Please use a PC Browser to access Register-Tadawul

How Mercury's New California Partnership With Liberty Mutual Has Changed Its Investment Story at MCY

Mercury General Corporation MCY | 93.05 | -0.49% |

- In early August 2025, Liberty Mutual announced a collaboration with Mercury Insurance to offer coverage to thousands of California Safeco Insurance customers affected by Liberty Mutual's changes to its personal lines strategy in the state.

- This partnership highlights Mercury's willingness to expand in regions where several insurers have reduced operations, presenting a significant business opportunity and alternative for California consumers.

- We'll now explore how Mercury's expanded role in California through this partnership may impact its core business outlook and investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Mercury General Investment Narrative Recap

To be a shareholder in Mercury General, you need to believe the company can leverage its strong regional presence and operational resilience to manage volatility in California’s insurance market, especially as it absorbs new customers through its recent partnership with Liberty Mutual. While this collaboration boosts Mercury’s policy base and short-term premium growth, an important catalyst, its impact on the biggest current risk, exposure to catastrophic wildfire losses and related reinsurance costs, remains limited for now.

One of the most relevant recent announcements is Mercury’s Q2 2025 earnings report, which showed a significant year-over-year rise in net income to US$166.47 million. This result highlights the company’s ability to improve underlying profitability, supporting the view that expanding its California footprint could further enhance financial stability, provided it can continue to effectively manage claims costs and catastrophe risks.

However, investors should be aware that despite growth opportunities, growing exposure to California's wildfire risks and reinsurance challenges means...

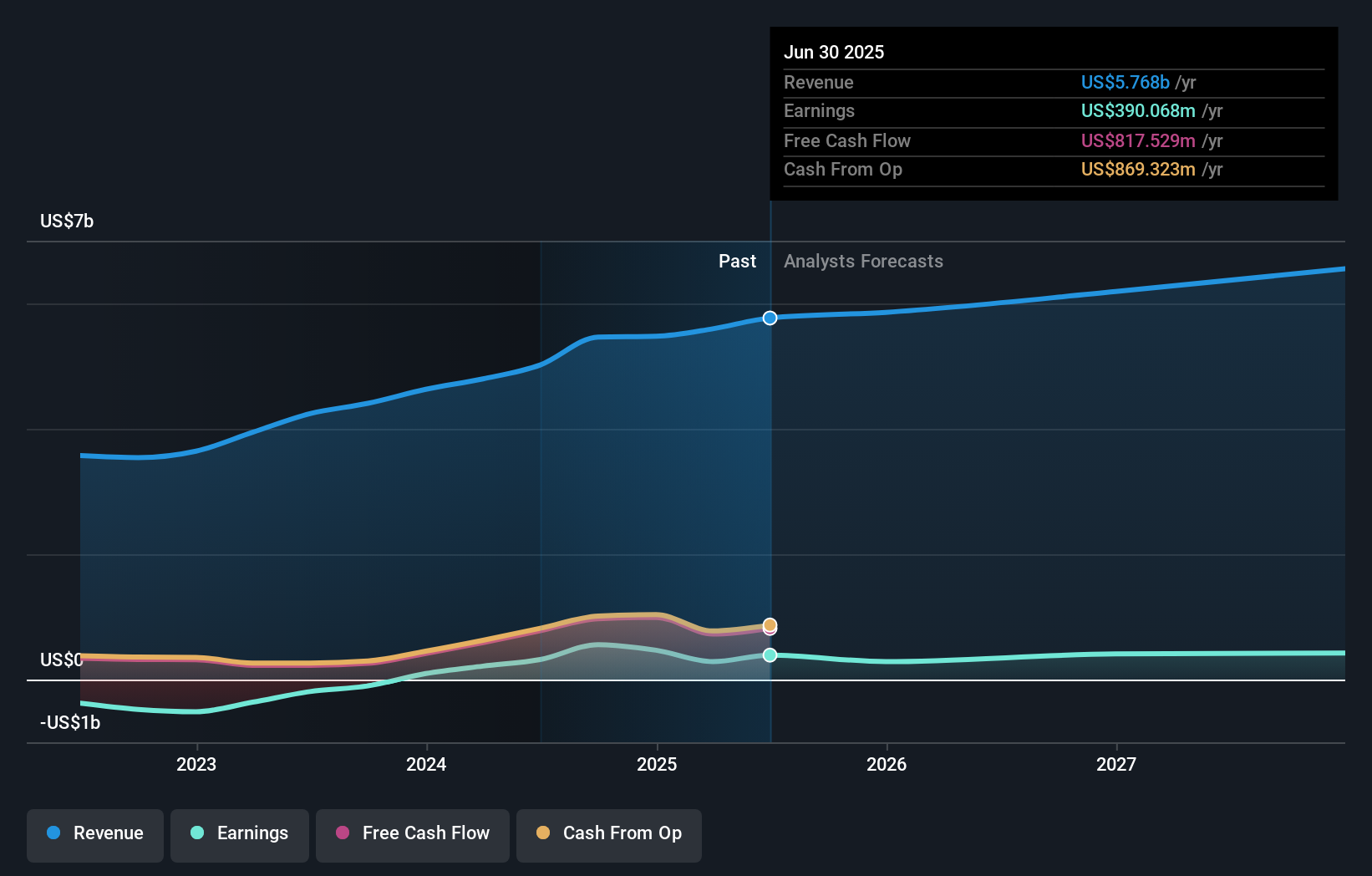

Mercury General's outlook anticipates $6.7 billion in revenue and $452.5 million in earnings by 2028. This is based on a 5.1% annual revenue growth rate and a $62.4 million increase in earnings from the current $390.1 million.

Uncover how Mercury General's forecasts yield a $90.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

All Simply Wall St Community fair value estimates for Mercury General converge at US$90, based on a single analysis. As you weigh this consensus, remember that new business from partnerships may serve as a growth catalyst, but differing opinions in the market show there are several alternative viewpoints to consider for this stock.

Explore another fair value estimate on Mercury General - why the stock might be worth just $90.00!

Build Your Own Mercury General Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury General research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mercury General research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury General's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.