Please use a PC Browser to access Register-Tadawul

How MercadoLibre’s Latest Expansion Impacts Its Current Value Amid 7% Stock Drop

MercadoLibre, Inc. MELI | 2018.10 | +2.43% |

- Ever wondered if MercadoLibre’s meteoric reputation actually means the stock is a bargain right now? You’re not alone. A fresh look at its value could surprise even savvy investors.

- Despite a stellar 13.8% gain year-to-date, MercadoLibre has dipped 7.0% over the past 30 days and is down 4.8% in the last year. This highlights just how quickly sentiment and risk perceptions can shift.

- Recent headlines have highlighted MercadoLibre’s ongoing expansion into new markets and its strengthening position in Latin American e-commerce. Both are key drivers behind its dynamic stock movements. Partnerships in digital banking and infrastructure upgrades have added both optimism and a dose of uncertainty regarding future earnings power.

- When it comes to valuation checks, MercadoLibre scores a solid 4 out of 6. This is not perfect, but certainly worth a closer look. Let’s break down how analysts approach valuing this growth giant and why there could be an even better way to understand its true worth by the end of this article.

Approach 1: MercadoLibre Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those amounts back to today's dollars. This approach aims to determine the present value of MercadoLibre's future ability to generate cash, offering a grounded look at its intrinsic worth.

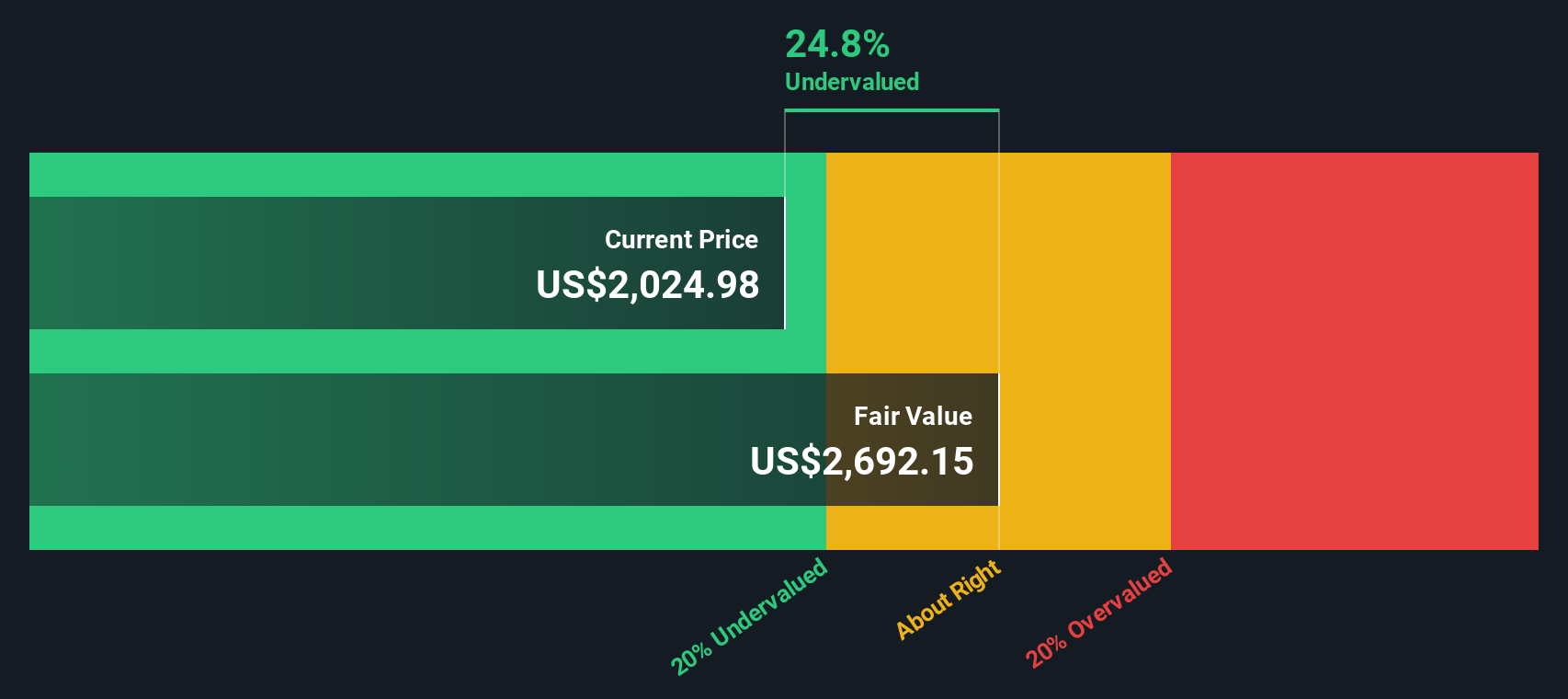

MercadoLibre currently produces Free Cash Flow (FCF) of about $8.77 billion. Analysts expect robust growth ahead, with projections showing FCF reaching $10.75 billion by 2027. Looking further out, estimates extrapolated by Simply Wall St suggest that annual FCF could climb steadily over the next decade, hitting around $15.66 billion by 2035.

