Please use a PC Browser to access Register-Tadawul

How McDonald's (MCD) Digital Monopoly Relaunch and Value Meals Are Shaping Its Investment Story

McDonald's Corporation MCD | 316.72 | +2.26% |

- McDonald's recently reignited customer excitement with the return of its Monopoly promotion in the UK, featuring an interactive digital gameboard and the debut of Monopoly-themed menu items, while also reintroducing limited-time value meals in select markets.

- This combination of digital engagement and affordability initiatives aims to boost foot traffic, reinforce brand relevance among younger consumers, and strengthen value perceptions amid evolving competitive and economic conditions.

- We'll now explore how this focus on interactive promotions and value-based offerings may influence McDonald's investment narrative and future growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

McDonald's Investment Narrative Recap

To be a McDonald's shareholder today, you need to believe in the company's ability to blend iconic brand power with digital innovation, international expansion, and menu value as economic pressures reshape consumer habits. The latest announcements, including the renewed UK Monopoly campaign and value meal rollouts, aim to counter weak traffic among price-sensitive guests, which remains the most important short-term catalyst, while sustained cost inflation in beef and labor is still the biggest margin risk; the recent news does not materially alter these drivers.

Of the various recent announcements, the relaunch of Extra Value Meals across major markets stands out, matching the urgent need to reinforce value for customers amid economic anxiety. This ties closely to investor focus on whether McDonald's can maintain or regain sales momentum by winning back low- to mid-income consumers, the segment most sensitive to price and brand loyalty.

But while promotions can bring people in, the risks associated with rising input costs, especially ongoing beef and labor inflation, are something investors should not overlook if margins remain under pressure...

McDonald's narrative projects $30.6 billion revenue and $10.4 billion earnings by 2028. This requires 5.5% yearly revenue growth and a $2.0 billion earnings increase from $8.4 billion today.

Uncover how McDonald's forecasts yield a $335.41 fair value, a 10% upside to its current price.

Exploring Other Perspectives

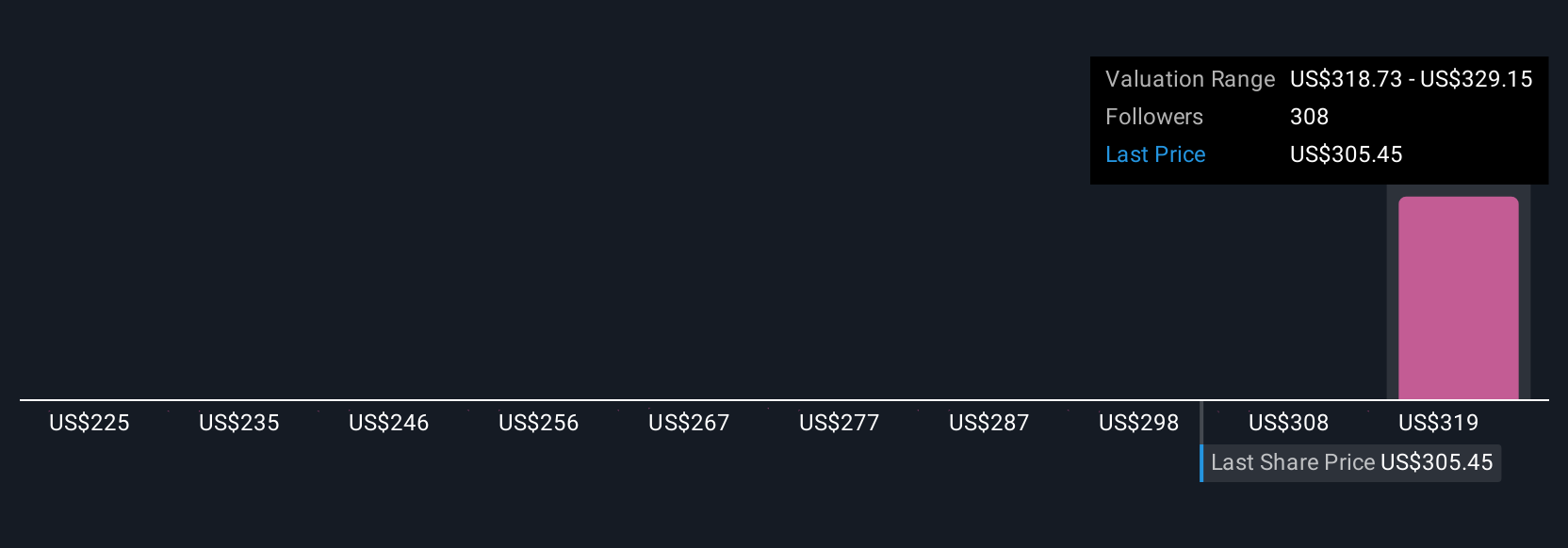

Eighteen members of the Simply Wall St Community estimate McDonald's fair value from US$225 to US$335.40 per share. Opinions are varied as investors weigh margin pressures from rising labor and beef costs that could shape future earnings. You can explore how others are viewing McDonald's opportunities and challenges.

Explore 18 other fair value estimates on McDonald's - why the stock might be worth 26% less than the current price!

Build Your Own McDonald's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McDonald's research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free McDonald's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McDonald's overall financial health at a glance.

No Opportunity In McDonald's?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.