronger net interest income and earnings, and shows how management is treating capital returns while net interest margin trends and balance sheet strength are in focus.

Yet even with these positives, investors still need to be aware of how ongoing competition for deposits could pressure funding costs and...

Popular’s narrative projects $3.8 billion revenue and $930.2 million earnings by 2028. This requires 10.5% yearly revenue growth and about a $210.5 million earnings increase from $719.7 million today.

Uncover how Popular's forecasts yield a $143.33 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Popular span roughly US$127 to US$288, showing how far apart individual views can be. When you set that against Popular’s slower net interest income growth than peers, it underlines why many readers look at multiple viewpoints before forming a view on the bank’s performance potential.

Explore 3 other fair value estimates on Popular - why the stock might be worth over 2x more than the current price!

Build Your Own Popular Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Popular research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Popular research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Popular's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.