Please use a PC Browser to access Register-Tadawul

How Leadership Succession and Leasing Momentum at Prologis (PLD) Are Shaping Its Investment Narrative

Prologis, Inc. PLD | 127.61 | -1.57% |

- Prologis, Inc. recently announced that Lori Palazzolo will retire as Chief Accounting Officer effective April 1, 2026, with Trisha Burns set to succeed her, and Palazzolo staying on as a senior advisor to guide the transition.

- This leadership update follows Bank of America's positive outlook for Prologis, highlighting renewed leasing activity and strengthening industry fundamentals.

- We'll explore how Bank of America's analyst upgrade and leasing momentum are shaping Prologis's investment narrative amidst industry changes.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

Prologis Investment Narrative Recap

To invest in Prologis, one needs to believe in the long-term demand for logistics real estate, supported by resilient global supply chains and the company's ability to convert its sizeable leasing pipeline into sustained revenue growth. The recent announcement of the Chief Accounting Officer transition is unlikely to materially impact the near-term catalyst, which remains the pace of lease signings, though the biggest risk is still slower-than-expected absorption and cautious tenant decision-making in a market with elevated vacancy rates.

Among recent developments, Bank of America’s analyst upgrade stands out, highlighting increased leasing conversions and a lower projected supply pipeline, factors that are central to the company’s immediate prospects and its ability to maintain pricing power as demand stabilizes. This upgrade reinforces sentiment around Prologis’s potential to benefit if leasing momentum continues to strengthen, despite macroeconomic headwinds.

However, investors should be aware that in contrast to renewal optimism, the persistence of high market vacancy rates raises key questions about...

Prologis' narrative projects $9.7 billion revenue and $3.6 billion earnings by 2028. This requires 3.0% yearly revenue growth and a $0.2 billion earnings increase from the current $3.4 billion.

Uncover how Prologis' forecasts yield a $120.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

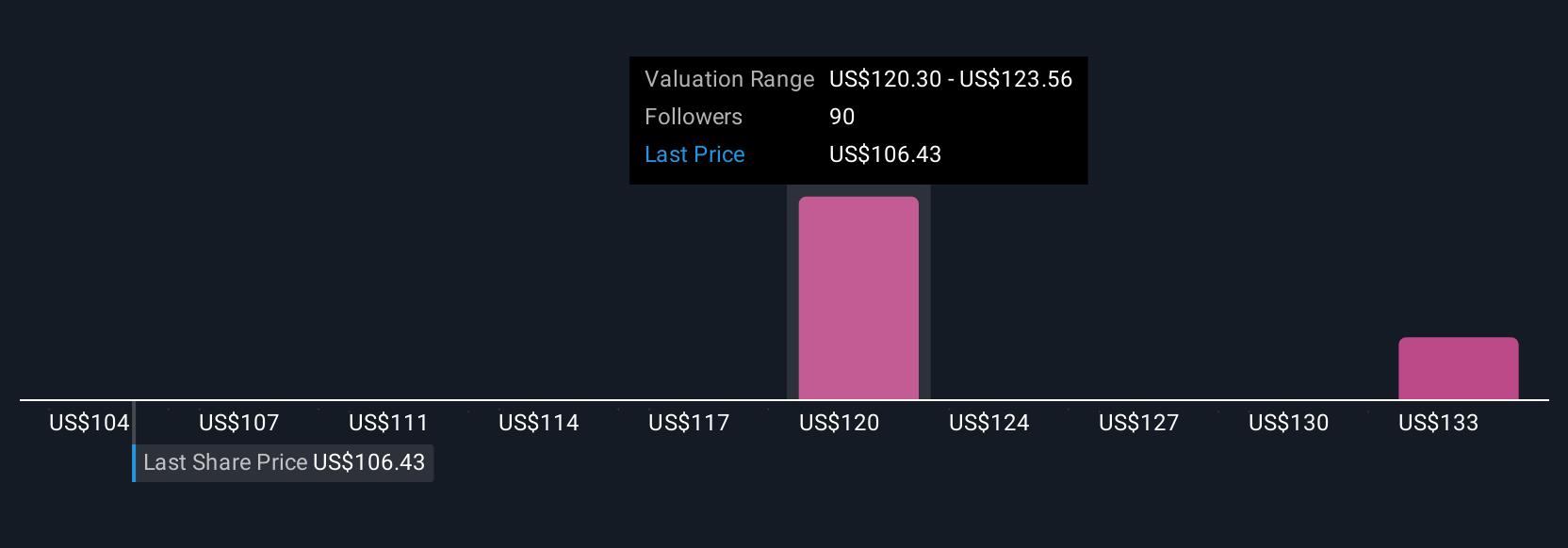

The Simply Wall St Community’s seven fair value estimates for Prologis range from US$103 to US$125, showing wide divergence in investor outlooks. While some anticipate upside, cautious leasing activity and elevated vacancy could weigh on future results, underscoring why individual perspectives on valuation and risk may vary substantially.

Explore 7 other fair value estimates on Prologis - why the stock might be worth as much as 10% more than the current price!

Build Your Own Prologis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Prologis research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Prologis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Prologis' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.