Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Seadrill (SDRL) Outlook Boost After Operational Gains and New Joint Venture

Seadrill Ltd. SDRL | 31.76 31.76 | -3.76% 0.00% Pre |

- On September 12, 2025, Citi maintained its Buy rating on Seadrill Limited after raising its financial outlook for 2026, citing increased expectations for revenue and earnings per share following recent operational improvements and contract wins, including a joint venture with Sonangol.

- This development reflects growing confidence in Seadrill's ability to capitalize on new business opportunities and improve its long-term positioning in the offshore drilling sector.

- We'll explore how Citi's recognition of stronger operational performance and new contract awards could impact Seadrill's broader investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

Seadrill Investment Narrative Recap

Being a Seadrill shareholder requires optimism in a sector rebound and the company's ability to secure lucrative rig contracts while closely monitoring operational risks and cash flows. Citi's increased outlook and higher price target reflect renewed optimism, but the biggest near-term catalyst, sustained improvement in rig utilization, remains only modestly affected as contract wins like the Sonangol joint venture take time to materially impact earnings. The key risk of ongoing legal and regulatory issues, particularly surrounding joint ventures and foreign claims, continues to cast uncertainty over cash outflows and profitability and is not fundamentally changed by this recent upgrade.

Among the latest announcements, Seadrill's nearly US$1.0 billion contract awards for its ultra-deepwater drillships in Brazil stand out as most relevant. These contracts, set to ramp up from early 2026, provide much-needed revenue visibility and could help offset currently soft dayrates and utilization trends highlighted as central to the company's investment case.

Yet, despite renewed optimism, investors should also be aware of the continued risk from unresolved legal disputes, especially as...

Seadrill's narrative projects $1.6 billion in revenue and $231.6 million in earnings by 2028. This requires 7.2% yearly revenue growth and a $154.6 million earnings increase from the current $77.0 million.

Uncover how Seadrill's forecasts yield a $43.50 fair value, a 33% upside to its current price.

Exploring Other Perspectives

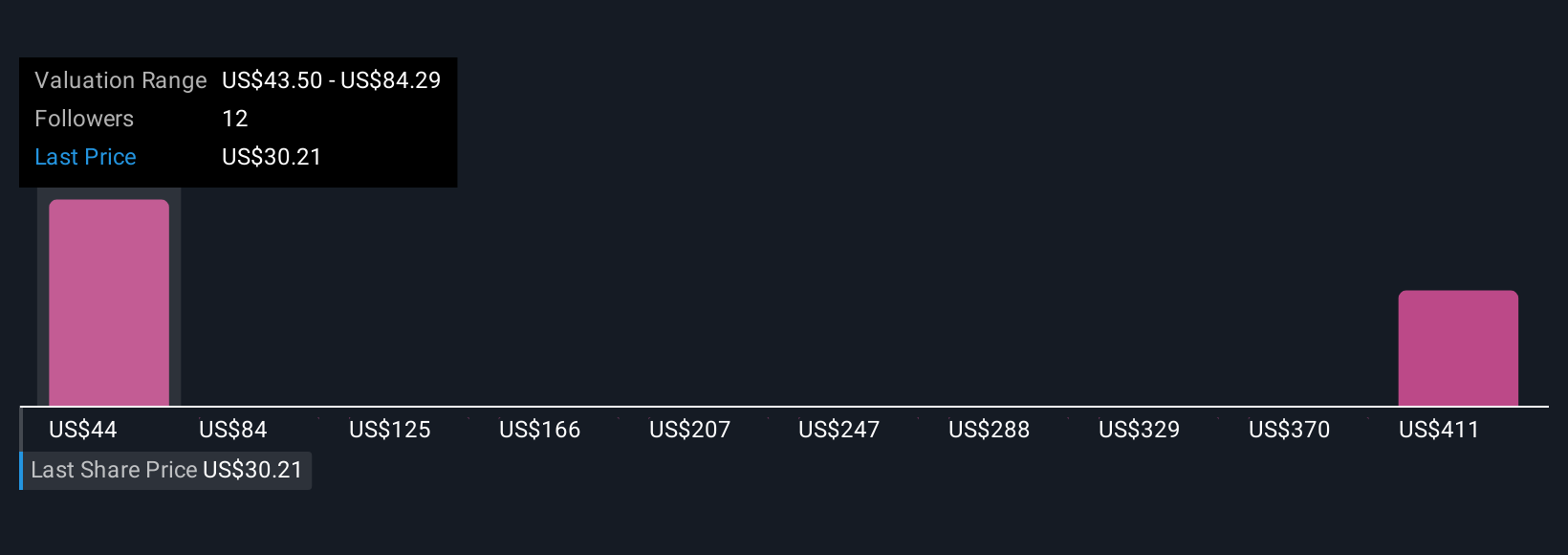

Four members of the Simply Wall St Community estimate Seadrill's fair value anywhere from US$43.50 to US$353.37 per share. With legal and regulatory risks unresolved, you can see how opinions sharply diverge on what the company is actually worth.

Explore 4 other fair value estimates on Seadrill - why the stock might be worth over 10x more than the current price!

Build Your Own Seadrill Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seadrill research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Seadrill research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seadrill's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.