Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Prosperity Bancshares (PB) Director Sale, Analyst Upgrades, and Rate Cut Optimism

Prosperity Bancshares, Inc.(R) PB | 71.41 | -0.83% |

- Director Ned Holmes recently sold 1,100 shares of Prosperity Bancshares, while fresh analyst coverage from Cantor Fitzgerald and an updated outlook from Citi highlighted changing investor expectations for the bank.

- Analyst optimism is increasing due to the anticipated impact of upcoming Federal Reserve interest rate cuts, combined with the company reporting strong second quarter 2025 earnings that slightly exceeded expectations.

- We'll explore how rising analyst optimism around interest rate policy may influence the company's growth story and investor outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Prosperity Bancshares Investment Narrative Recap

To own shares of Prosperity Bancshares, one needs to believe that expanding into high-growth Texas markets and a disciplined approach to deposits and loan pricing can support consistent earnings and revenue growth, while managing persistent asset quality and operational risks. The recent analyst upgrades and strong earnings report reinforce optimism for near-term growth, especially with potential Federal Reserve rate cuts, but these developments may not fully address ongoing concerns about asset quality and sustained balance sheet expansion.

The most relevant recent announcement is the company’s Q2 2025 earnings, with net income rising to US$135.16 million and net charge-offs improving year-over-year. While this adds support to the near-term growth catalyst of higher earnings power, investors should still watch for pressure points around loan and deposit trends.

But while optimism is building, investors should not overlook the emerging signals of asset quality stress that...

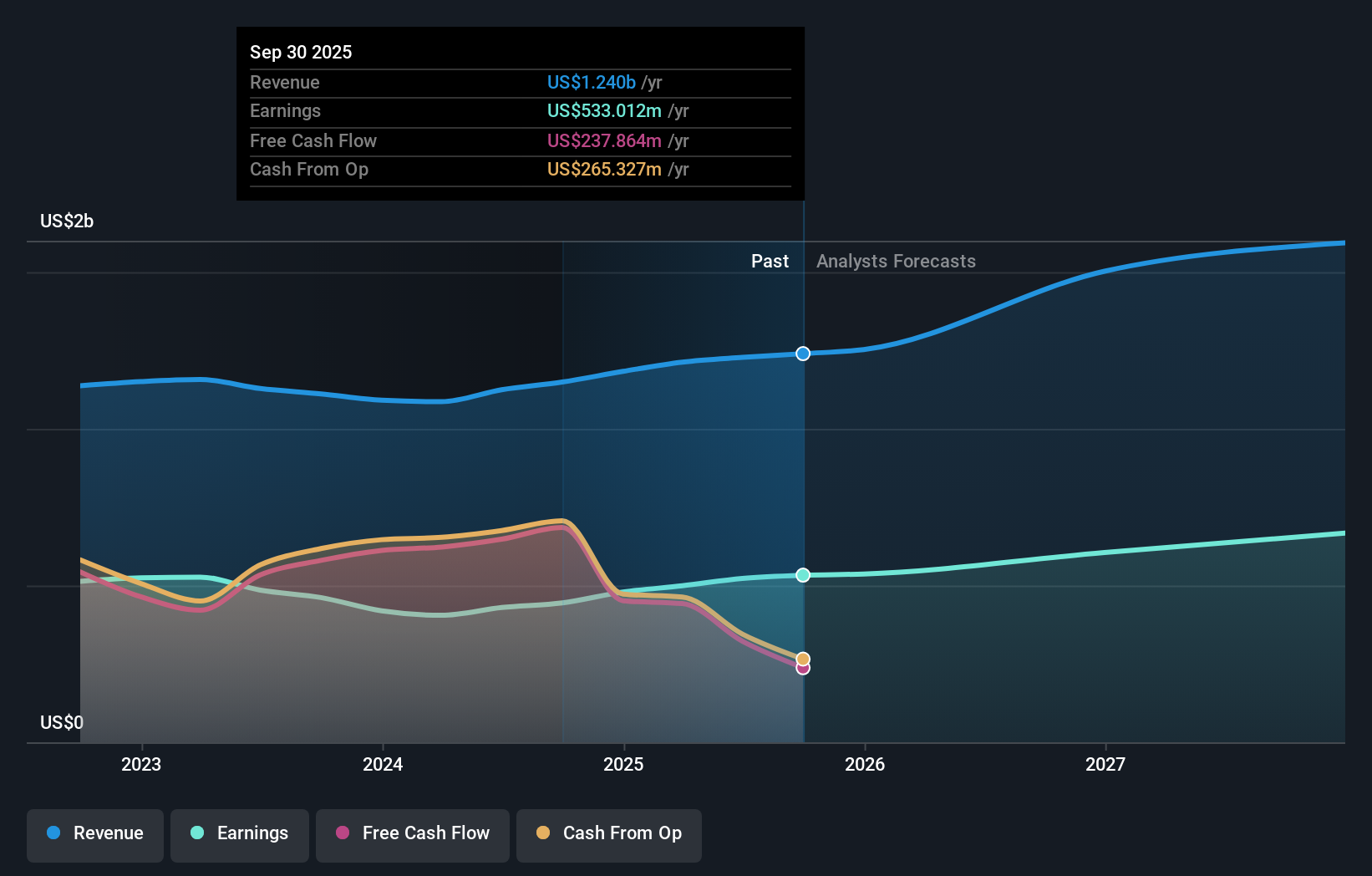

Prosperity Bancshares' narrative projects $1.7 billion revenue and $731.7 million earnings by 2028. This requires 11.0% yearly revenue growth and an increase of $209 million in earnings from $522.7 million today.

Uncover how Prosperity Bancshares' forecasts yield a $81.69 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates for Prosperity Bancshares between US$52 and US$94.97, based on two different analyses. While opinions vary, the recent rise in analyst optimism around rate cuts highlights the importance of continuously weighing external market catalysts against the company’s underlying fundamentals.

Explore 2 other fair value estimates on Prosperity Bancshares - why the stock might be worth 23% less than the current price!

Build Your Own Prosperity Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prosperity Bancshares research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Prosperity Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prosperity Bancshares' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.