Please use a PC Browser to access Register-Tadawul

How Might Leadership Changes and New Share Issuance Shape Portland General Electric's Capital Plans (POR)?

Portland General Electric Company POR | 48.23 | -2.13% |

- Recently, Portland General Electric reported that President and CEO Maria Pope sold 18,896 shares valued at US$803,080, filed an automatic shelf registration to offer 2,452,692 shares under its Dividend Reinvestment and Direct Stock Purchase Plan, and announced the upcoming resignation of Board member Dawn Farrell effective October 1, 2025.

- These actions may raise investor attention regarding potential share dilution, insider activity, and corporate governance amid ongoing leadership and capital structure changes.

- We'll explore how the automatic shelf registration could influence Portland General Electric's investment narrative and future capital plans.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Portland General Electric Investment Narrative Recap

Being a Portland General Electric shareholder means believing in steady regional power demand and the company's ongoing push into grid resilience and renewables, supported by constructive regulation. The recent CEO share sale and shelf registration, while likely to draw investor attention, are not expected to shift the immediate focus from system upgrades and clean energy investments as the main short-term catalyst, or from regulatory and DER-driven margin risks as the biggest challenge facing the business right now.

The automatic shelf registration of over 2.4 million shares, enabling ongoing equity issuance under the Dividend Reinvestment and Direct Stock Purchase Plan, is most relevant here. It offers flexibility for capital raising, supporting large-scale infrastructure projects critical to revenue growth, without materially affecting the company's capacity to execute on near-term strategic initiatives.

Yet, in contrast to the healthy demand narrative, investors should be mindful of the margin pressures posed by clean energy mandates and cost recovery limits...

Portland General Electric's outlook anticipates $4.0 billion in revenue and $479.0 million in earnings by 2028. This implies a 4.7% annual revenue growth rate and a $185.0 million increase in earnings from the current $294.0 million.

Uncover how Portland General Electric's forecasts yield a $46.36 fair value, a 9% upside to its current price.

Exploring Other Perspectives

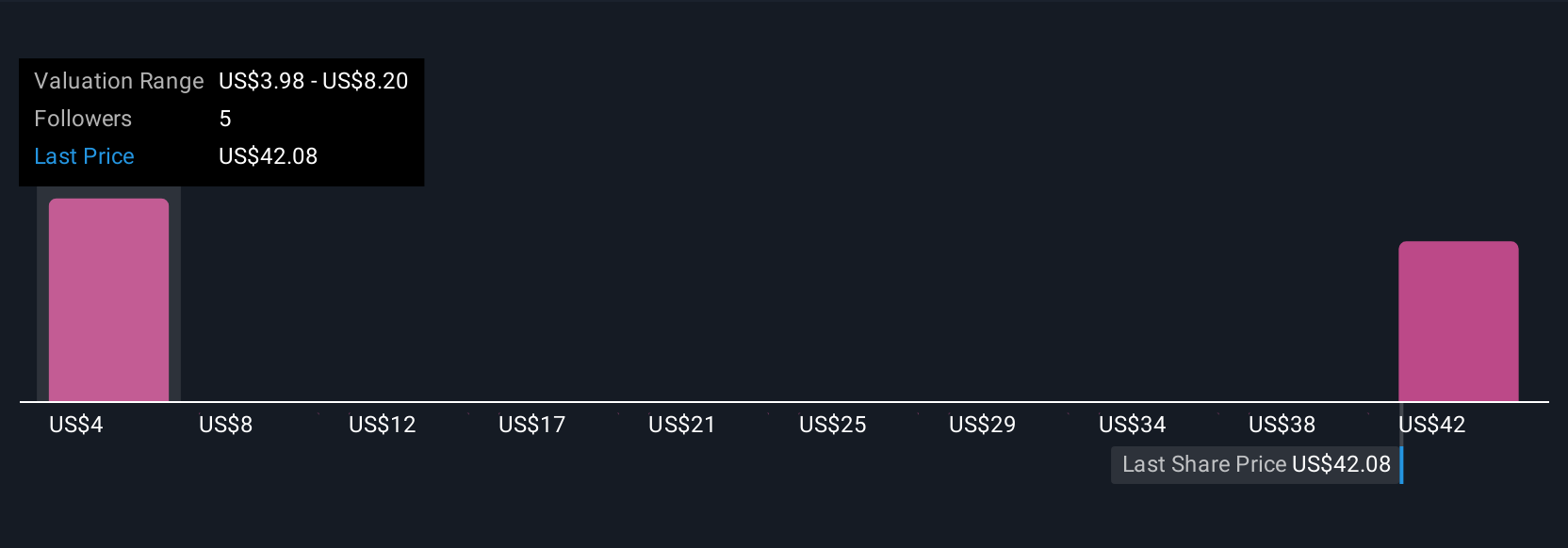

Simply Wall St Community members estimate Portland General Electric’s fair value between US$4,030 and US$46,364 across 2 independent analyses. While many view clean energy demand as a growth driver, margin compression remains a concern that could shape outcomes for patient investors.

Explore 2 other fair value estimates on Portland General Electric - why the stock might be worth less than half the current price!

Build Your Own Portland General Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Portland General Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Portland General Electric's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.