Please use a PC Browser to access Register-Tadawul

How Litigation Over Connectivity Program Disclosures May Shape Charter Communications (CHTR) Investor Confidence

Charter Communications, Inc. Class A CHTR | 197.89 | -4.25% |

- In recent months, Charter Communications faced multiple class action lawsuits alleging the company made misleading statements regarding the end of the Affordable Connectivity Program and its impact on internet subscriber losses and revenue declines.

- This wave of litigation raises material concerns about Charter's risk management and transparency amid challenges in customer retention and financial performance.

- We will now examine how heightened investor scrutiny over Charter’s communication practices may alter its long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Charter Communications Investment Narrative Recap

To be a shareholder in Charter Communications today, you need to believe that its strong operational foundation, anchored by broadband and innovative mobile offerings, will outpace ongoing competitive threats and regulatory headwinds. The recent wave of class action lawsuits over alleged misleading disclosures about the Affordable Connectivity Program's end brings Charter's transparency and risk management into sharper focus. While these legal developments have amplified near-term uncertainty, they serve more as a validation of the current risk profile without materially changing the biggest catalyst: Charter’s ability to maintain and grow its broadband subscriber base despite intensified competition.

Among recent events, the drop from the S&P 100 index in September 2025 stands out as particularly relevant. This removal likely reflects both market sentiment around Charter's loss of internet customers in Q2 and investor concern about execution risks amid elevated litigation, spotlighting how short-term setbacks can affect Charter's positioning during pivotal moments for its broadband business.

In contrast, investors should be aware that Charter’s high return on equity is strongly influenced by...

Charter Communications' outlook anticipates $56.8 billion in revenue and $6.0 billion in earnings by 2028. This is based on a projected annual revenue decline of 0.9% and an earnings increase of $0.7 billion from current earnings of $5.3 billion.

Uncover how Charter Communications' forecasts yield a $387.60 fair value, a 44% upside to its current price.

Exploring Other Perspectives

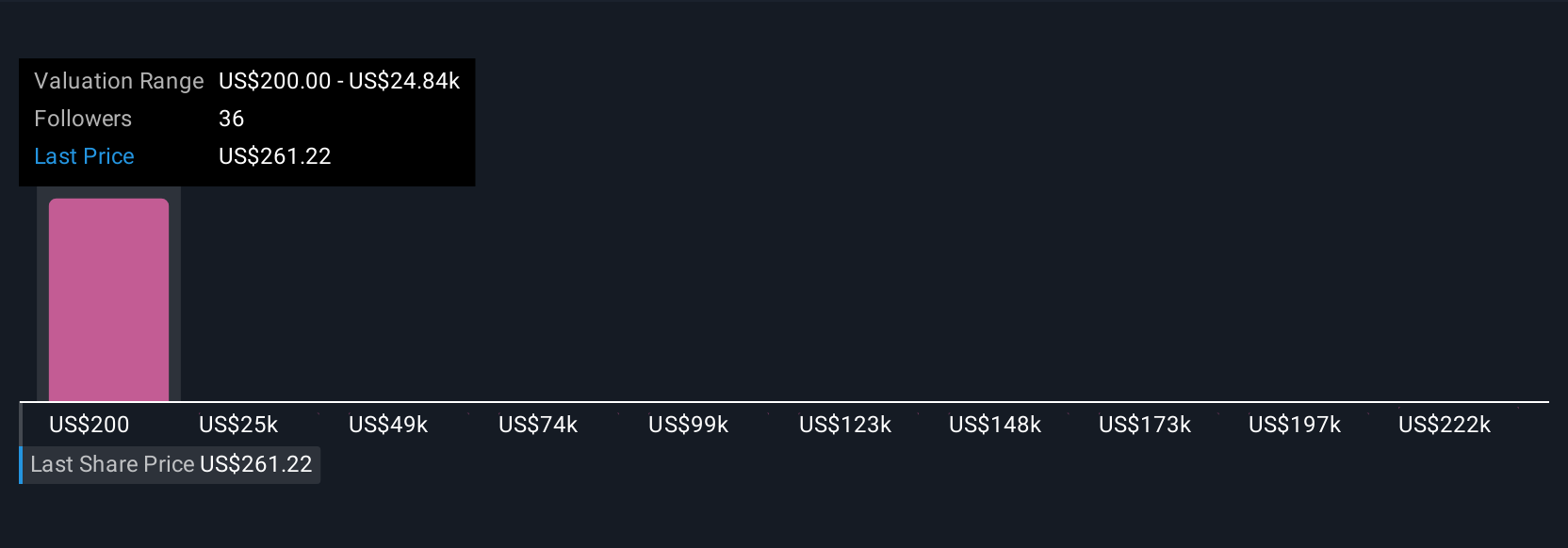

Four members of the Simply Wall St Community estimate Charter’s fair value anywhere from US$223 to US$846 per share. As legal risks intensify following recent lawsuits, consider how different viewpoints capture both the uncertainty and the potential in Charter’s future performance.

Explore 4 other fair value estimates on Charter Communications - why the stock might be worth 17% less than the current price!

Build Your Own Charter Communications Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charter Communications research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charter Communications research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charter Communications' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.