All these projections, when discounted back to their present value using a 2 Stage Free Cash Flow to Equity model, result in a DCF fair value estimation of $2,903.87 per share. Based on this, the stock is currently trading at a 30.8% discount to its estimated intrinsic value.

With a sizable margin between the market price and its calculated worth, the DCF model demonstrates a notably undervalued stock.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MercadoLibre is undervalued by 30.8%. Track this in your watchlist or portfolio, or discover 924 more undervalued stocks based on cash flows.

Approach 2: MercadoLibre Price vs Earnings (PE)

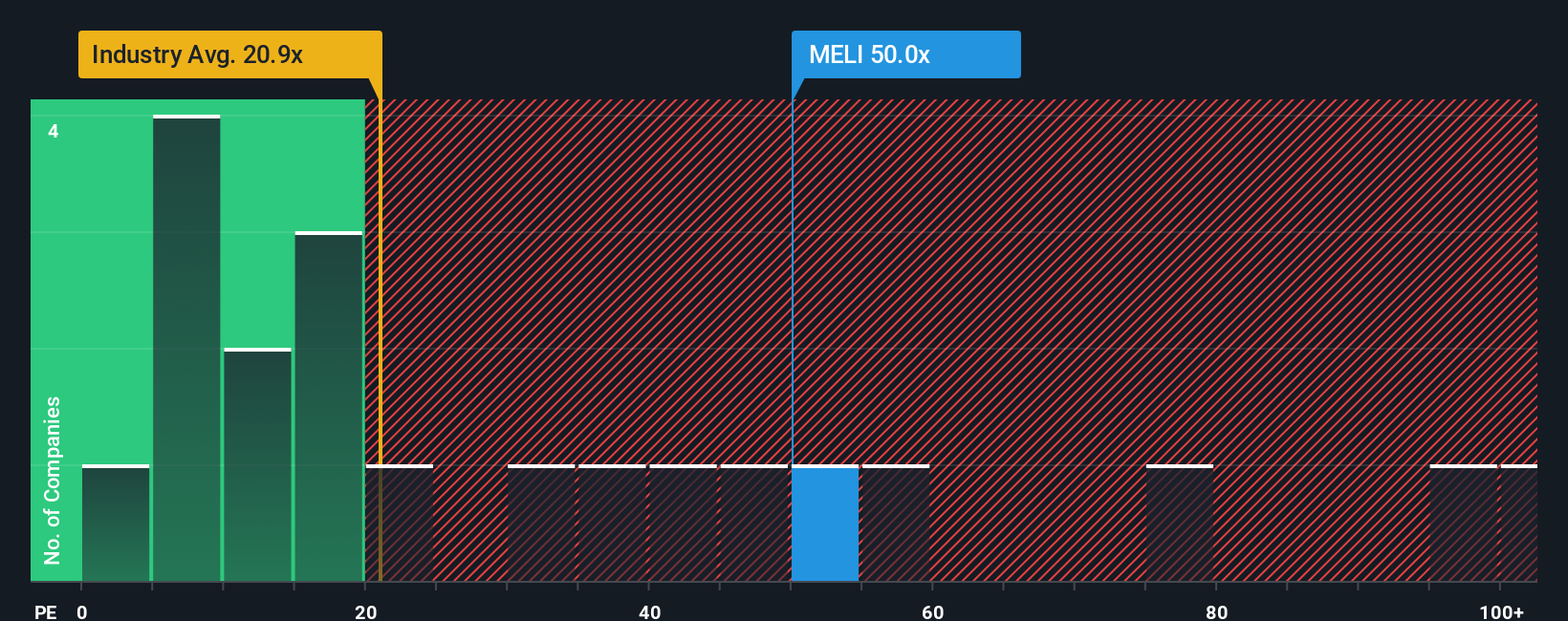

For companies like MercadoLibre that consistently generate profits, the Price-to-Earnings (PE) ratio is a widely trusted valuation tool. This multiple helps investors gauge how much they are paying for each dollar of earnings, and is especially useful for comparing established, profitable businesses.

A company’s fair or “normal” PE ratio depends heavily on expected future growth and risk. High growth prospects and stable operations typically justify a higher PE, while more uncertainty or slower expected growth usually mean a lower ratio makes sense.

