Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Select Medical (SEM) Reaffirming Guidance Amid Lower Net Income

Select Medical Holdings Corporation SEM | 15.36 | -0.42% |

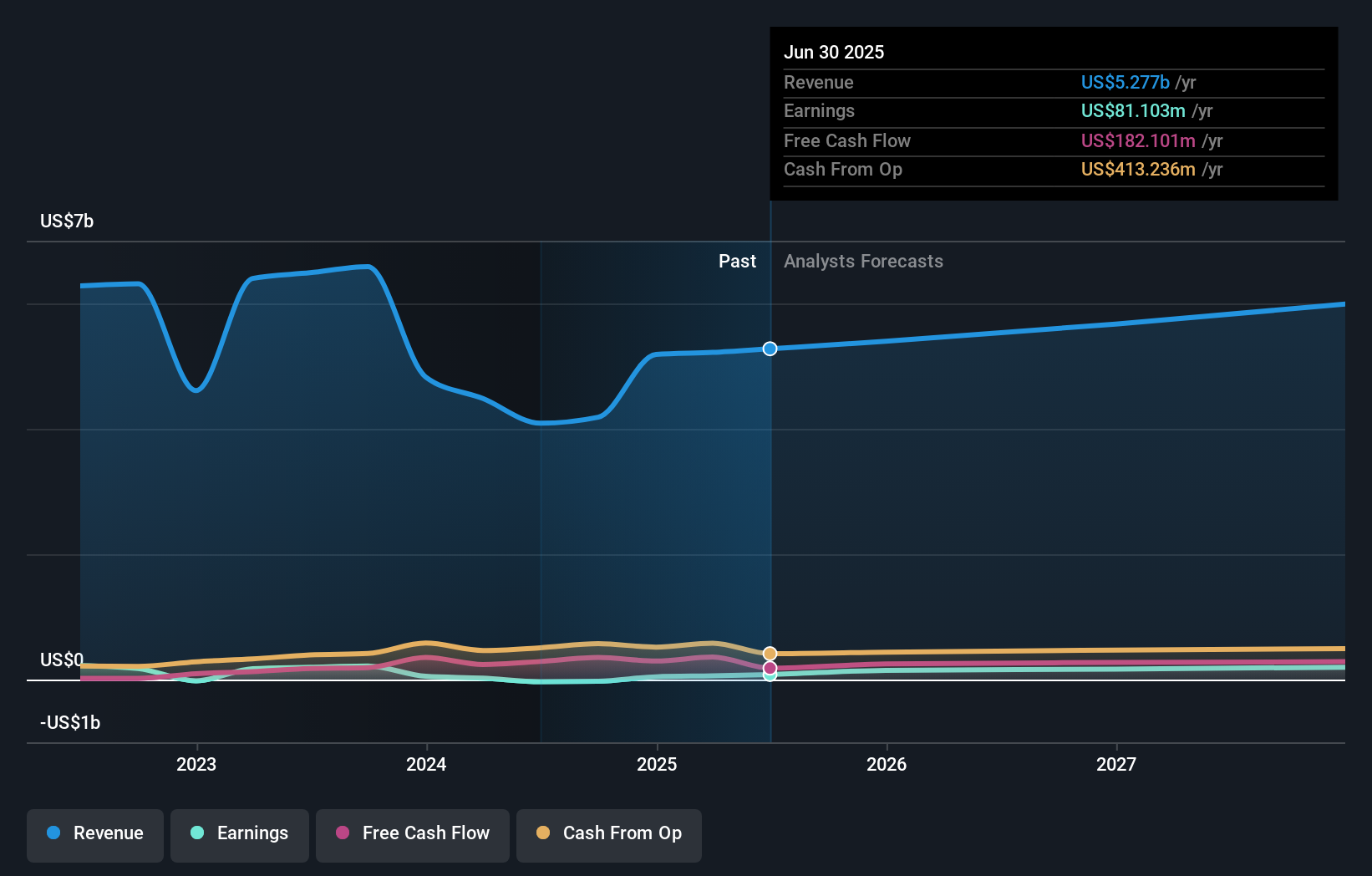

- Select Medical Holdings Corporation recently reported its second quarter 2025 results, showing sales of US$1.34 billion and net income of US$40.57 million, alongside reaffirmed full-year revenue and earnings guidance.

- Despite increased sales, net income dropped compared to the prior year, while the company reiterated its expectations for the remainder of 2025 and announced a continued quarterly cash dividend.

- Let's explore how the company’s maintained full-year guidance, despite weaker net income, may influence its investment case going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Select Medical Holdings Investment Narrative Recap

Being a shareholder in Select Medical Holdings means believing in the company's ability to expand its inpatient rehab capacity and improve performance across its segments, despite ongoing regulatory pressures and cost headwinds. The recent Q2 2025 results, with higher sales but lower net income, do not materially change the near-term outlook: the main catalyst remains the growth and maturing of new inpatient rehab facilities, while regulatory and reimbursement risks are the most significant short-term threats. Among the company’s recent moves, the reaffirmation of full-year revenue and earnings guidance stands out. This represents management’s confidence amid margin pressures and supports the idea that inpatient rehab expansion could help deliver on financial targets, even as net income faces headwinds from elsewhere in the business. Yet, it's important for investors to remember that if regulatory actions continue to squeeze margins in major divisions, the company's pathway to delivering on guidance could face obstacles that ...

Select Medical Holdings' outlook anticipates $6.1 billion in revenue and $294.5 million in earnings by 2028. Achieving this would require 5.3% annual revenue growth and a $233.7 million increase in earnings from the current $60.8 million level.

Uncover how Select Medical Holdings' forecasts yield a $20.50 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Select Medical’s fair value from US$20.50 up to US$38.85, based on two individual forecasts. With regulatory risks persisting for core divisions, you should consider how community insights might differ from the broader market view.

Explore 2 other fair value estimates on Select Medical Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Select Medical Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Select Medical Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Select Medical Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.