Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Trupanion (TRUP) Raising Full-Year Guidance Amid Industry Headwinds

Trupanion, Inc. TRUP | 37.75 | +0.85% |

- Earlier this month, Trupanion reported stronger-than-expected second-quarter earnings and raised its full-year 2025 revenue guidance to a range of US$1.42 billion to US$1.43 billion.

- Despite the upbeat outlook, the company continues to face industry challenges with a return on equity of 3.1%, well below the sector average, pointing to ongoing operational pressures.

- We'll explore how Trupanion's raised full-year guidance influences its investment narrative, particularly regarding long-term revenue growth expectations.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Trupanion Investment Narrative Recap

To be a shareholder of Trupanion, you would need to believe in the sustained expansion of the pet insurance market combined with Trupanion's ability to capitalize on this through stronger subscriber growth and operational gains. The recent insider sale by a company director does not materially change the immediate catalyst, which remains centered on whether the company's improved guidance for full-year revenue can be matched by actual acceleration in subscriber growth, nor does it offset the persistent risk of elevated customer acquisition costs and margin pressure if pet owner price sensitivity increases.

The most relevant recent announcement is Trupanion’s raised revenue guidance for 2025, now projecting US$1.417 billion to US$1.434 billion for the year. This boost points to confidence in the business’s core strategy, although it heightens the focus on delivering actual subscriber growth rather than relying only on higher average revenue per user, a key near-term trigger for investor sentiment and potential share price movement.

In contrast, investors should be aware that Trupanion’s biggest challenge may still be...

Trupanion's narrative projects $1.7 billion in revenue and $17.4 million in earnings by 2028. This requires 8.3% yearly revenue growth and a $6.4 million earnings increase from the current earnings of $11.0 million.

Uncover how Trupanion's forecasts yield a $56.50 fair value, a 31% upside to its current price.

Exploring Other Perspectives

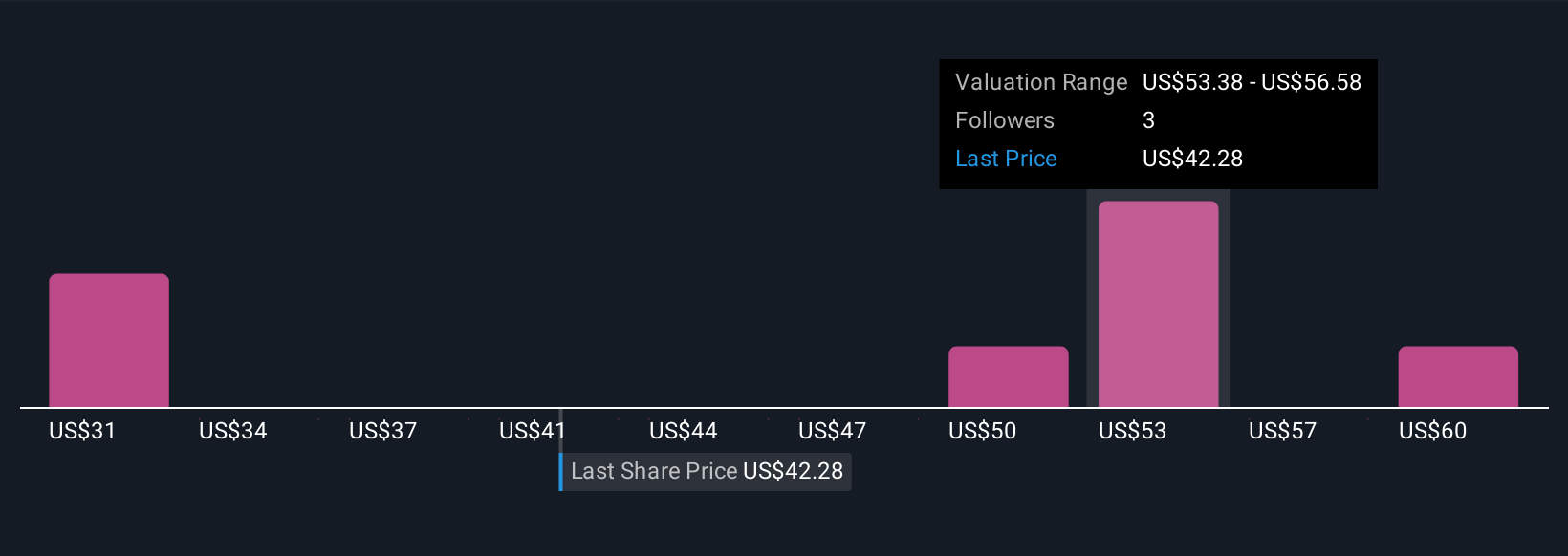

Simply Wall St Community members provided five fair value estimates for Trupanion between US$31.00 and US$62.97 per share. While the top catalyst is subscriber growth, attention from the community underscores how opinions about sustainable revenue expansion can differ sharply.

Explore 5 other fair value estimates on Trupanion - why the stock might be worth as much as 46% more than the current price!

Build Your Own Trupanion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trupanion research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Trupanion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trupanion's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.