Currently, MercadoLibre trades at a PE ratio of 49.0x. This is notably higher than the Multiline Retail industry average of 19.0x, but is roughly in line with the average of its listed peers at 51.5x.

Simply Wall St's proprietary “Fair Ratio” is 31.7x, calculated specifically for MercadoLibre by considering its earnings growth potential, profit margins, industry characteristics, company size, and risk factors. This approach goes beyond generic peer or industry comparisons because it tailors the expected multiple to MercadoLibre’s unique situation. It offers a more holistic and meaningful benchmark.

Since MercadoLibre’s actual PE ratio of 49.0x is well above its Fair Ratio of 31.7x, this suggests the stock is currently overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MercadoLibre Narrative

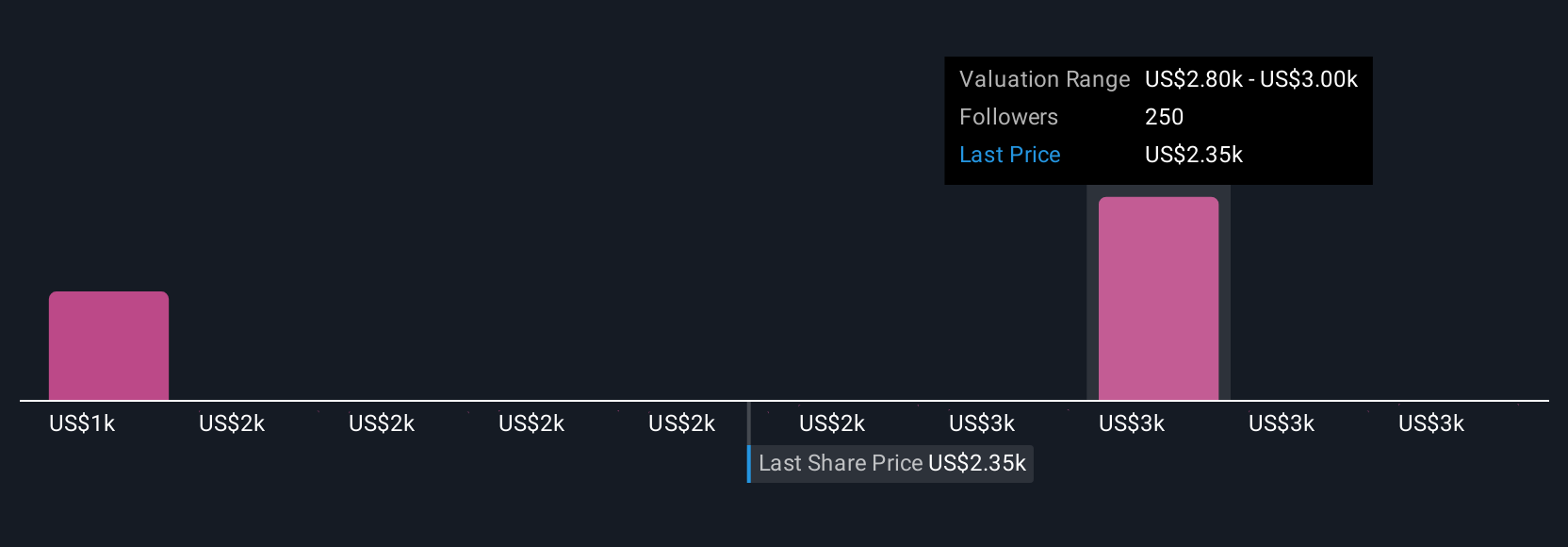

As mentioned earlier, there is an even better way to understand a company’s value than standard metrics: Narratives. A Narrative is your story or perspective about a business, combining what you believe about its future, such as expected revenue, profit margins, and risks, with the numbers so you can estimate fair value based on your convictions rather than just consensus or historical data.

This approach helps link MercadoLibre’s business story to specific financial forecasts and, ultimately, a fair value per share. This lets you see how your view fits with current market pricing. Narratives are made simple and accessible on Simply Wall St, used by millions of investors, directly within each company’s Community page. Any investor can participate, share, and compare perspectives.

Whenever new information or news is published, Narratives update dynamically, keeping your view and fair value calculation relevant. By comparing your Narrative’s fair value to the current price, you can clearly see whether you would consider MercadoLibre a buy, hold, or sell, which can help you make timely decisions.

For example, right now, some investors see MercadoLibre’s fair value as high as $3,500, reflecting optimism about its growth and margins. Others are more cautious with a $2,170 projection, highlighting risks from competition and margin pressure.

Do you think there's more to the story for MercadoLibre? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.