Please use a PC Browser to access Register-Tadawul

How Magnite’s (MGNI) REMAX Partnership and Profit Return Could Shape Its Advertising Future

MAGNITE INC MGNI | 16.54 | +4.42% |

- Magnite recently reported second quarter results featuring increased sales to US$173.33 million and a return to profitability, while also unveiling several high-profile partnerships, including working with REMAX, FanDuel Sports Network, and podcast platform Acast to expand its media and data capabilities across key digital channels.

- The REMAX collaboration marks a significant move into commerce media for real estate, enabling advertisers access to first-party homebuyer intent data packaged and activated onsite and offsite, which could broaden Magnite’s reach and strengthen its value proposition in verticalized advertising.

- We’ll now examine how the REMAX partnership’s integration of real-time intent data could influence Magnite’s long-term investment narrative and growth prospects.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Magnite Investment Narrative Recap

For anyone considering Magnite, it usually comes down to confidence in the ongoing shift of digital ad budgets toward independent platforms, especially as brands and agencies look for alternatives to walled gardens. The latest Q2 earnings, showing both higher sales (US$173.33 million) and a return to profitability, help reinforce this narrative, but do little to reduce the biggest near-term risk: heavy customer concentration among major CTV streamers, where any change in relationship or contract could trigger significant revenue swings.

Of the recent announcements, the REMAX partnership stands out for its relevance to both short-term and longer-term catalysts. By enabling advertisers to access and activate REMAX’s first-party homebuyer data across Magnite’s supply, this collaboration demonstrates how new verticalized commerce media networks could diversify Magnite’s client base, expand its inventory, and partially offset concentration risks tied to large CTV customers.

But against this positive backdrop, it’s important for investors to be aware that customer concentration risk remains, especially if major CTV partners decide to shift budgets or renegotiate deals…

Magnite's outlook anticipates $828.2 million in revenue and $131.4 million in earnings by 2028. This scenario requires a 6.5% annual revenue growth rate and an $88.3 million increase in earnings from the current $43.1 million.

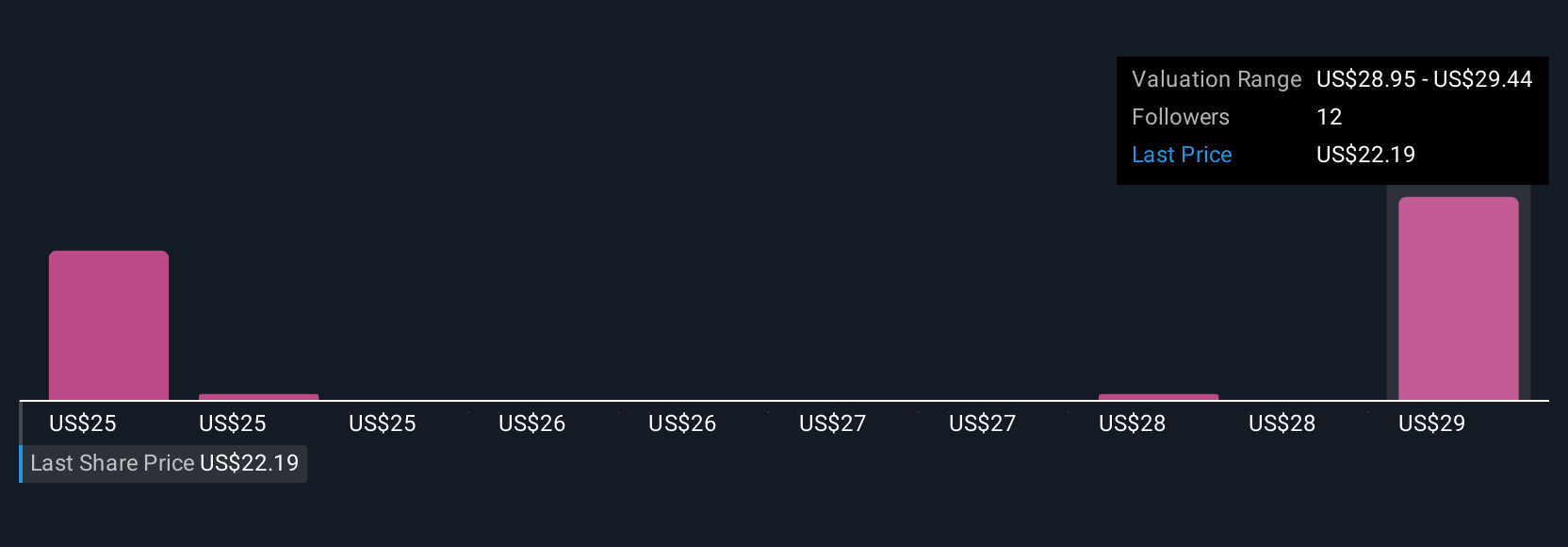

Uncover how Magnite's forecasts yield a $27.58 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Magnite's fair value in a wide range between US$24.70 and US$33.03, based on five independent analyses. As these perspectives diverge, customer concentration with top CTV streamers continues to influence revenue stability and emphasizes the need to consider varying opinions before making assumptions about the company’s outlook.

Explore 5 other fair value estimates on Magnite - why the stock might be worth just $24.70!

Build Your Own Magnite Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Magnite research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Magnite research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Magnite's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.