Please use a PC Browser to access Register-Tadawul

How Investors May Respond To Zymeworks (ZYME) Ending ZW171 Trials and Focusing on Zanidatamab

Zymeworks Inc. ZYME | 25.59 | -1.01% |

- In September 2025, Zymeworks Inc. announced it had voluntarily ended clinical development of ZW171, a T cell engager targeting mesothelin-expressing cancers, after assessing Phase 1 trial results in ovarian and non-small cell lung cancer.

- This move follows a period of significant regulatory progress for zanidatamab, which recently received accelerated and conditional approvals in the US, Europe, and China for HER2-positive biliary tract cancer, and underscores the company's pivot towards advancing its broader antibody therapeutics pipeline through global partnerships.

- We'll examine how the focus on zanidatamab's commercial approvals and pipeline momentum may influence Zymeworks' investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Zymeworks Investment Narrative Recap

To be a Zymeworks shareholder today, you need to believe in the company's ability to drive sustained revenue from partnered antibody assets like zanidatamab, while advancing its proprietary pipeline beyond early-stage setbacks. The discontinuation of ZW171, though disappointing, does not materially affect the company’s most important near-term catalyst: commercial progress and milestone achievements for zanidatamab. However, it does reinforce the risk of clinical attrition in Zymeworks' internally owned pipeline and highlights continued reliance on external partners for revenue stability.

The most relevant recent announcement is zanidatamab's accelerated and conditional approvals for HER2-positive biliary tract cancer in the US, Europe, and China, which stands out as a tangible source of near-term revenue and future royalty streams. These approvals place zanidatamab at the center of Zymeworks’ value proposition, especially as pipeline attrition, such as with ZW171, underscores the importance of successful partnered launches for both earnings and potential reinvestment in R&D. Yet, as commercial execution by partners becomes even more pivotal ...

Zymeworks' outlook anticipates $150.9 million in revenue and $24.2 million in earnings by 2028. This projection is built on a 7.1% annual revenue growth rate and a $97.9 million increase in earnings from current earnings of -$73.7 million.

Uncover how Zymeworks' forecasts yield a $21.05 fair value, a 34% upside to its current price.

Exploring Other Perspectives

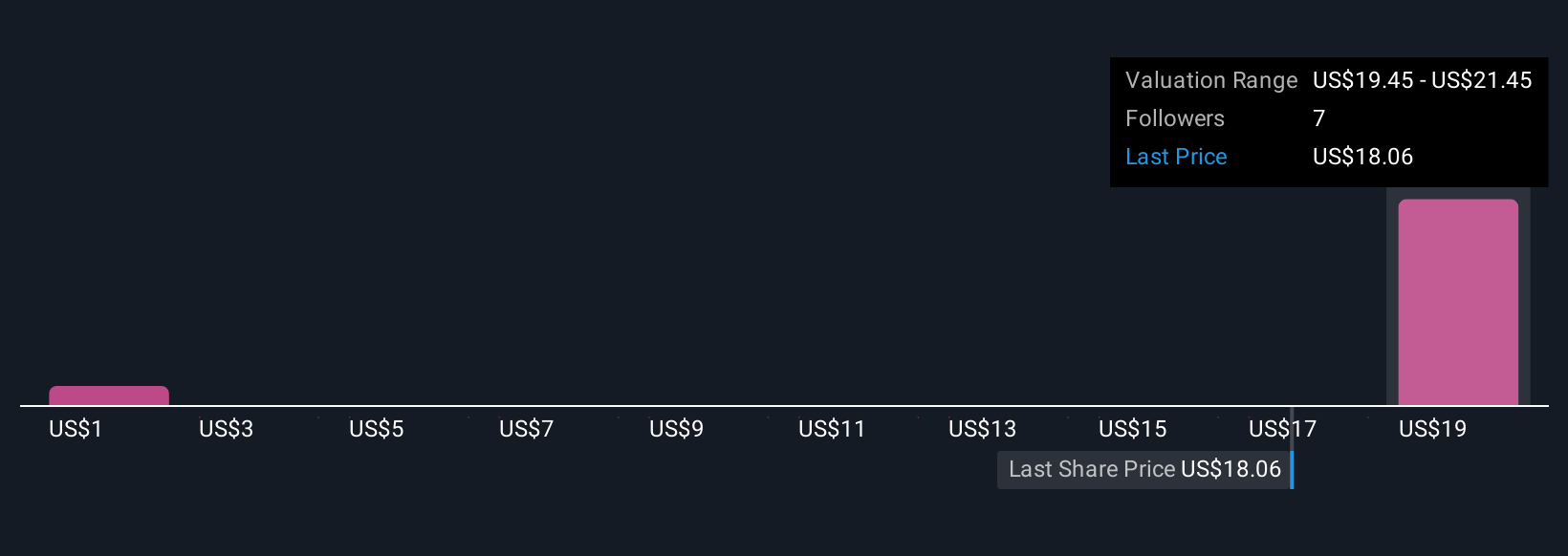

Simply Wall St Community members assigned fair value estimates for Zymeworks ranging from US$1.43 to US$21.05, with only two perspectives represented. While views diverge, most revenue remains tied to partnered asset milestones, making partner delivery crucial for the company’s outlook.

Explore 2 other fair value estimates on Zymeworks - why the stock might be worth less than half the current price!

Build Your Own Zymeworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zymeworks research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Zymeworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zymeworks' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.